When everyone expected a rise, the approval and commencement of Spot Bitcoin ETFs by the SEC led to a more than 15% drop in BTC price, falling from $49,000 to $40,297. Consequently, there was a noticeable decrease in BTC’s trading volumes. Another blow to the market came from Grayscale, with reports suggesting that sales of Bitcoin assets by the Grayscale Bitcoin Trust (GBTC) had been executed. However, according to the CryptoQuant team, this may not be as it seems.

Why Is Bitcoin Falling?

Julio Moreno, a prominent figure at the forefront of CryptoQuant research, stated that the current Bitcoin price correction, which is believed to have occurred, is not due to GBTC-centered sales as the market news suggests.

Grayscale Bitcoin Trust (GBTC) reportedly sold about 60,000 Bitcoin, but Moreno countered that the combined net purchases related to the spot Bitcoin ETF by approximately 10 institutions, including BlackRock, Fidelity, Bitwise, amounted to about 72,000 BTC. This indicates that the inflow has indeed increased along with the transaction volumes in the billions.

One of the main reasons for Bitcoin’s decline was indicated to be the sell-the-news activity. It was added:

Some on-chain metrics and indicators still suggest that the price correction may not be over, or at least that a new rally may not yet be on the cards. Short-term traders and large Bitcoin holders continue to make significant sales in a risk-averse context. Moreover, according to CryptoQuant’s views, unrealized profit margins have not fallen enough for sellers to be exhausted.

Another prominent figure in the cryptocurrency world, CredibleCrypto, stated in his analysis that the definitive data shows a net positive of +5,000 Bitcoin purchases since the day the BTC flow associated with ETFs occurred. He also added that the impact of this situation will be ten times that of the halving event.

BTC Price to Witness Short-Term Correction

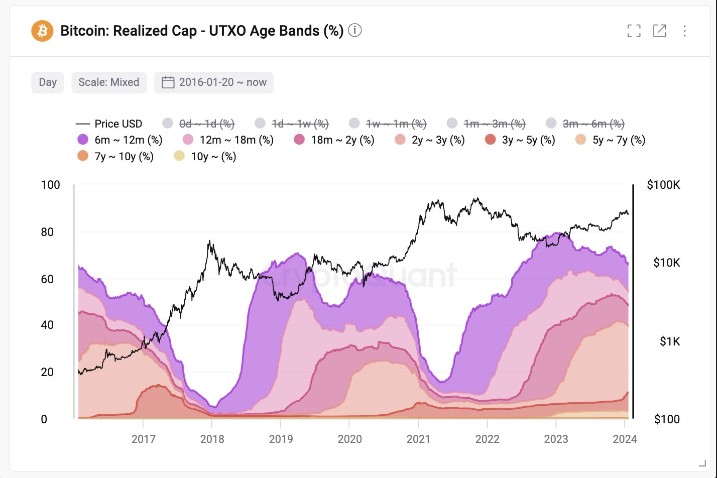

CryptoQuant founder and CEO Ki Young Ju stated on January 20 that Bitcoin in the distribution phase has not been fully transmitted to individual users. He mentioned that the recent 15% correction could continue and the decline could deepen.

Despite all this, he emphasized that this long-term bull market cycle will continue and that the process will persist until Bitcoin is completely distributed to individual users. According to the CEO, the long-term outlook continues to be positive.