During the preparation of the article, the king of cryptocurrencies reached the $31,300 resistance level, and altcoins are experiencing double-digit increases. It is still too early to celebrate, but continued closures at higher levels could indicate the end of a two-year period of chaos. However, a rejection from the $31,000 region would quickly push the price down to $29,000 through panic selling.

Will Cryptocurrencies Rise?

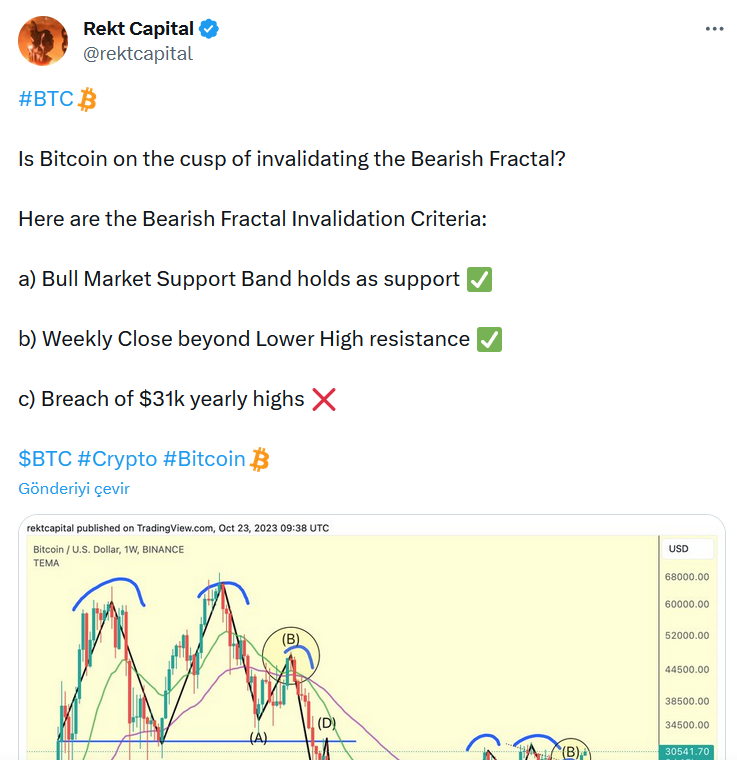

The king of cryptocurrencies reached its highest level since July, hitting $31,000. Popular crypto analyst Rekt Capital, who was previously known for his bearish predictions, had been emphasizing for weeks that there was a selling wave targeting $25,000 and even lower. Although he seems to have been proven wrong now, he doesn’t seem too unhappy about it.

Rekt Capital argued that BTC/USD could ignore the fractal of the downward trend in the game over the next 2023 if there are closures above $31,000.

Bitcoin and Crypto Predictions

The True Market Deviation indicator of on-chain analysis firm Glassnode is boosting investors’ confidence. As Chief Analyst Checkmate pointed out during the day, the Average Active Investor Value (AAIV) metric surpassed the key level. This move occurred before the rise to $31,000.

On the other hand, James Van Straten, the research and data analyst at crypto analysis company CryptoSlate, speaks highly of the strength of the rally. According to him, the approval of the US-based Bitcoin ETF is being priced in. Although the green light has not yet been given, as we have been saying for months, the SEC is now cornered. Bloomberg, JPMorgan, and many other institution experts give almost 100% chance of ETF approval by next year.

The negative premium of GBTC, the largest Bitcoin trust preferred by institutional investors, is also rapidly decreasing. This is a clear reflection of the confidence in ETF approval.

In conclusion, daily and weekly closures are much more important for Bitcoin at this time. If we have reached the end of the bear market and this is happening early with the pricing of ETF approval, we may see a move towards $37,000 and even higher before the end of the year.