Bitcoin (BTC) has maintained its position as the leading cryptocurrency since its inception. In addition, it has recently reached one of the highest levels of market dominance in history. When comparing Bitcoin’s increasing dominance to its previous price performance and its comparison with other cryptocurrencies, what kind of picture does it paint?

The Current State of Bitcoin Dominance

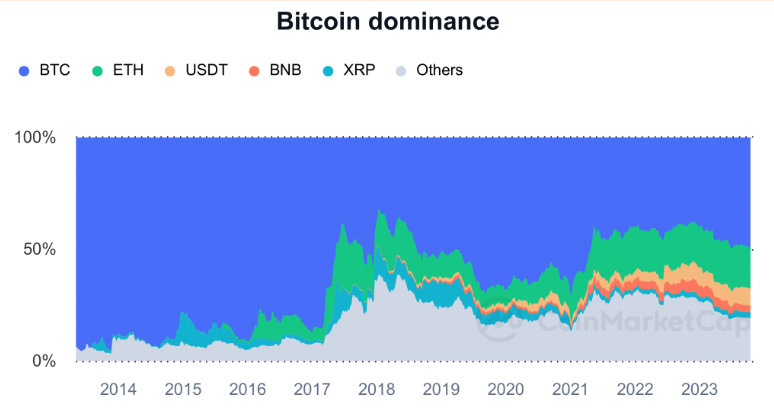

BTC dominance can shed light on many aspects of the market. According to data from CoinMarketCap, when the historical movement of BTC dominance is examined, important points stand out. It was observed that Bitcoin made noticeable and continuous upward movements before reaching its current dominance peak.

It was revealed that these movements in BTC were preparing the ground for a level not seen for months. According to CoinMarketCap data, Bitcoin’s dominance was over 49% at the time of writing, and considering market conditions, it was a sign of how dominant it was to be close to owning 50% of the entire cryptocurrency market.

Furthermore, a decrease in trading volume was observed in the Bitcoin price analysis at the time of writing. It was seen that there was a decrease of more than 40% in trading volume, and a slight decrease in Bitcoin’s market value was reflected in the charts.

Bitcoin Price?

The significant increase in Bitcoin’s dominance is largely associated with price increases. Especially the sharp rise it experienced around October 16th after the ETF news was considered as a reason for this.

On that day, it had shown an increase of nearly 10%, but it had entered a downward trend after the denial of the ETF news. After that, the movement continued in this direction. When the BTC price chart was examined, it was seen that it experienced a decrease of less than 1%. It continues to find buyers at the level of $28,400. In addition, the Relative Strength Index (RSI) has risen above 60. This structure of the RSI indicates a strong upward trend in the Bitcoin price.

Finally, it is useful to note that the current RSI position also carries the possibility of a price decrease for BTC, contrary to what was mentioned earlier. If there is a decrease in the Bitcoin price, it can be observed that the market value decreases, and this can cause a decrease in Bitcoin’s dominance in the cryptocurrency market.

Türkçe

Türkçe Español

Español