The recent process in the cryptocurrency markets has led to increased volatility in the market. Especially after the victory against SEC in the Grayscale case, Bitcoin experienced a rise. However, a new decline was added to the ones that have been happening for the past ten years in September, and the profits evaporated. In the first week of October, there was a significant rise, but the recent events have once again saddened Bitcoin investors.

What is Happening in the Bitcoin Market?

In the early days of 2023, there were significant liquidations on the short side in the futures market. On August 17, this situation was seen on the long side. Since the bankruptcy of Terra in May 2022, the market has witnessed the largest liquidations in long contracts.

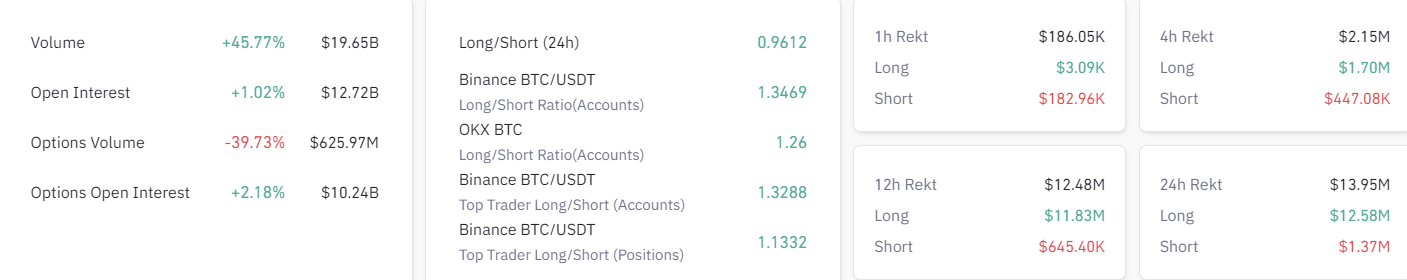

Since August 17, investors have continued to withdraw capital from risky assets like Bitcoin, and the futures trading volume has decreased by 40% until October 9. In the last 24 hours, $12.6 million worth of long positions have been liquidated in the futures market.

If long position liquidations in the Bitcoin market cannot be covered by investors, it causes the price of Bitcoin to drop. Especially after Binance ended its zero-commission campaign, there was a significant decrease in futures market volumes. The lack of liquidity and volume continues to harm the cryptocurrency market, especially Bitcoin.

Investors Do Not Lose Hope

Despite all these unfavorable conditions, institutional investors continue to show significant interest in the cryptocurrency market. Despite the legal regulation problems in the US, large institutions continue to take steps that could ignite a significant rally. This is supported by the ETF applications of 9 major investment firms awaiting approval from the SEC.

However, SEC officials are doing their best to slow down this process despite the calls from major financial companies. Most likely, these ETF approvals will be postponed by the SEC until 2024, and this will continue to negatively impact the cryptocurrency market. Some investors believe that BlackRock is suppressing the price of Bitcoin due to the ETF application.

Some analysts believe that despite the pressure on the price of Bitcoin, factors that could occur in the short term in the US, such as interest rate cuts and ETFs, will trigger a Bitcoin rally.