Risky Altcoins

Last year, one of the most famous names in the cryptocurrency world, Vitalik Buterin, proved himself right with his warning. Now, he is focusing on a different issue. When he mentioned the risks related to bridges in 2022, we announced it to you as breaking news. Subsequently, the bridge hacks that occurred within 6 months resulted in losses exceeding 1 billion dollars.

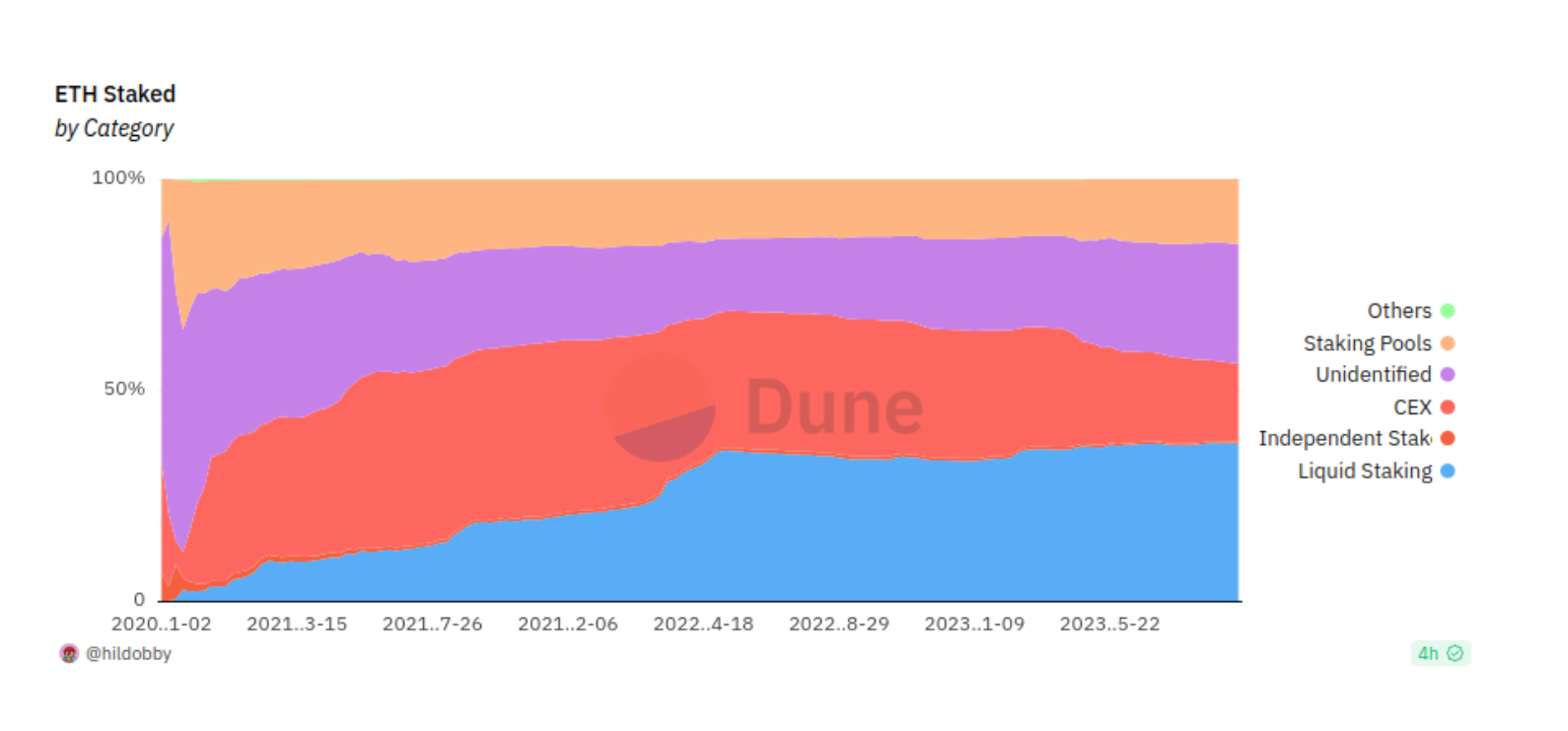

Ethereum Liquid Stake Protocols

Buterin, the co-founder of Ethereum, focused on the control power of DAOs over liquid stake pools in his recent blog post. He discusses the risks of DAOs monopolizing the selection of node operators in liquid stake pools.

“With the DAO approach, if a single stake token dominates, it leads to a governance device that controls a significant portion of all Ethereum validators and is potentially vulnerable to attack. To give credit to protocols like Lido, they have taken precautions against this, but a single defense layer may not be sufficient.”

A small parenthesis, those who do not have 32 ETH assets use liquid stake platforms like Lido to become validators in the Ethereum PoS network and benefit from stake income. He says that if Lido alone controls a large percentage of validators as a protocol in the future, it is a serious risk.

At this point, Rocket Pool seems to be more advantageous because you have the opportunity to become a node operator by depositing 8 Ether. However, this also brings a different risk.

“The Rocket Pool approach carries the risk of attackers (mostly) transferring the cost to users when launching a 51% attack on the network.”

The only solution presented by Buterin for now is the diversification of liquid stake providers. Lido has grown significantly in the context of Ethereum, and Vitalik implies in his latest post that he will support alternatives. Thus, possible risks of DAOs will be reduced due to different liquid stake providers. Because the possibility of any provider being excessively large and creating a systemic risk is not negligible today.

However, even this is not a good long-term solution. Buterin is also aware that this is not a permanent solution. It is possible to see different stake protocols and their tokens entering our lives for a new balance that will reduce the risk, even if it is more difficult. Investors in LDO and RPL Coin, in particular, have achieved good profits, and those who have discovered alternatives in the early stages can see similar gains.

Türkçe

Türkçe Español

Español