Aave (AAVE), one of the most important projects of the Ethereum (ETH) network and the DeFi ecosystem, has recently reached a significant level. Aave launched Aave V3 in January, and since then there has been an incredible change in interest in the project.

Aave Continues to Grow

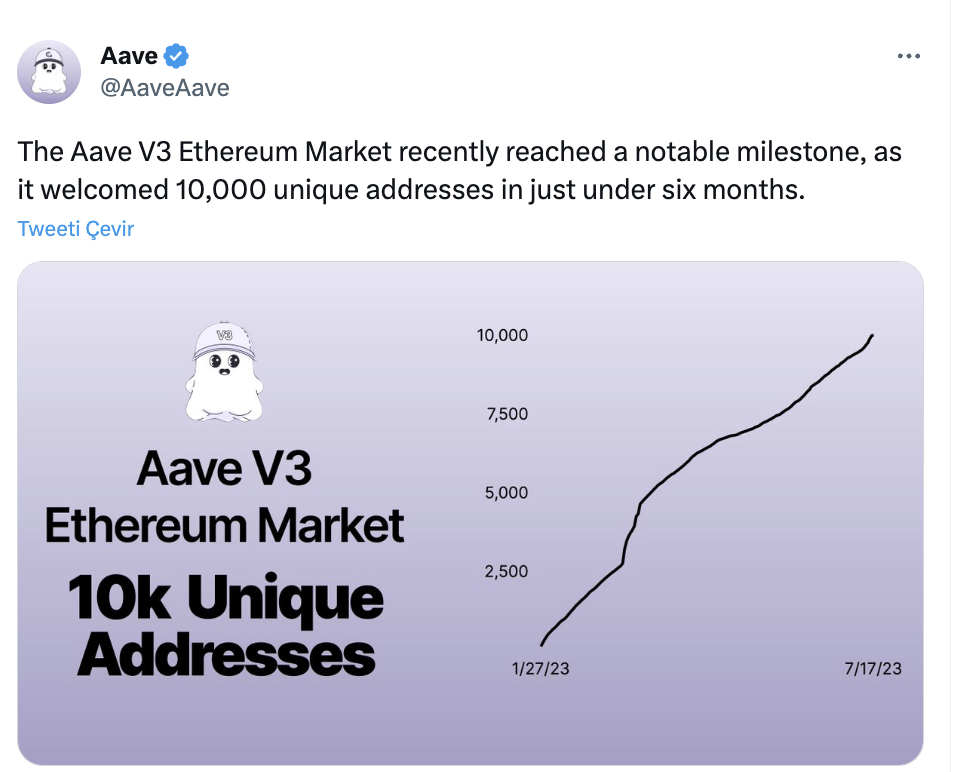

According to the latest information, Aave V3, which was launched on January 27, has reached 10,000 unique addresses. The increase and the rate of increase since January 27 show that the DeFi world is still alive and people’s interest in it continues to grow.

Since the implementation of V3 on the network, it has attracted $2.24 billion in capital. Of this, $2.24 billion was deposited, while $765 million was used for borrowing and deposited as collateral. Aave’s success in the DeFi world is due to the seamless progress of previous protocols and versions.

Aave has made significant contributions to the DeFi world. The Aave platform has grown by 60% in a short period of time, and as of January 1, the total locked token value on AAVE was $3.82 billion, which has now increased to $6.12 billion.

Aave Positively Impacts the Ethereum Ecosystem

When Aave V3 was first released, it was made available on many networks such as Polygon, Arbitrum, Avalanche, Fantom, Harmony, and Optimism. The increase in the total value of locked tokens on Aave led to it surpassing MakerDAO in terms of total locked token value. MakerDAO is currently the second-largest protocol on the Ethereum network in terms of total locked token value. Lido Finance (LDO), which is ETH-focused, ranks third, and Ethereum-focused DeFi protocols continue to thrive.

Currently, there are 373,000 wsETH on the Aave network, all of which are staked, which is actually positive for ETH. As the amount of ETH staked in Ethereum-focused DeFi protocols increases, selling pressure on ETH may decrease. The second-largest cryptocurrency by market capitalization, ETH, may achieve sustainable growth as a result.