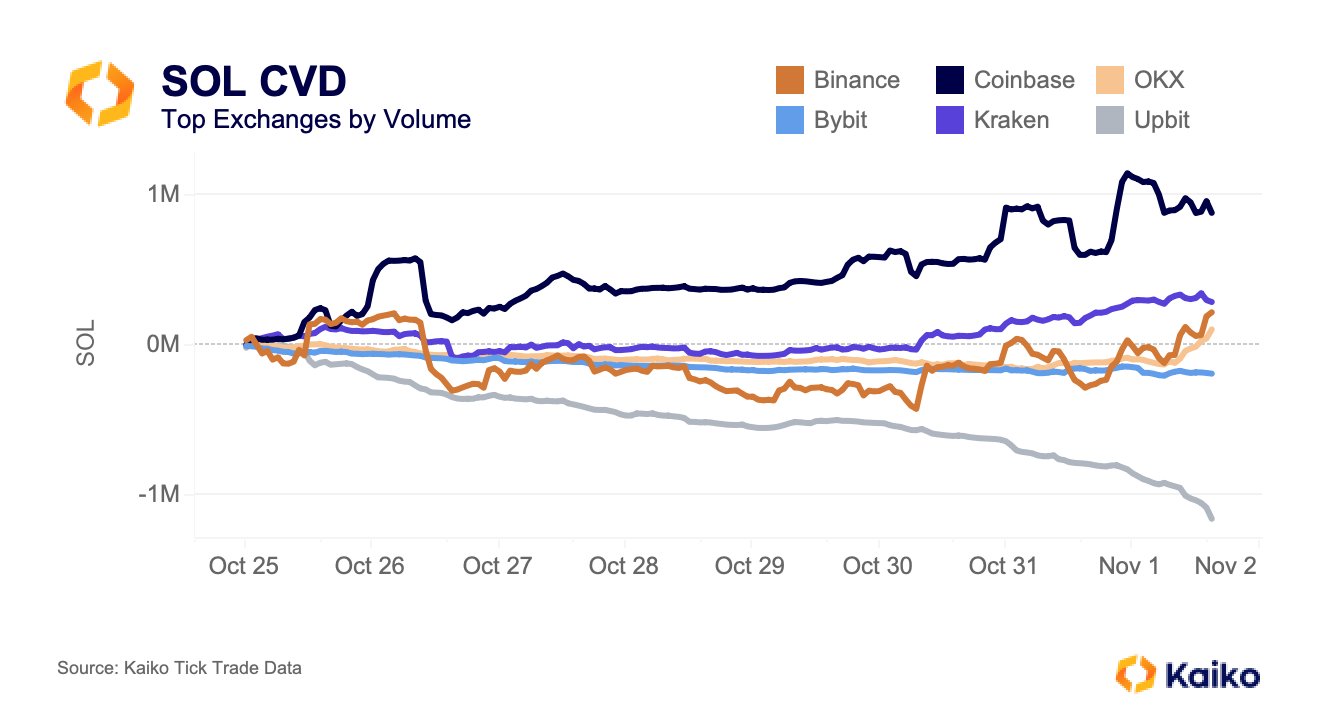

Data provided by Paris-based crypto research firm Kaiko reveals an important detail behind the significant increase in Solana’s SOL, which has risen over 50% in the past two weeks and nearly 70% in the past month. The data shows that the US-based major cryptocurrency exchange Coinbase is a significant source of growth for the altcoin.

The Role of Coinbase in the Increase of Solana’s Price

Since October 25, the cumulative volume delta (CVD) of SOL has increased by approximately $1 million on Coinbase, indicating a net capital inflow. While CVD turned positive on Binance and Kraken earlier this week, it has been negative and declining on South Korea-based cryptocurrency exchange Upbit for the past two weeks.

The CVD metric shows the net difference between buying and selling volumes over time. It represents the total of bullish/bearish pressures in the market, with positive values indicating an excess of buying volume and negative values indicating a shortage of buying volume.

According to Kaiko analyst Riyad Carey, the median order size on Coinbase is much higher than other cryptocurrency exchanges. This is considered as a sign that institutional investors are more interested in buying SOL through Coinbase than individual investors.

Coinbase’s leadership in the SOL market comes after the asset management firm VanEck published a report detailing a bullish scenario that could push the price of the altcoin up to $3,200 by 2030. VanEck’s rise prediction is based on a scenario where Solana becomes the first blockchain hosting applications with over 100 million users.

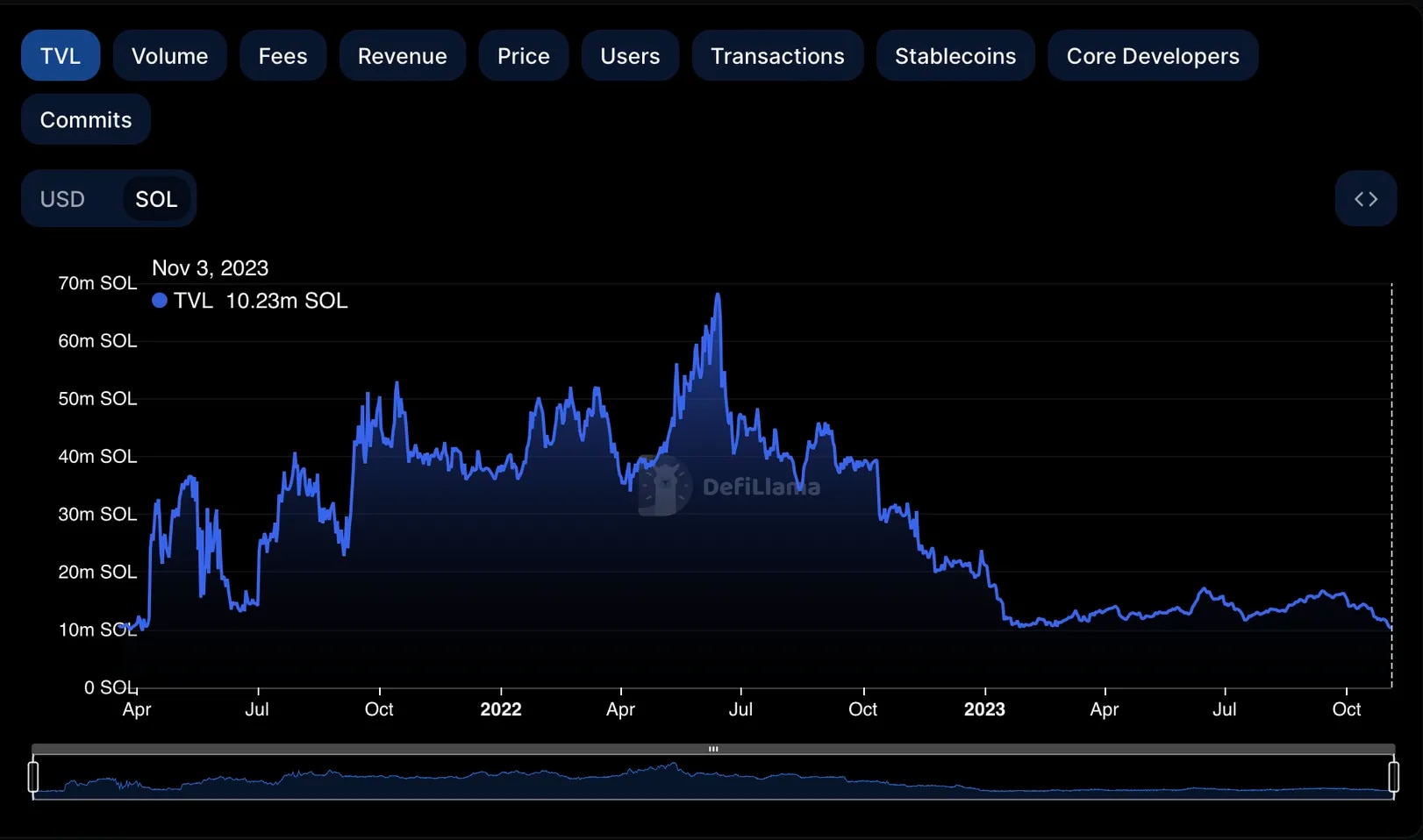

On-Chain Data Does Not Support the Price Increase

However, the recent price increases of SOL have not yet been able to stimulate on-chain activity as expected. According to DefiLlama, the total value of locked assets in Solana-based decentralized finance (DeFi) protocols has dropped from 12.03 million SOL to 10.23 million SOL in the past two weeks, reaching the lowest level since April 2021. Although TVL is a problematic measure, it is widely followed to gauge the usage of smart contracts.

On-chain analyst Patrick Scott noted that the volume on Solana-based decentralized exchanges (DEX) and the number of active wallet addresses on the network have increased on his personal X account, but these increases are not sufficient to support the price increase.