The waiting queue for new validators in Ethereum’s (ETH) blockchain, which used to be extremely long, is now almost completely cleared. This is the first time since the major “Shapella” update in April, which marked Ethereum’s complete transition to a Proof of Stake (PoS) consensus mechanism.

Waiting Time to Become an Ethereum Validator is Rapidly Decreasing

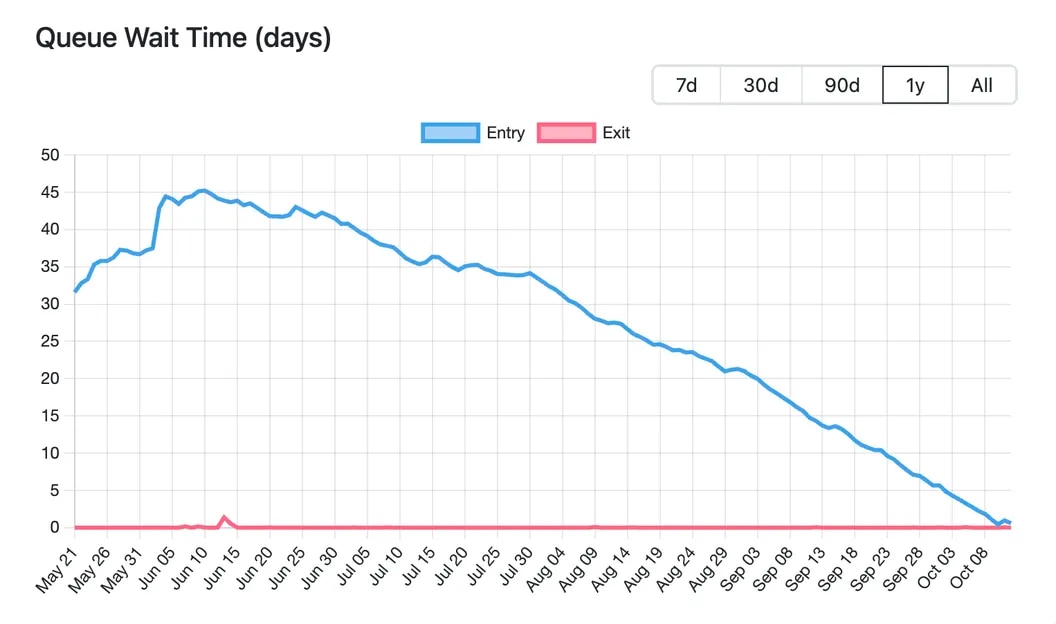

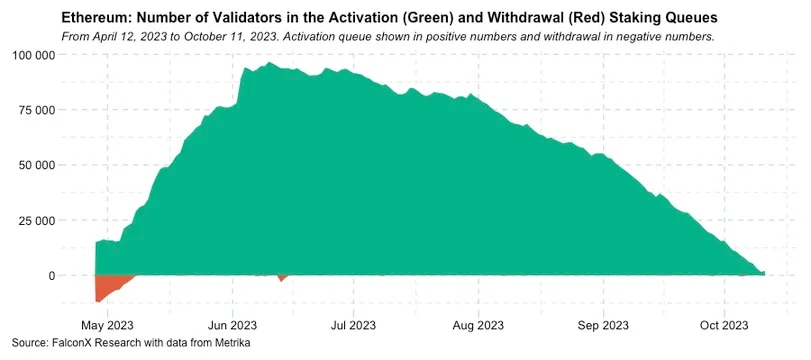

Current data shows that the number of validators waiting to join the network, which peaked at 96,000 at the beginning of June, has now dropped to 598. Furthermore, with the decrease in the waiting queue for validators, the waiting time to add a new validator to the network has dropped below five hours as of October 12. This means that new validators now face a shorter waiting time compared to the 45-day waiting period for staking due to the high demand for Ether (ETH) staking on the network.

Validators can participate in securing Ethereum’s PoS chain and verifying transactions by staking ETH. In return for their efforts, they earn staking rewards. Ethereum’s rules limit the number of new validators that can join the network in each blockchain “epoch” or approximately every 12 seconds.

The Shapella update of Ethereum eliminated the risk of investors being unable to withdraw their staked ETH, which was a significant concern. This update initiated a wave of participation in Ethereum’s staking mechanism.

David Lawant, the research director at FalconX, a institutional cryptocurrency exchange, noted in a market report that ETH staking growth has been “extremely strong” since the Merge and Shapella updates, which transitioned Ethereum to PoS in September 2022, but the initial excitement has started to wane. Lawant said, “An empty activation queue implies a significant slowdown in staked ETH growth.”

Staking Reward Rate Decreased to 3.5%

According to the Compound Ether Staking Rate (CESR) provided by CoinDesk, the staking reward rate has decreased from approximately 5-6% at the beginning of this year to 3.5% due to increased average network activity and a high number of stakers earning income from transaction fees. In contrast, short-term US Treasury yields exceeded 5% with the Federal Reserve raising interest rates to combat inflation.

Meanwhile, Ethereum’s staking reward rate has increased to over 22% from 15% in April and 6.5% in September. However, it still lags behind other popular PoS networks. For example, this rate is measured at 69% for Solana (SOL), 63% for Cardano (ADA), and 53% for Avalanche (AVAX).

Lawant attributed this largely to ETH being used as a “network resource” and Ethereum having a “more distributed staker base.”

Türkçe

Türkçe Español

Español