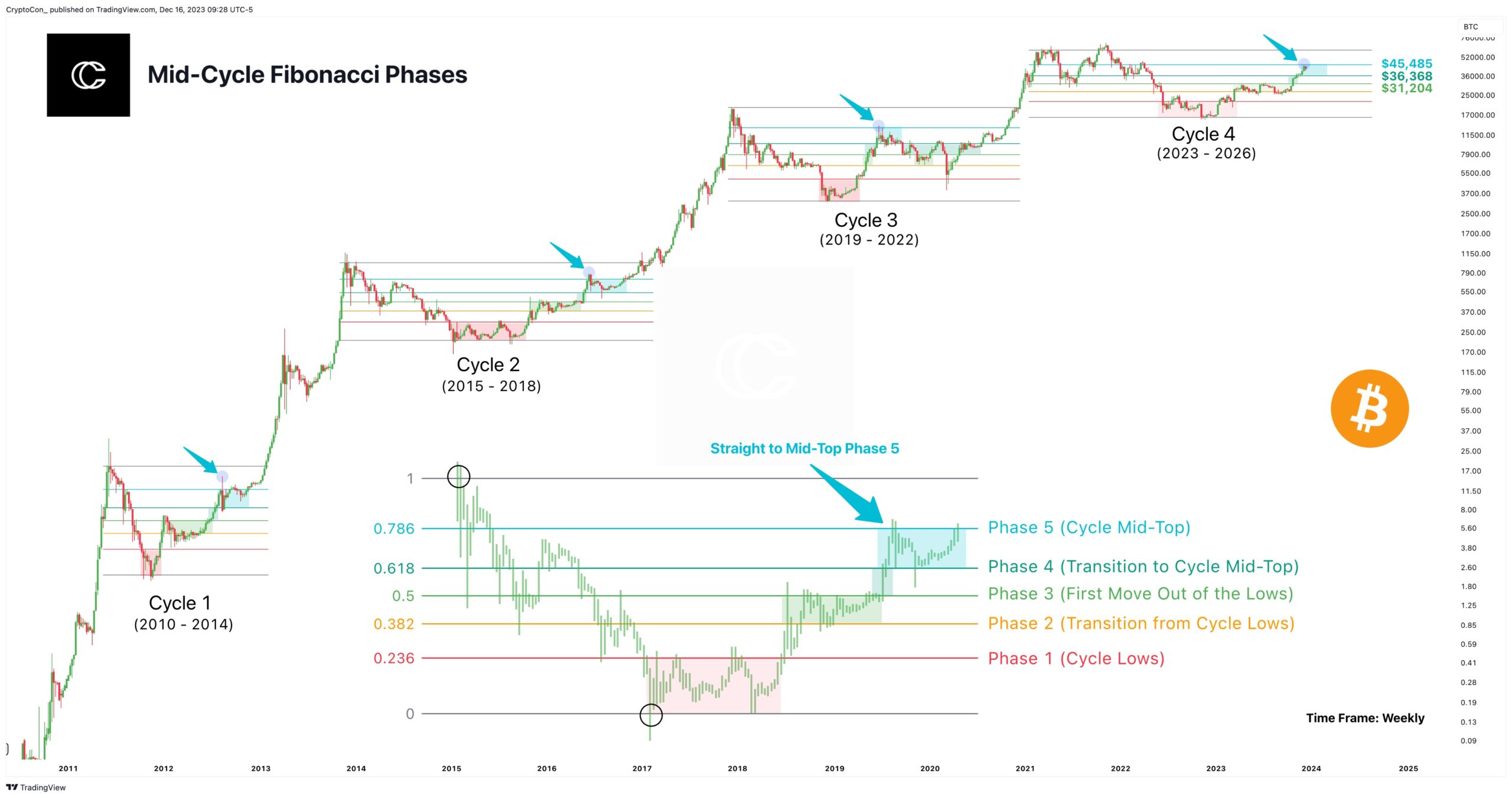

CryptoCon, closely monitoring the movements of the cryptocurrency Bitcoin, has detected a significant development in the middle stages of the Fibonacci cycle. According to the analysis, recent data suggests that Bitcoin may have completed the 5th stage of this cycle and could reach a notable high of 45,000 dollars. This situation points to a potential shift in the crypto world and is sparking discussions about what results might emerge in the coming months.

Expectation of a Corrective Period and Fundamental Levels

If the completion of Phase 5 is confirmed, the crypto community is preparing for a standard correction period. Analyst CryptoCon views the significant range between 28,000 and 32,000 dollars as an area of interest for this anticipated correction. The expectation is that this corrective phase could emerge within the next 1 to 2 months and may extend into January and February.

Despite hopes for a potential upward movement, there is a prevailing thought that the risks associated with Bitcoin’s current position could outweigh potential rewards. As the market progresses through this critical juncture, investors and traders need to be cautious and remain vigilant in their strategies.

For those interested in the cryptocurrency space, understanding the middle stages of Fibonacci’s cycle and their potential impacts on Bitcoin’s trajectory is becoming increasingly important. The completion of Phase 5 at 45,000 dollars presents a new narrative that shapes expectations for the coming months.

Understanding Cycle Changes in Cryptocurrencies

Navigating the crypto market requires a nuanced understanding of key levels and potential correction zones. The identified range between 28,000 and 32,000 dollars emerges as a critical focal point for market participants, emphasizing its importance in ongoing market dynamics.

As investors evaluate their positions and risk tolerance, being informed about Bitcoin’s mid-cycle changes and related corrective periods becomes very important. The continuously evolving nature of the cryptocurrency market highlights the importance of adapting strategies to align with emerging trends.

In conclusion, the completion of the 5th stage of Bitcoin’s mid-cycle Fibonacci phases invites a period of reflection and strategic planning for investors. The anticipated correction and identified price levels will provide a roadmap for navigating the crypto world in the coming months.