Uniswap (UNI) has been experiencing a decline following recent developments. The emergence of low demand has led to a 5% decrease since the announcement of a 0.15% fee for transactions involving Ethereum (ETH), wETH, USD Coin, and other cryptocurrencies.

Current Status and Comments on Uniswap (UNI)

Hayden Adams, the founder of the Uniswap protocol, made a statement on October 16th, stating:

“This interface fee is one of the lowest fees in the industry and will allow us to continue researching, developing, building, deploying, improving, and expanding crypto and DeFi.”

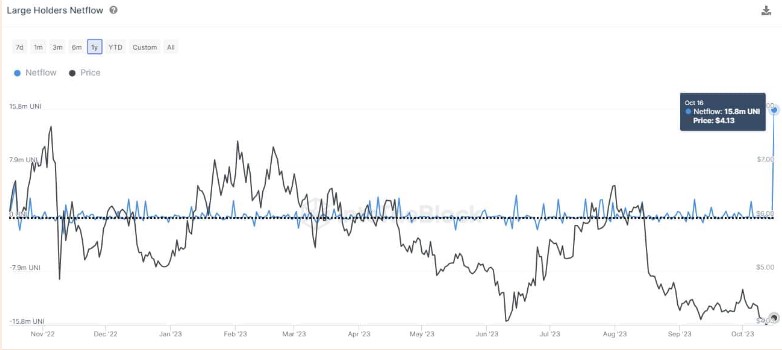

This announcement was made on the day when the largest token movement of UNI occurred since March 2021. The transaction involved a significant amount of 15.8 million UNI tokens being transferred from one crypto wallet to another.

According to IntoTheBlock, the movement was a result of an internal transfer to the vesting contract by the Uniswap team, rather than a lack of investor confidence.

The Future of UNI Coin

According to data from 21milyon.com, the DeFi token was trading at $3.89 at the time of writing. The Relative Strength Index (RSI) of UNI coin was 31.81, indicating a neutral position. Additionally, the Money Flow Index (MFI) of the token was 36.03, below the neutral line.

The Chaikin Money Flow (CMF) indicator of UNI briefly stayed above the zero line on October 11th but quickly turned negative, indicating market weakness. A negative CMF value suggests downward pressure on the price of a cryptocurrency. At the time of writing, UNI’s CMF value was -0.15.

The altcoin Parabolic Stop and Reverse (SAR) indicator, which reflects potential reversal points in the price direction of a cryptocurrency, also showed signs of a downtrend. When the indicator points remain above the price, it indicates a downward trend. Additionally, when these reversal points are close to each other, it signifies a strong trend.

Türkçe

Türkçe Español

Español