One of the leading companies in the market, Glassnode, has stated that Ethereum (ETH) has fallen behind Bitcoin (BTC) for specific reasons. In a new analysis, Glassnode notes that the level of investor interest that has propelled Bitcoin to all-time highs (ATHs) under current market cycle conditions has not been directed towards ETH.

Current State of Bitcoin and Ethereum

Analysts state that the approval of spot Bitcoin exchange-traded funds (ETFs) has been a significant factor in the actions taken by market participants who have purchased BTC over the last 155 days. Access COINTURK FINANCE to get the latest financial and business news.

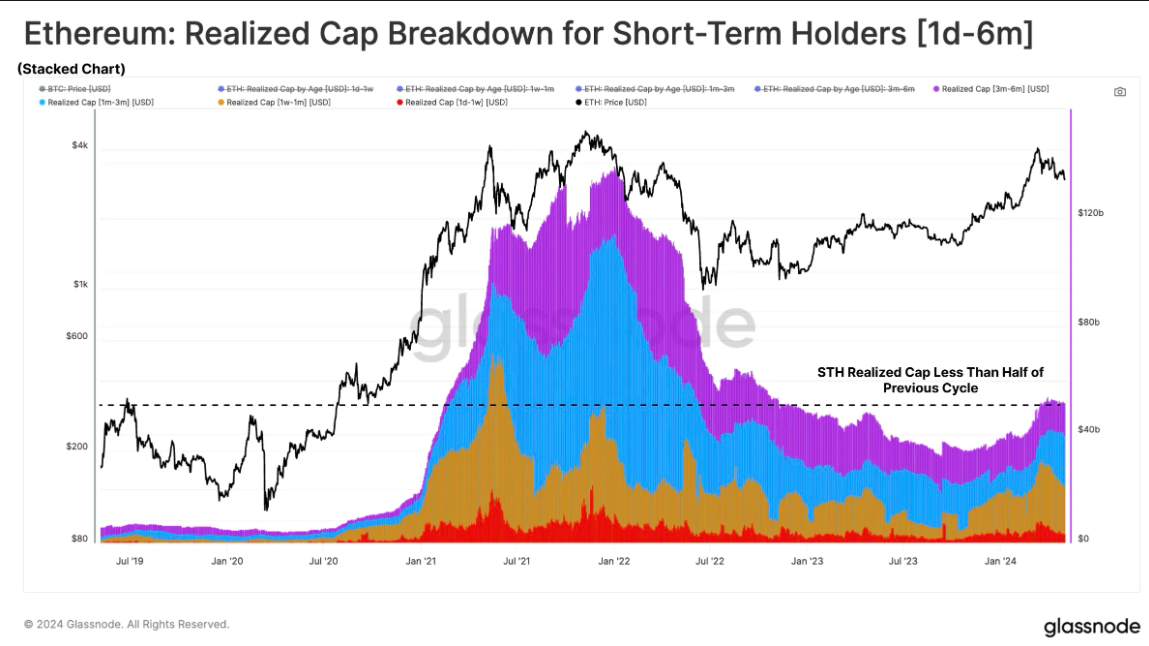

After Bitcoin reached its all-time high on March 14, there was a noticeable increase in speculative activities. Particularly, capital accumulation was observed among short-term holders (STHs), and the USD wealth held in coins moved in the last six months approached $240 billion near the ATHs. However, this trend has not been reflected for ETH, which has yet to see a price break above its 2021 ATH.

While Bitcoin’s STH-Realized Cap is almost at the same level as the last bull run peak, ETH’s STH-Realized Cap has hardly risen from low levels, indicating a clear lack of new capital inflows. In many ways, this lack of new capital inflow reflects ETH’s lower performance compared to BTC, likely partly due to the interest and accessibility brought by spot Bitcoin ETFs.

The Realized Cap metric is known to record the price at which each coin is transacted, showing how many owners are in profit or loss.

On the other hand, discussions include that following the U.S. Securities and Exchange Commission’s (SEC) decision on May 23, the approval of spot Ethereum ETF applications could host a significant capital inflow for ETH, clearly understanding the impact this had on Bitcoin.

The market is still awaiting the SEC’s decision expected by the end of May to approve a series of ETH ETFs.

Current Prices of Bitcoin and Ethereum

Bitcoin continues to reflect a positive outlook in the market. Following a 1.8% increase in the last 24 hours, BTC is currently trading at $62,455. Bitcoin’s market cap has risen above $1.23 trillion during this period.

On the other hand, Ethereum has seen a nearly 2% rise, currently trading above $3,021, noting that it dropped below $3,000 during the day. Ethereum’s market cap is at $362 billion.