According to the latest data from Binance, the largest memecoin, Dogecoin (DOGE), made its biggest single-day increase since April 3rd with a 10% surge on July 25th. Despite speculation that the impressive rise in DOGE, which has gained 25% in the past two weeks, could be attributed to its potential integration as a payment option on the rebranded Twitter platform, data indicates that the rise may now reach a point of stabilization.

Increasing Open Interest in Dogecoin

Markus Thielen, Research and Strategy Manager at Matrixport, noted that Elon Musk’s efforts to rebuild Twitter could lead to a surge in DOGE during the expected summer slowdown in the cryptocurrency market.

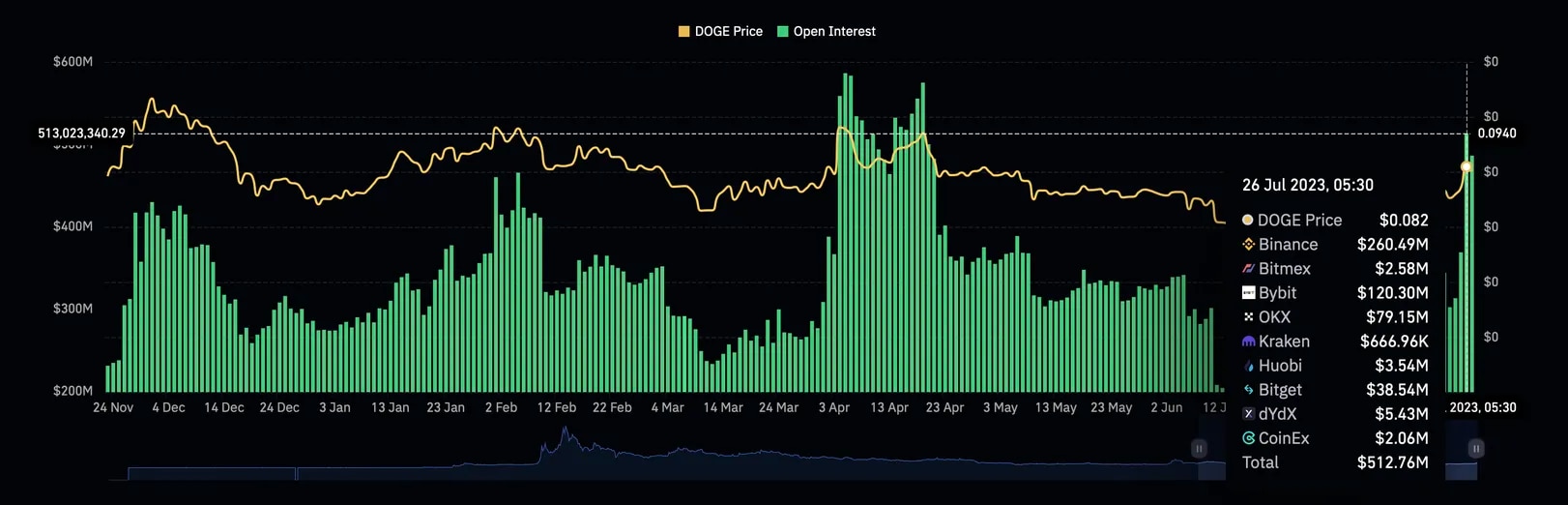

The perpetual futures market associated with DOGE also indicates an increased interest in the altcoin among investors. The conceptual open interest, representing the locked dollar value in active perpetual futures contracts, surpassed $500 million for the first time since April 19th. This figure has more than doubled in the past two weeks, with the open interest in DOGE reaching 6.2 billion in DOGE, approaching the previous peak of 6.43 billion recorded on April 8th.

The increasing open interest and price rise indicate new capital inflows into the market, confirming the upward trend for Dogecoin.

Funding Rates Suggest the End of the Surge

Funding rates in perpetual futures represent the costs associated with holding long or short positions. Positive values indicate dominance of long positions, while negative values indicate dominance of short positions. The current neutral funding rates suggest a balance between long and short positions for DOGE.

However, at the time of writing, the open interest-weighted funding rates have dropped to zero, indicating a balance between long and short positions that anticipate a rise and a decline. This balance could be a sign of a potential pause in the upward momentum for DOGE following its recent impressive performance.