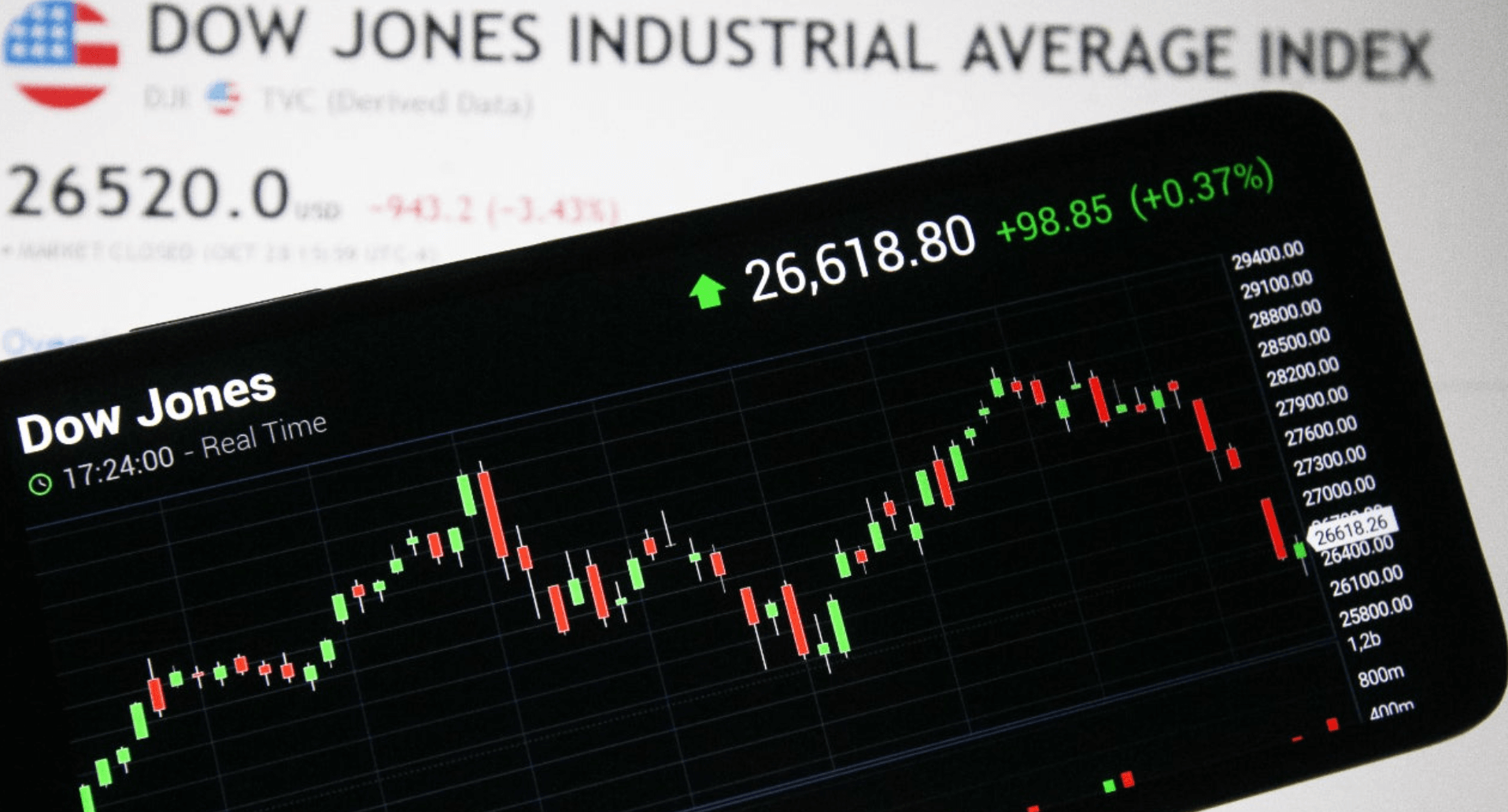

The Dow Jones Index, situated in the United States, tracks the performance of the stocks of 30 major leading companies. Known as the Dow Jones Industrial Average (DJIA), the index was established in 1885 and is regarded as a general indicator of the American stock market. It calculates using primarily the prices of the companies’ stocks and provides insights into the US economy.

What Are Stocks?

Shares represent ownership stakes in a company held by its shareholders, serving as a financial instrument. Companies may offer their shares to the public for capital increase or growth financing purposes. By purchasing these shares, shareholders become company partners, potentially receiving a portion of the company’s profit. Additionally, shareholders may influence the company’s management and decision-making processes.

Shares can be bought and sold on stock exchanges, offering investors the opportunity to benefit from the company’s performance and growth.

What Is a Stock Index?

A stock index is a financial metric devised to measure and represent the performance of a group of stocks. It typically comprises shares traded on a specific exchange or market. Stock indices offer investors, economists, and analysts the ability to track the overall trend and performance of the stock market in a given market.

Stock indices follow the general price movements of shares and use these movements as an indicator. Indices are often calculated using a weighted method, taking into account the market values of the stocks included in the index. Hence, the performance of stocks of companies with larger market values has a greater impact on the overall index performance.

Stock indices can be found in different markets and countries. For instance, popular stock indices in the US include the S&P 500 (SPX), Dow Jones Industrial Average (DJIA), and Nasdaq Composite (IXIC). Europe uses indices like the STOXX 50 (STOXX50E), Germany has the DAX (GDAXI), Japan uses the Nikkei 225 (N225), and Turkey has the BIST. Each index represents a specific group of stocks according to its criteria and methods.

Stock indices play several vital roles for investors and analysts. Firstly, indices serve as indicators reflecting the general trend and health of the market. Investors analyze the upward or downward trends of indices to comprehend the overall market condition. Secondly, indices are used as a benchmark for measuring portfolio performance. Investors can evaluate how their portfolios are performing relative to the index. Lastly, indices can form the basis for financial products. Many investment funds or exchange-traded funds (ETFs), for instance, track the performance of a specific index, offering investors the opportunity to invest based on the index.

In conclusion, stock indices are critical financial measures used to understand the general market trend and stock performance. By monitoring stock indices, investors, analysts, and economists gain insights about the markets and base their investment decisions on this information.

What is the Dow Jones Index?

The Dow Jones Index is a stock index created to measure the performance of the shares of 30 large and leading companies traded on the New York Stock Exchange (NYSE). Also known as the Dow Jones Industrial Average (DJIA), it’s commonly referred to as just “Dow”. The Dow Jones Index is one of the oldest stock indexes globally, typically representing the overall health of the U.S. economy and the performance of the stock market.

The Dow Jones Index was established by Charles Dow and Edward Jones in 1896. Initially, the index only included the shares of 12 companies, but this number was later expanded to 30. The term “industrial” is used as the index primarily covered the shares of large companies in the industrial sector. However, today, the Dow Jones Index includes not only shares from industrial sector companies but also companies from various sectors such as finance, technology, services, and retail.

The Dow Jones Index is a price-weighted index, i.e., it’s based on the prices of shares. The proportion at which each company is represented in the index is determined based on the share price’s total market value. Hence, companies with a higher market value have a greater impact on the overall performance of the index. Thus, while the Dow Jones Index reflects the performance of large and leading companies, the impact of smaller companies is more limited.

The calculation of the Dow Jones Index utilizes the total prices of the shares of the 30 companies in the index. This total is divided by a factor called the Dow Divisor to obtain the index value. The Dow Divisor allows the index to adapt to changes over time and takes into account factors such as stock splits, mergers, or changes.

What are Dow Jones Stocks?

The stocks included in the Dow Jones Index are the 30 companies whose performance dictates the Index’s direction. These stocks generally belong to America’s largest and most recognized companies. Companies included in the Dow Jones Index are selected through a process based on certain established criteria. The stocks in the Index represent various sector companies and provide information about economic growth, consumer trends, and market conditions. Some familiar companies included in the Dow Jones Index are Apple, Microsoft, Boeing, Coca-Cola, Visa, Nike, and Procter & Gamble. These companies play a significant role in both the US economy and the global financial markets.

In conclusion, stocks are financial instruments representing ownership stakes in companies. The Dow Jones Index is an Index that tracks the performance of 30 major companies’ stocks in the US. Stocks listed on the Dow Jones Index are those representing companies whose performance reflects the general market trend and is associated with economic growth. These stocks are closely monitored by investors and economists and are used to understand financial market movements.