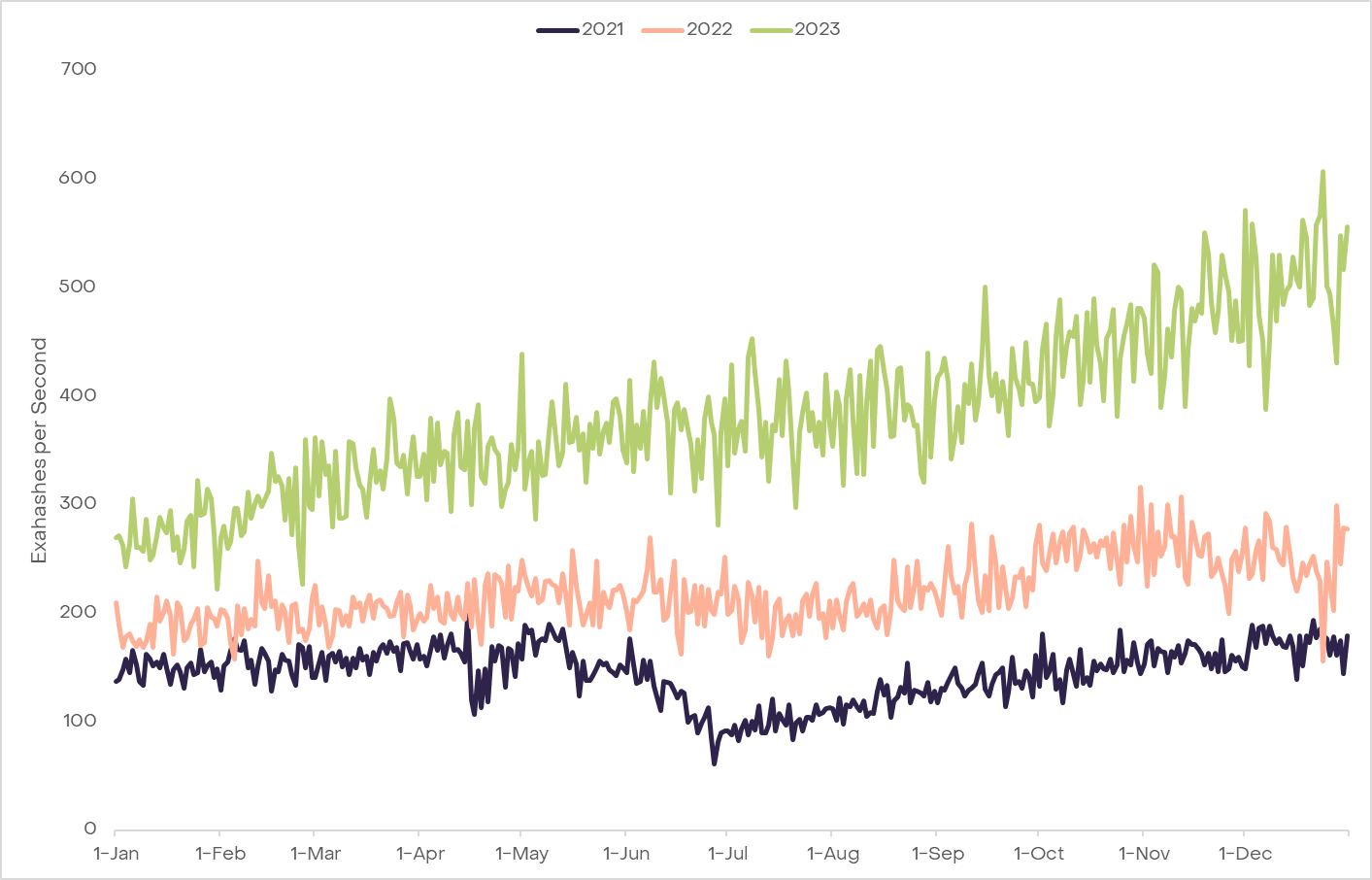

The rise in the cryptocurrency market is leading to notable developments in many blockchain ecosystems, including Bitcoin. Accordingly, the hashrate value, which measures the computational power required for Bitcoin mining, has reached its highest level ever. This indicates that miners are using increasingly significant resources to solve complex mathematical puzzles and earn Bitcoin.

Hashrate Continues to Climb

Past data on Hashrate suggests that miners tend to increase their capital expenditures to maintain their competitive power before halving. This competition in the field usually results in an increase in mining difficulty in the months before the event. Consequently, miners who cannot keep up with the higher production costs are pushed out of the market.

According to Grayscale, in the fourth quarter of 2023, there is a noticeable tendency for miners to sell their Bitcoin assets to create liquidity before the decrease in block rewards. These measures indicate that Bitcoin miners are at least well-equipped to overcome the upcoming challenges in the short term.

Even if some miners exit the market, a drop in the hashrate could lead to adjustments in mining difficulty. This could potentially reduce the cost per Bitcoin for the remaining miners in the market and maintain the network’s stability.

Bitcoin Price Performance After Halving

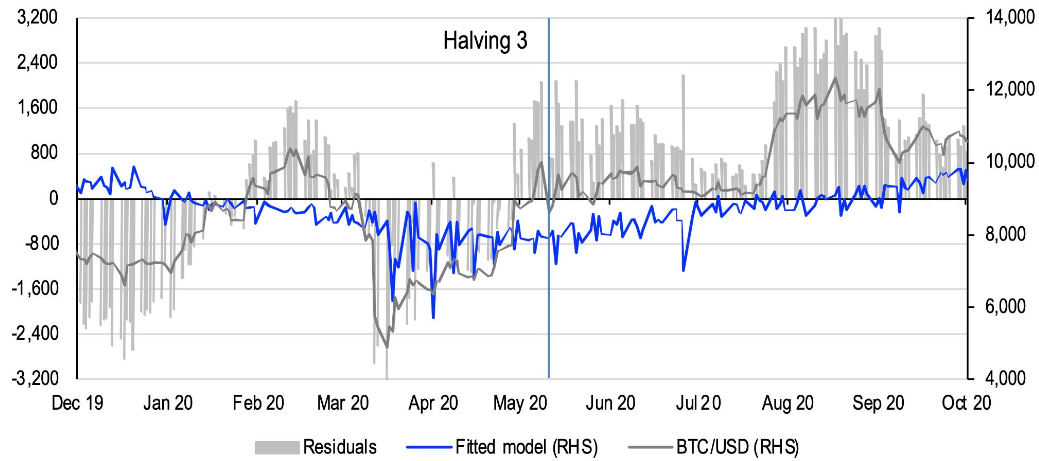

Historically, Bitcoin prices have risen following the halving event. After the first halving in 2012, the price soared from $12 to $126 within six months. Similarly, after the second halving in 2016, Bitcoin’s price rose from $654 to $1,000 within seven months. After the third halving in 2020, the price increased from $8,570 to $18,040 in the same period.

While initial concerns led some investors to sell their Bitcoin assets, renewed interest in Bitcoin is expected. The law of supply and demand will likely balance the market and lead to a recovery in Bitcoin prices after the initial drop.

Recent research by Coinbase highlights the growing institutional interest in crypto assets, indicating a shift towards more mature market behavior. This trend is characterized by decreased volatility and an increased inclination towards investment strategies. This transition marks a new era in crypto investment, with institutional players moving beyond pure speculation to adopt strategic, long-term positions.