Another significant week of US macroeconomic data that could reinforce the Federal Reserve’s views on interest rate cuts is approaching. While Bitcoin investors are mostly focused on the halving event, pressures from the March Consumer Price Index (CPI) and Producer Price Index (PPI) will emerge in the next few days. The US inflation narrative is currently forming a contrasting process with signals coming from Europe.

US Data and Bitcoin

Fed Chairman Jerome Powell recently stated that officials feel comfortable with a data-driven approach to interest rate cuts as inflation gradually decreases and the economy withstands tighter policy. Therefore, markets have moved their expectations for the start of interest rate cuts towards the end of the year. The Kobeissi Letter, a trade source, included the following statement in a section of its weekly journal:

“This week is all about inflation data and the Fed’s next steps.”

The latest forecasts from CME Group’s FedWatch tool show a less than 50% chance of a 0.25% cut in June or July. However, Europe and the United Kingdom are increasingly seeking earlier interest rate cuts. Bank of England Governor Andrew Bailey stated in March:

“We are not yet at the point where we can reduce interest rates, but things are moving in the right direction.”

Excitement Continues in the Mining Sector with Upcoming Halving

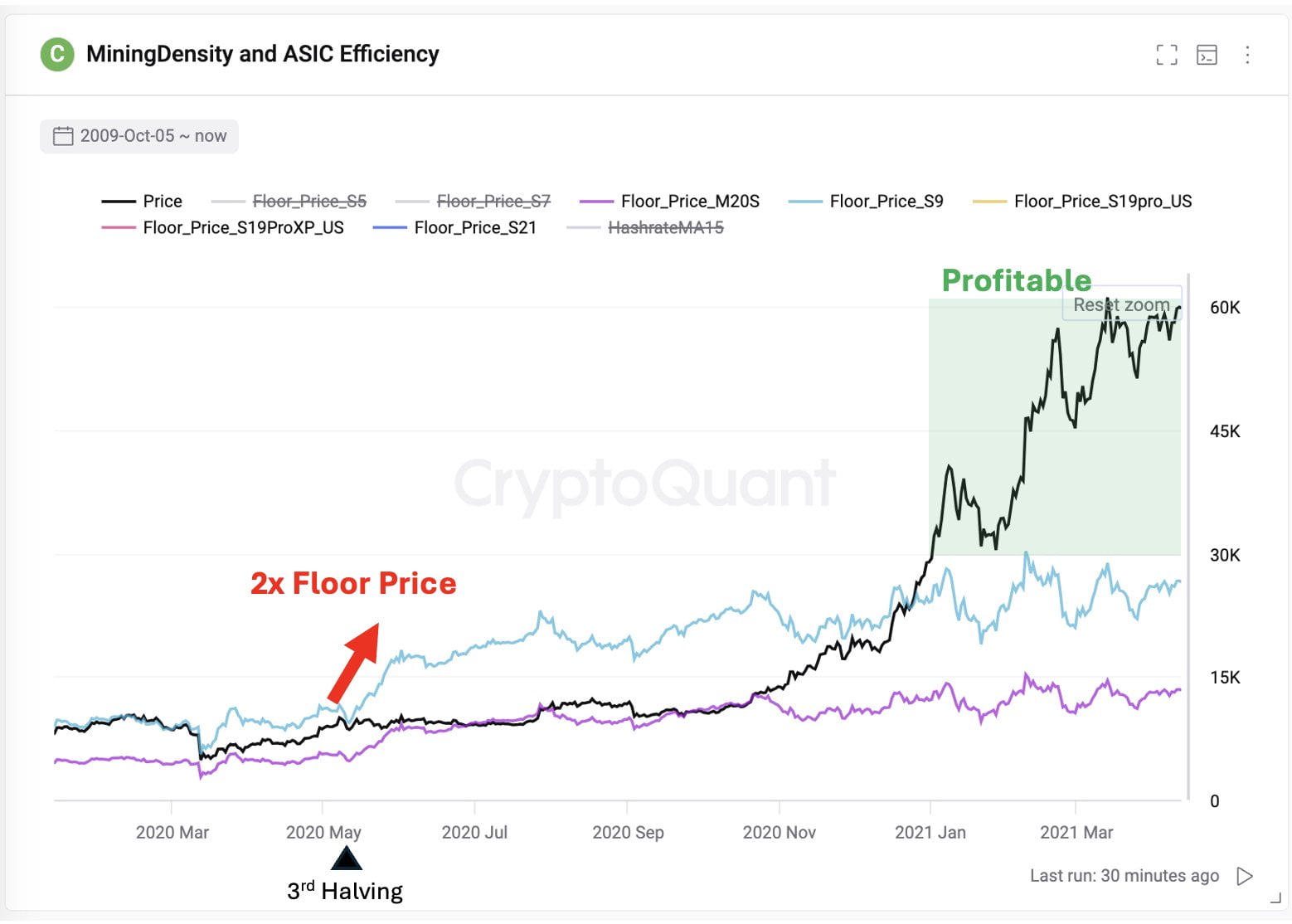

Bitcoin halving is just 11 days away, and attention is increasingly turning to the preparations of miners. There is less than two weeks left for the new Bitcoin amount per mined block to decrease by 50% to 3.125 BTC. Miners increased sales in 2024, and now analysts see a period of adjustment ahead. Ki Young Ju, CEO of the on-chain analysis platform CryptoQuant, stated this week:

“Bitcoin mining costs will double by the end of the month following the halving event, rising from $40,000 to $80,000 for the widely used S19 XPs by US miners.”

Ki noted that mining costs are already twice what they were in 2020, but the price increases in Bitcoin have mitigated the impact on miners’ profitability:

“Since the halving event in May 2020, mining costs have doubled, but a parabolic bull run that covered these costs and reached profitability started.”

During this period, many analysts believe that the revenue stream for Bitcoin Ordinals and increased transaction fees will be maintained after the halving event. Laurent Benayoun, CEO of crypto consultancy and market maker Acheron Trading, said in an interview last week:

“It’s not clear that miners will be worse off in dollar terms after the halving event, quite the opposite.”