The S&P 500, or SPX, is a stock index encompassing 500 large companies operating in the United States. Utilized as a benchmark reflecting the overall performance of the U.S. stock market, the S&P 500 offers investors portfolio diversification opportunities, serving as a vital tool to monitor the U.S. economy’s status.

What is the S&P 500?

The S&P 500 index represents a stock market index covering the stocks of 500 large companies located in the U.S. The abbreviation “S&P” refers to the Standard & Poor’s company, and the index is designed to measure and track the stock performance of these companies. The S&P 500 reflects the overall financial health of large corporations in the U.S. economy and is mainly used to follow the general trend in financial markets.

The index is calculated primarily based on the market values of the selected 500 companies. Market value is a figure derived by multiplying the current stock price of the company by the total number of shares. The index ranks companies by market value, meaning companies with larger market values have more weight in the index.

The S&P 500 is also a widely used metric to monitor and evaluate the overall performance of the U.S. stock market. Investors and analysts assess the overall health of the U.S. economy by following the index’s performance and establish their positions by identifying general trends in the stock market. Moreover, financial instruments such as derivative products and investment funds are also found on the S&P 500 index.

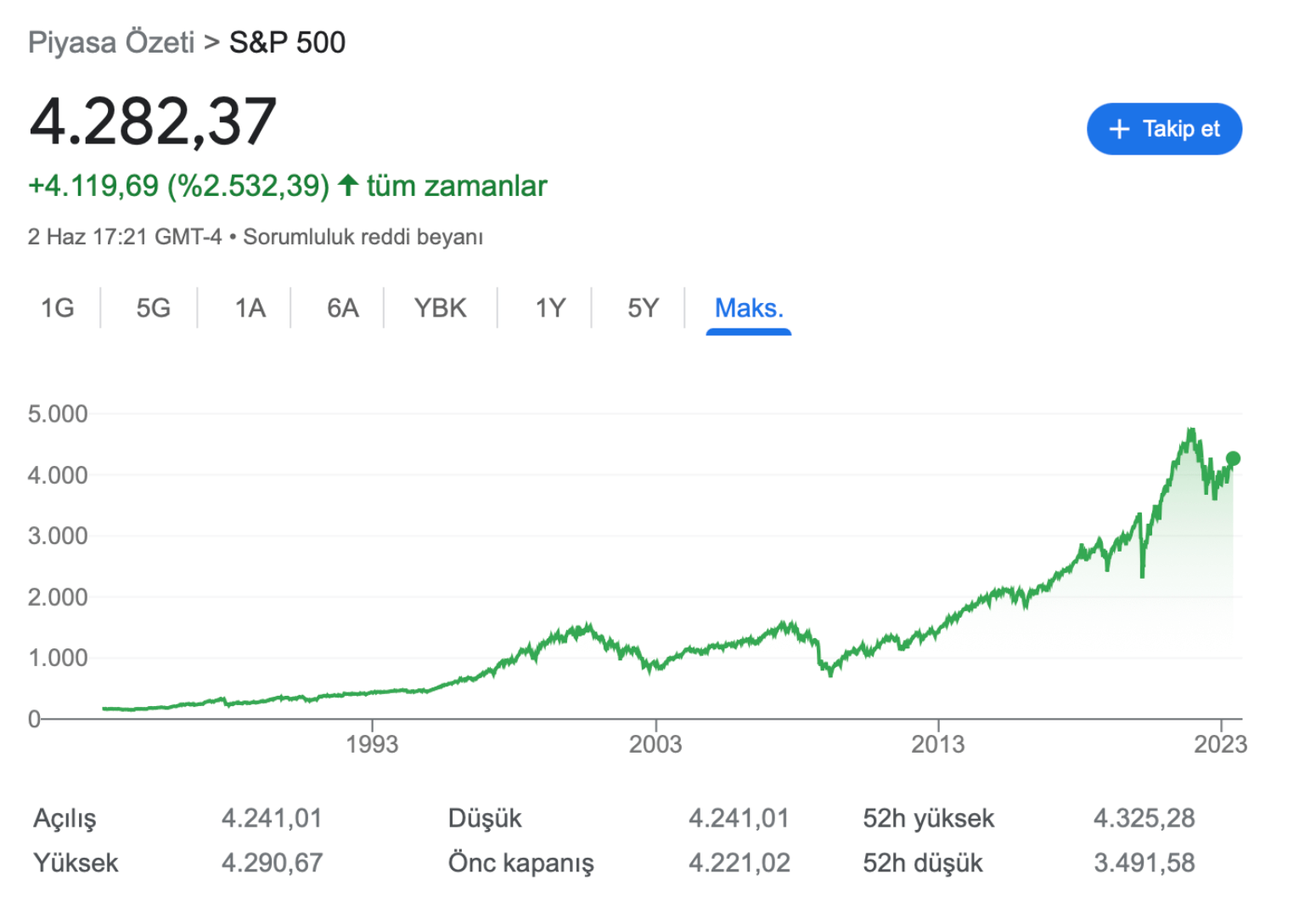

The S&P 500 index can make sharp movements up and down over time and can reach trough and peak points during certain periods. Troughs denote periods associated with market downturns when the index has declined to its lowest levels. These periods typically see selling pressure and a negative market sentiment. Peaks, on the other hand, represent times when the index has reached its highest levels. These periods usually observe buying pressure and a positive market sentiment. Peaks are often considered the high points of market rallies. The most recent peak in the index was recorded at 4,766.18 on December 31, 2021, and the most recent trough was recorded at 2,304.92 on March 20, 2020.

Troughs and peaks can be significant turning points for investors. Troughs are seen as potential buying opportunities, while peaks are considered profit-taking or selling points.

SP500 Stocks and What You Need to Know

The S&P 500, encompassing stocks of 500 different companies, provides a comprehensive index that reflects the performance of various industry sectors. This assortment includes technology, finance, health, energy, retail, and more. Such diversity ensures the representation of the general market performance and offers investors a chance for diversification. Leading companies like Apple, Microsoft, Amazon, Alphabet (Google), Meta (Facebook), Berkshire Hathaway, Johnson & Johnson, JPMorgan, Visa, Procter & Gamble Company significantly contribute to the index.

The S&P 500 index, containing many large and recognized companies, serves as an attractive investment option. It allows investors to invest in various sectors, hence diversifying their risks. It is typically used as an industry and economic indicator, reflecting the general performance of the US stock market.

Investors interested in trading on the S&P 500 index can find numerous investment funds and Exchange Traded Funds (ETFs) that track the index. These funds enable investors to invest in the stock market based on the performance of the S&P 500 index. Also, some investors may trade using futures contracts or options on the S&P 500 index.

Nevertheless, the performance of the index can be affected by several factors. Economic conditions, interest rates, company balance sheets, political developments, and global markets can cause sharp fluctuations in the index’s value. Hence, investors tracking the performance of the S&P 500 should consider these factors holistically and diversify their portfolios by evaluating other investment tools.

Importance of S&P 500 and the Advantages It Offers to Investors

The S&P 500 index offers several advantages, making it a crucial indicator and benchmark for many investors and analysts. Its first benefit is as a market performance measure. As it reflects the general performance of the US stock market, it can be used to monitor overall market trends. Investors can identify market trends and potential risks by tracking the index’s performance.

The second advantage offered by the S&P 500 is portfolio diversification. Since the index includes 500 companies from various sectors, it provides investors with the opportunity to diversify their portfolios. This diversity allows investors to distribute their portfolios evenly, paving the way to mitigate their risks.

The third advantage is liquidity. Stocks in the S&P 500 index are generally considered liquid. This means that investors can buy and sell shares quickly and easily. Liquidity offers flexibility for investors to change their positions or take profits whenever they want.

The S&P 500 index’s fourth advantage is the potential for long-term growth. Since the index contains many large and successful companies, it offers long-term growth potential. Its movement in conjunction with the overall growth of the US economy and the innovation and growth potential of companies makes it an essential indicator for the markets.

The fifth advantage offered by the index is tax benefits. Some funds investing on the S&P 500 index can offer tax advantages. Benefits such as tax deferrals and low tax rates can aid investors in generating more effective returns.