Stellar (XLM) is under pressure due to the losses in September. Despite Bitcoin (BTC) reclaiming $28,000, XLM has yet to show a strong recovery to recover its recent losses. So, will the altcoin continue to decline or will it make a comeback?

Negative Sentiment in XLM!

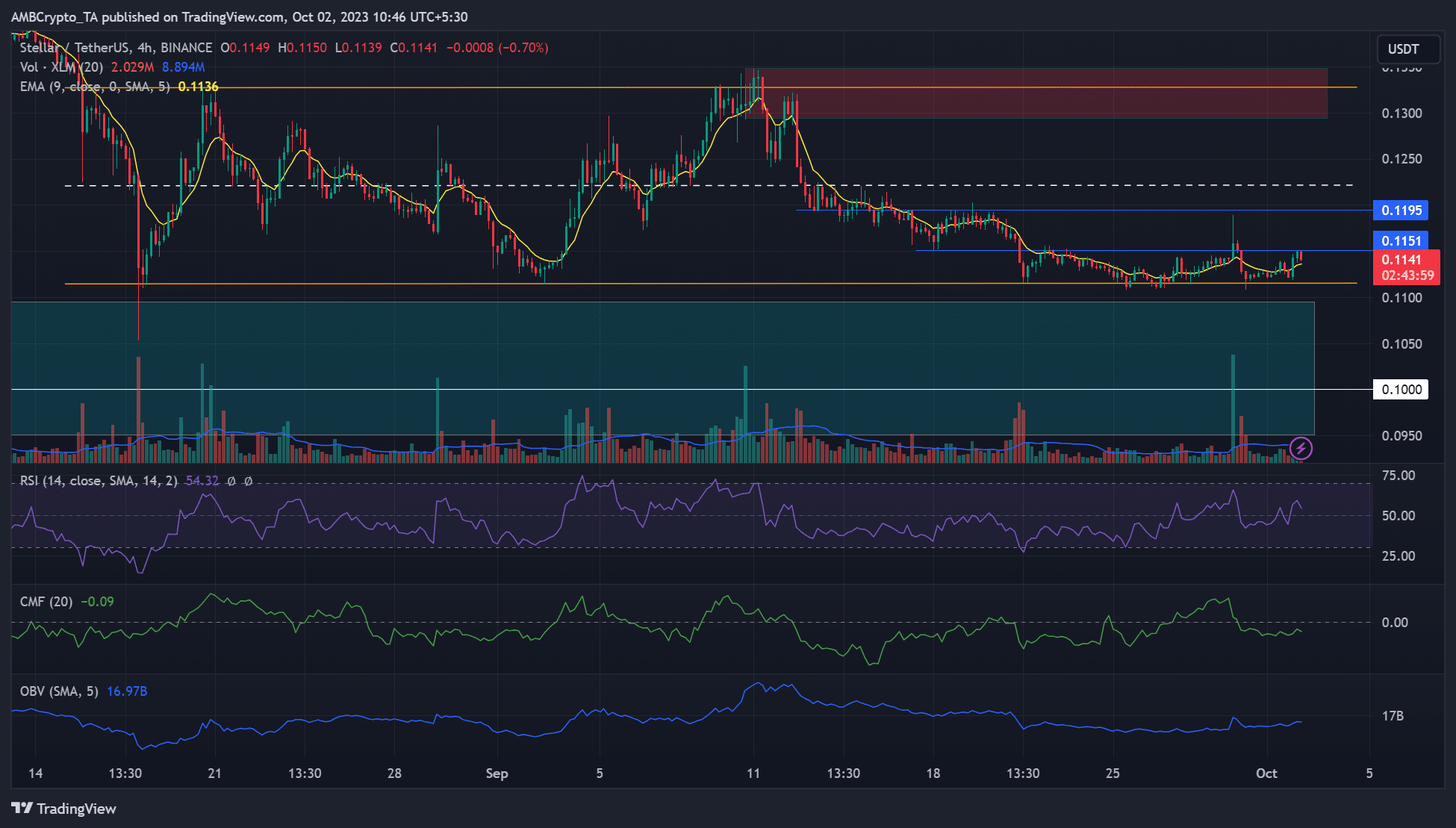

Even the recently launched stablecoin in the popular cryptocurrency couldn’t catalyze a strong upward recovery. Considering XLM’s suppressed performance, what could be the possible price movement in the short term? The previous price tests in August and early September at the low level of $0.112 resulted in a strong recovery, with the immediate target of the mid-range being $0.122. It was seen as difficult for this to repeat at the end of September and the beginning of October.

With the weekly bullish order block (OB) being slightly below the lowest level of the range at $0.0949 to $0.1094, the region can still withstand an additional drop. However, bulls may need to overcome two obstacles, which are $0.1151 and $0.1195, to retest the mid-range of $0.122.

The Future of XLM Token Price!

The negative capital inflows in the past few days may have contributed to the slow performance, as indicated by CMF being below zero. However, OBV and RSI suggest that demand has been moderate in the past few hours and there are positive readings indicating buying pressure. According to Coinalyze’s Accumulative Swing Index (ASI), the long-term price trend of XLM was downward. This means that sellers may still be able to dominate the market in lower time frames.

However, open interest rates and CVD have shown improvement since the end of September. This indicates that there has been some increase in demand in the futures market and buyers have gained some advantage. Therefore, according to experts, the mentioned low range can be defended, and buyers can profit from the two obstacles and the mid-range.

Türkçe

Türkçe Español

Español