Famous data analysis firm Glassnode highlighted an issue in its latest article in the weekly bulletin The Week On-Chain. According to the research, recent times have been tough for Bitcoin miners and their profits are not promising. However, the emergence of Bitcoin Ordinals has increased miners’ income, but this situation may disappear in the future, especially after the halving event.

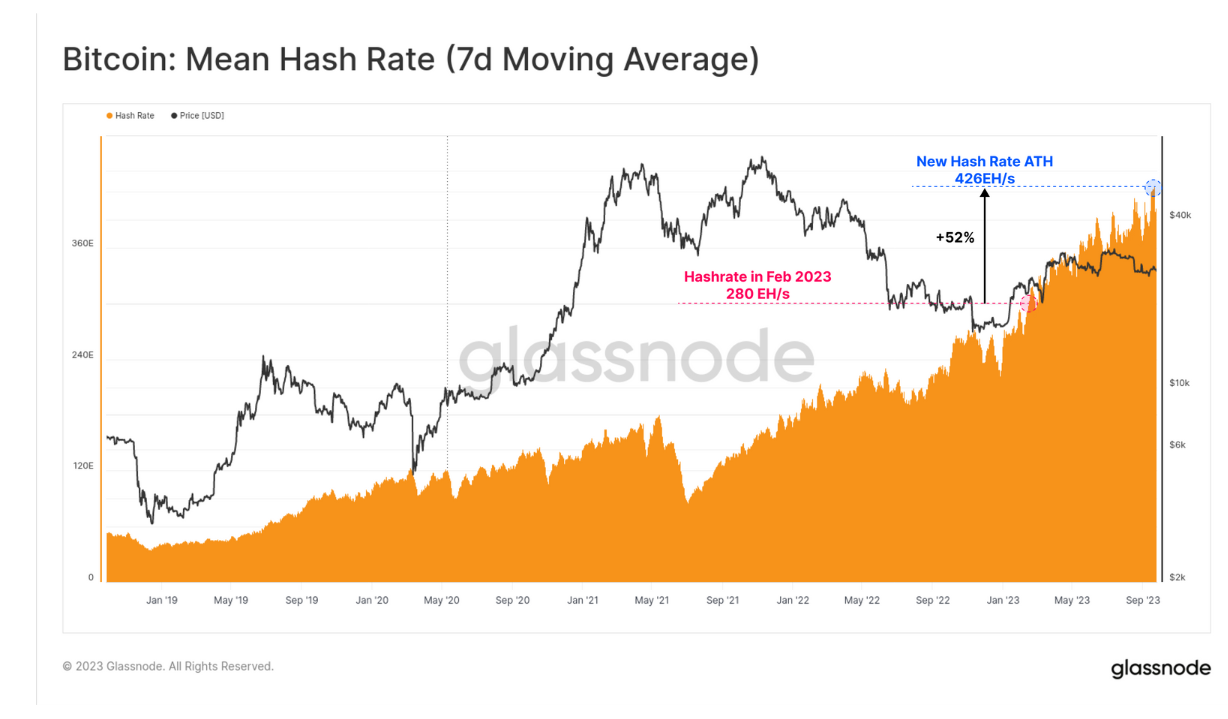

Hash Rate Reaches Record High

The competition among Bitcoin mining companies has become a serious problem with the record-breaking hash rate. The increase in the hash rate, which can be described as the estimated total computational power distributed to the blockchain, causes a decrease in income due to the increase in costs. According to data analysis platform Glassnode, this situation indicates one of the most challenging periods for miners when current Bitcoin price levels are considered. While revenues are decreasing significantly, costs continue to rise.

The percentage of income obtained through mining shows an increase of 1% to 4% compared to the lowest levels seen during bear markets of the Bitcoin price. However, these percentages remain modest compared to historical standards. The Week On Chain bulletin explained this situation with the following statement:

“The amount of hashrate competing for these rewards has increased by 50% since February, with more miners and newer ASIC hardware coming online.”

Key Level for Miners: $30,000

The increase in the hash rate lays the foundation for a major problem approaching. With the halving event in April 2024, mining rewards will decrease by 50% and the production cost per Bitcoin will double. The cost is currently around $15,000, and this figure will exceed $30,000 after the halving.

Glassnode presented two different models in its research to estimate the price at which miners will incur a loss and compared the cost with mining difficulty. The researchers stated the following in the bulletin:

“According to this model, we estimate that the most efficient miners on the network have a purchasing price of approximately $15.1 thousand. However, the purple curve shows that this level doubles to $30,200 after the halving, which will put the majority of the mining market under significant income stress.”

Türkçe

Türkçe Español

Español