Bitcoin price fell over 5% today, reaching down to $43,212. So what caused this drop? There can be many reasons, but fundamentally, the rationale for the decline is clear. There has never been a period where Bitcoin’s price continuously rose without any corrections, which are triggered by various reasons, and one thing everyone should be aware of is investor psychology.

Why Is Bitcoin Falling?

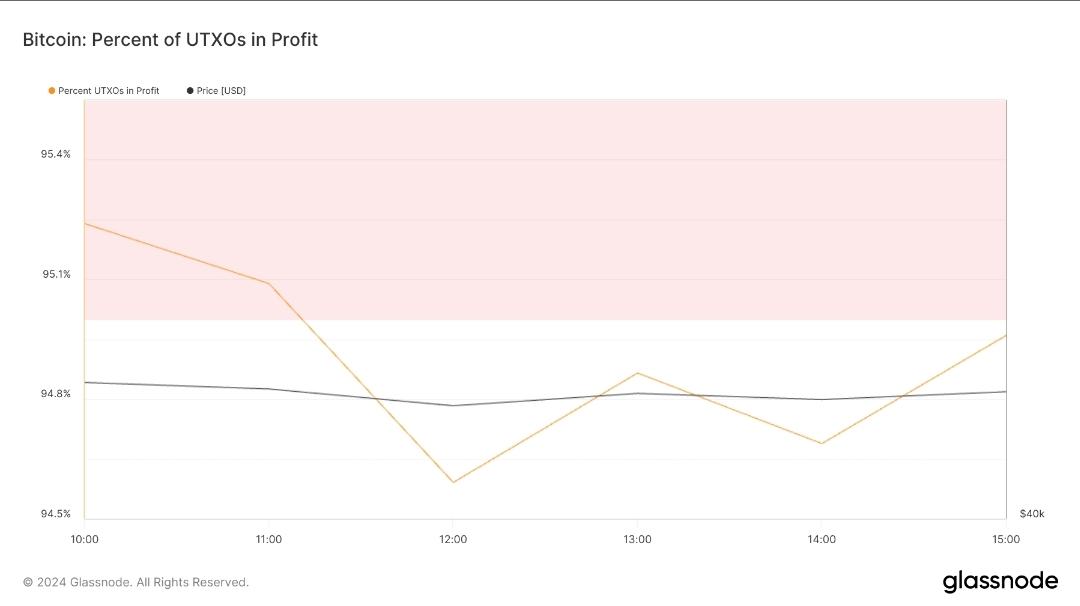

BTC price has fallen to the $43,000 region with ongoing sales. We had already shared the targets with you when the technical outlook seemed to indicate a downturn. For days, there was a piece of on-chain data that we had been highlighting. While everyone was in FOMO with ETF excitement, popular Turkish crypto analyst Barış Kardeş warned investors due to the profitable supply reaching 95%.

“Friends, this indicator tells us; when my metric reaches 95% and above, the probability of a decline is high. Now, whether this will be a correction or a crash, I cannot say, but according to my working principle, you should carefully follow these levels.”

This metric, which many experts have pointed out, is considered a signal of decline on the assumption that investors who are currently waiting profitably could sell at any moment. It wasn’t all that surprising that this happened while ETF approvals had been granted and they had started trading on exchanges.

On-chain analysis provides much better results in understanding investor psychology because it allows monitoring their very diverse and branched different behaviors. It includes miners’ profitability, selling tendency, earnings status, the intensity of operating mining devices, and much more.

If investors’ wallets are largely profitable (and if we’re talking about 95%, this is really significant), then the thing to do here is to sell. That’s why we now see the BTC price dropping.

Cryptocurrencies Will Rise

You don’t need to be a seer; the 2024 calendar tells us that even if we see similar or even deeper corrections, the markets will rise. Investors have many convincing reasons from historical data to believe this.

Firstly, we are in the very early stages of ETFs starting to spread worldwide. These ETF issuers need to see their assets in Coinbase Custody Wallets multiply with more demand. Of course, this should trigger a scarcity of supply.

There is a Bitcoin block reward halving in April, which means a reduction in sales pressure from miners and a further tightening of new supply entering the exchanges. If the new supply entering circulation contracts while ETFs create a strong wave of demand, an acceleration in the rise is expected.

By the middle of the year, if macro data does not continue to come in so absurdly bad, we will see the start of interest rate cuts. Even with short-term fluctuations during this period, growth in risk assets like cryptocurrencies is expected as the dollar cheapens in the world.

There are US elections in November at the end of the year, and a significant portion of the candidates have made pro-crypto statements. The departure of crypto adversaries like Gensler and Biden could boost motivation.