Crypto markets, which started October with expectations of a rise, have not been able to recover as expected. The lack of interest in ETFs for ETH has weakened investors’ risk appetite. However, all data is not against cryptocurrencies, and an important change that signals an increase is attracting attention.

Bitcoin and Long-Term Bonds

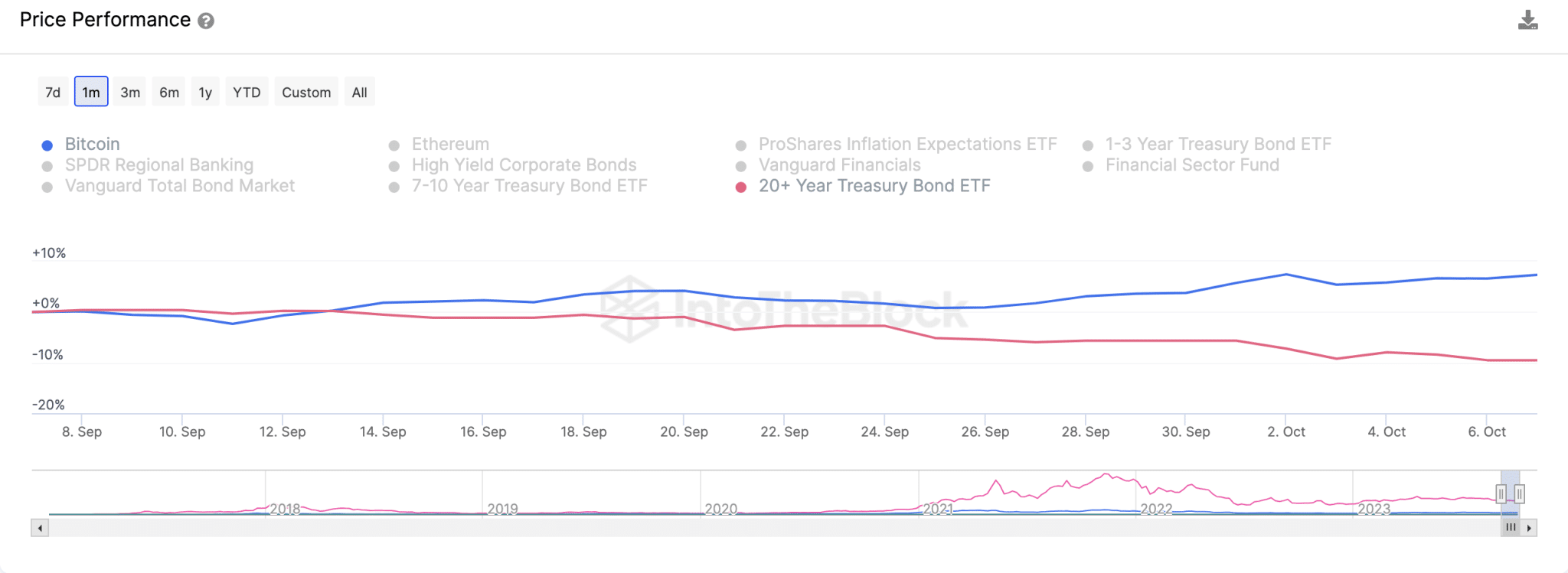

In September, the correlation between Bitcoin and long-term bonds reached its lowest level in the past year. The latest report shared by IntotheBlock analyst Lucas Outumuro seems promising for crypto investors. Outumuro discusses the situation of Bitcoin and long-term bonds.

Rising interest rates in 2022 led to a decline in both long-term bonds and BTC. Due to the decrease in returns, the value of bonds decreased, and the price of BTC decreased due to investors’ escape from risk markets. As interest rate increases slowed down this year, the value of both assets increased.

However, while long-term bond prices fell in the last month, the price of BTC increased, and a low correlation of -0.74 was formed between them. According to IntoTheBlock’s data, during the 30-day period, the price of Bitcoin (BTC) increased by 7%, while long-term bond ETFs experienced a 10% loss.

What to Expect for Cryptocurrencies?

According to Outumuro, the negative correlation between the two assets was related to the perception of the king cryptocurrency as a store of value again. In other words, as the perception of BTC changed, the correlation was disrupted. The popular analyst draws attention to the NVT ratio to support this narrative.

According to the analyst’s interpretation, the increase in BTC’s NVT ratio indicates a sign of power beyond transactional benefit.

“In 2023, we saw an increase in demand for Bitcoin as the cracks in the traditional financial system became apparent. When SVB collapsed in March and the Fed intervened with the BTFP program, the price of Bitcoin rose by over 20%.”

According to him, the recent change was promising.

“It may be too early to call for a bull market, but it is clear that the broader market has changed its tone about Bitcoin.”

On the other hand, BTC continues to trade in a narrow range. RSI is positive, and closures above $28,143 for the BTC price can accelerate the overall market rally.