Bitcoin experienced a volatile week, with an increase in volatility compared to previous weeks. This led to the creation of various scenarios regarding Bitcoin price movements. The failure to achieve a daily bar closing above $28,000 was particularly noteworthy for the crypto community.

The Battle Continues on the BTC Chart

According to data from TradingView, Bitcoin made two attempts to break above $28,000 this week, but failed to close the daily bar above this level. In the past 24 hours, volatility decreased significantly after an unsuccessful move.

Popular analyst and investor Daan Crypto Trades shared several posts with his followers. According to the analyst, there is an ongoing battle between two important moving averages (MA) on the daily bars:

“The question is whether the daily 200 MA (purple) or the daily 200 EMA (blue) will surrender first. If I have to make a prediction, it will probably determine the trend for the rest of October. The battle between $27,000 and $28,000 will continue.”

Daan Crypto Trades shared another post later on, addressing a different topic. The analyst highlighted the increasing open interest (OI) on exchanges, which led to a narrow range for short positions and subsequent long positions:

“This has usually led from a short squeeze (up) to a long squeeze (down). We saw it again yesterday. It’s worth keeping an eye on this area,” he said.

According to data from CoinGlass, a data analysis platform, significant losses were observed in both long and short positions until October 6. This clearly demonstrates the increased volatility in Bitcoin’s price.

FTX Starts Selling Bitcoin

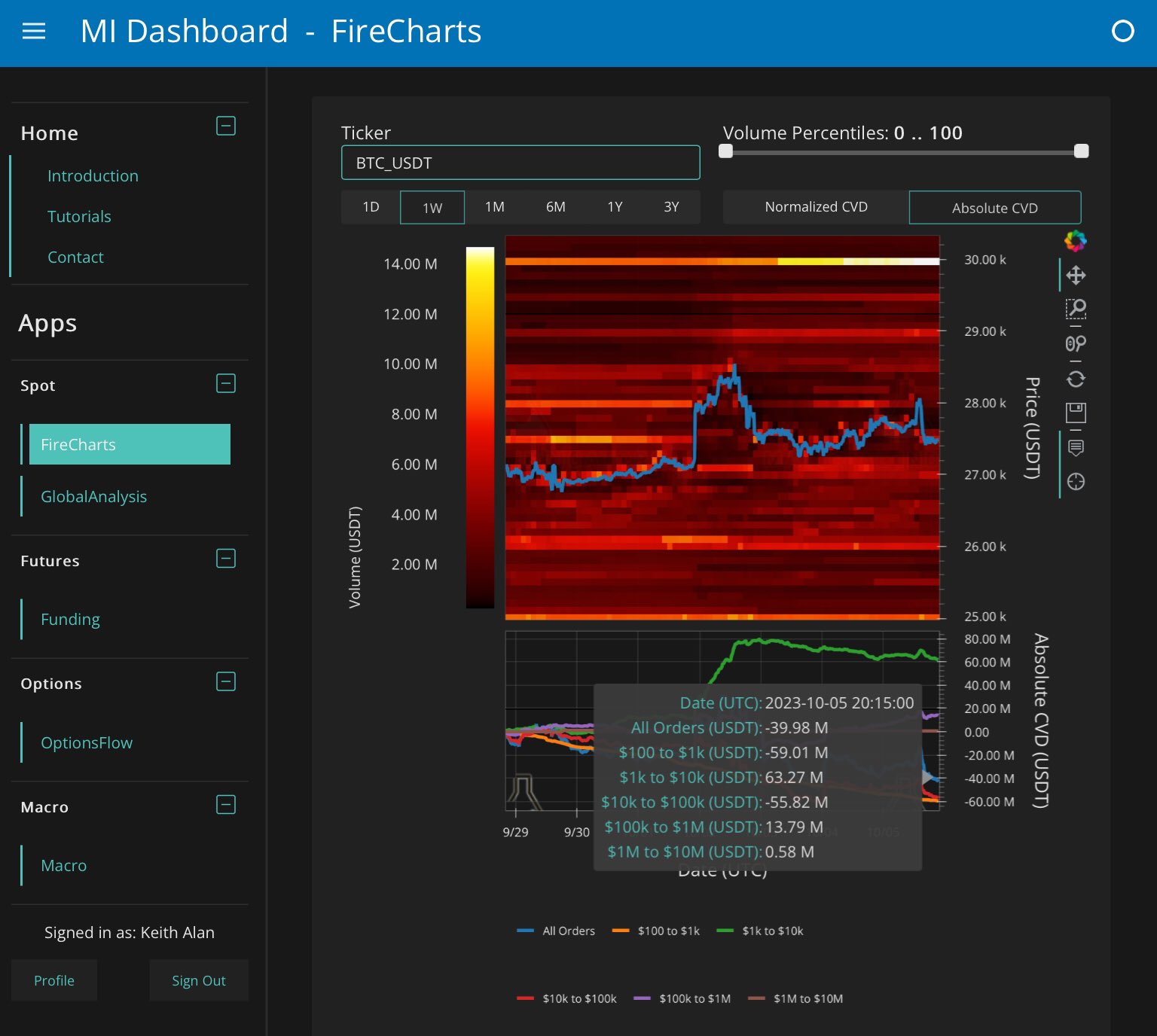

Another data analysis platform, Material Indicators, drew attention to the actions of investors known as whales. The company classified whales based on volume and noted conflicting movements in certain “classes.” According to Material Indicators’ data, spot orders between $100,000 and $1 million caused the price to rise, but this increase was short-lived:

“This week, they aggressively bought and sold at the local peak. Then, they started selling for a net market order of $13.8 million on Binance within the past 7 days.”

According to the company’s data, other whale groups made a total of $60 million in net sales during the same period. Analysts referred to potential sales from FTX in this regard.

“We can speculate whether this is part of FTX’s liquidation. It doesn’t really matter who it is, but if there is any surprise, it’s not that the price hasn’t risen, but that it hasn’t fallen further.”