The world’s largest cryptocurrency exchange, Binance, is experiencing significant losses in its legal battle. In a market dominated by fear and uncertainty, Binance’s market share has dropped for the seventh consecutive time. Lawsuits filed in the United States, legal issues in Europe, and the decision to withdraw from the Russian market could have serious consequences for Binance.

Why is Binance Experiencing a Decline?

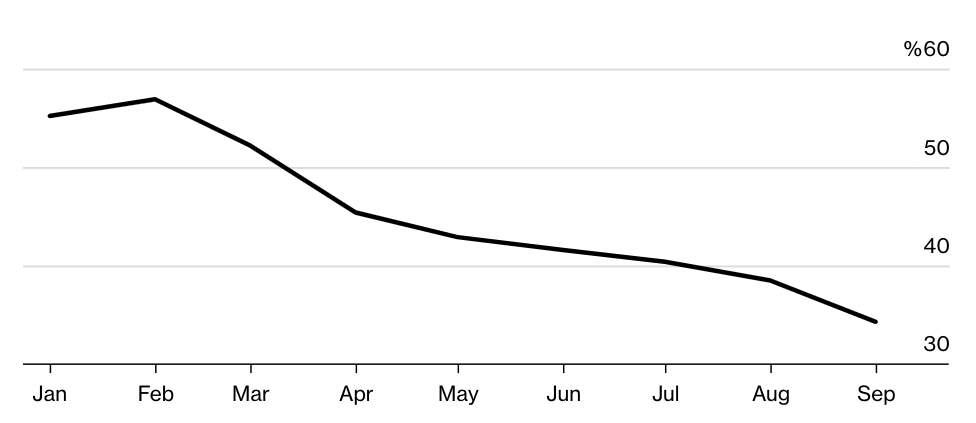

According to a report by Bloomberg published on October 5th, Binance continues to lose ground. According to data analysis platform CCData, Binance’s market share in the cryptocurrency market has dropped this month as well. According to the data, Binance has been losing market share for the past seven months.

The report states that Binance’s market share dropped from 38.5% in August to 34.3% in September. The record market share of 55.2% was reached in January 2023.

During this period, Binance has been losing market share not only in the spot market but also in the futures market. According to the data disclosed in the report, Binance’s market share in the futures market declined from 53.5% in August to 51.5% in September. The record level of 62% reached in January 2023 was noteworthy.

According to Jacob Joseph, an analyst at CCData, the legal process in the United States is the sole problem triggering the loss of market share. The end of Binance’s zero commission campaign for major trading pairs during this period may have also led users to other platforms.

Trading Volume Shifted to Different Exchanges

The decline in market share continues due to Binance’s termination of services in certain regions. Binance completely withdrew from the Russian market and sold its local business to the CommEx exchange. Russian customers accounted for 7% of this platform’s traffic.

In addition, Binance made changes to its trading commission fees at the beginning of September. Users can now earn points and reach VIP levels on the platform, which introduced a different system. Non-VIP users without defined VIP points are currently subject to a 0.1% commission fee in both the spot and futures trading.

The report also reveals that Binance’s lost spot trading volume has been distributed among well-known crypto exchanges such as HTX, Bybit, and DigiFinex. In the futures market, trading volume has shifted to OKX, Bybit, and Bitget, competing crypto exchanges.

Türkçe

Türkçe Español

Español