Bitcoin; Ethereum, Ripple, Solana, and many altcoin projects continue to recover to regain the upward momentum typically associated with “Uptober” in the crypto market. As crypto assets continue their positive growth, the total crypto market value reached $1.15 trillion on October 23, with Bitcoin trading at $31,033 at the time of writing.

Fund Inflows Accelerate

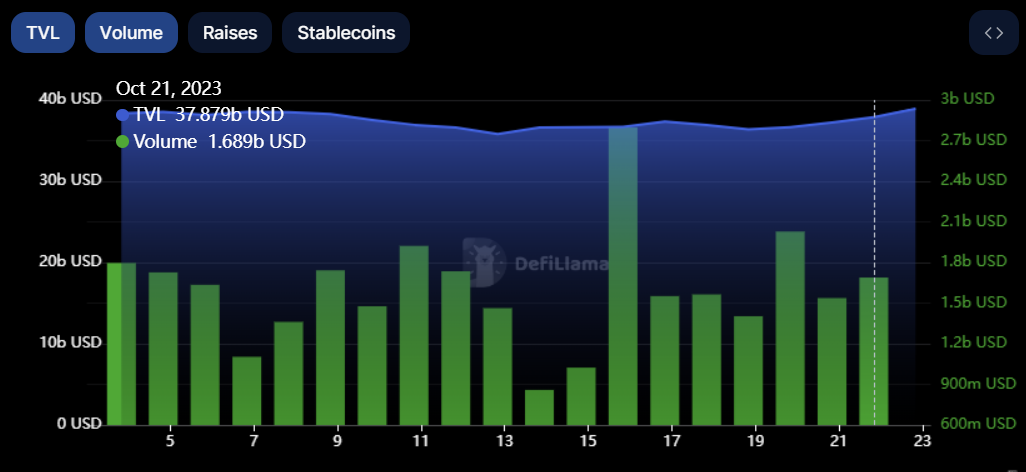

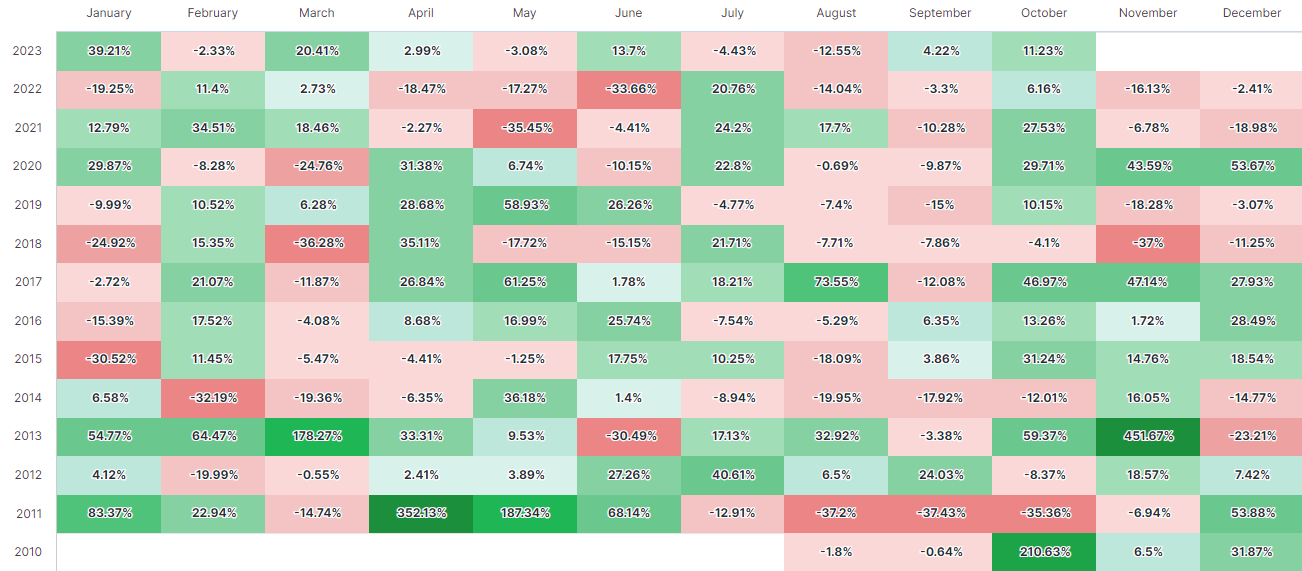

October is referred to as “Uptober” based on historical data due to the positive returns in the cryptocurrency market. The Bitcoin and cryptocurrency market volume increased from $1 billion to $2.7 billion on October 15, and the total trading volume has not fallen below $1 billion since October 13.

Bitcoin’s positive returns in October and the increase in volume, with gains achieved more than three times during the month, create an optimism surrounding the increase in volume. October statistically is one of the strongest months for Bitcoin gains, delivering a return of 11.2% so far in 2023.

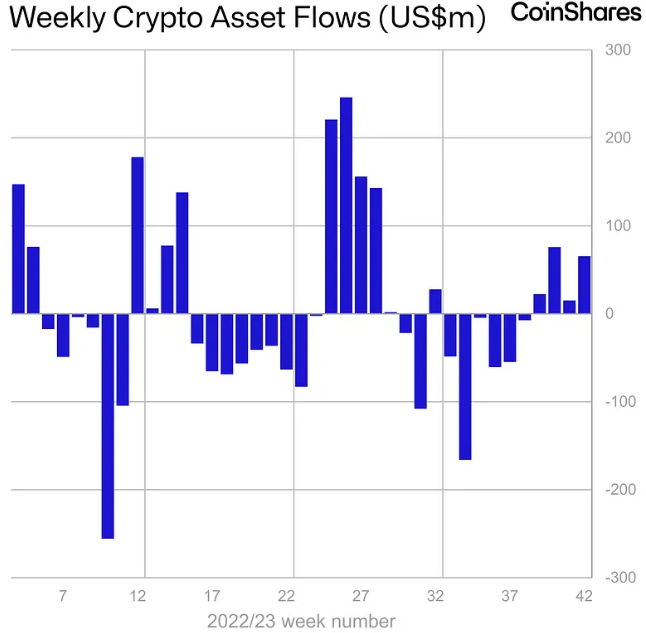

The strong performance in October coincided with a period of increased inflows into the cryptocurrency market. Four consecutive weeks of inflows were observed in the cryptocurrency market. In the 42nd week of 2023, total inflows reached $66 million.

Halving Time is Running Out

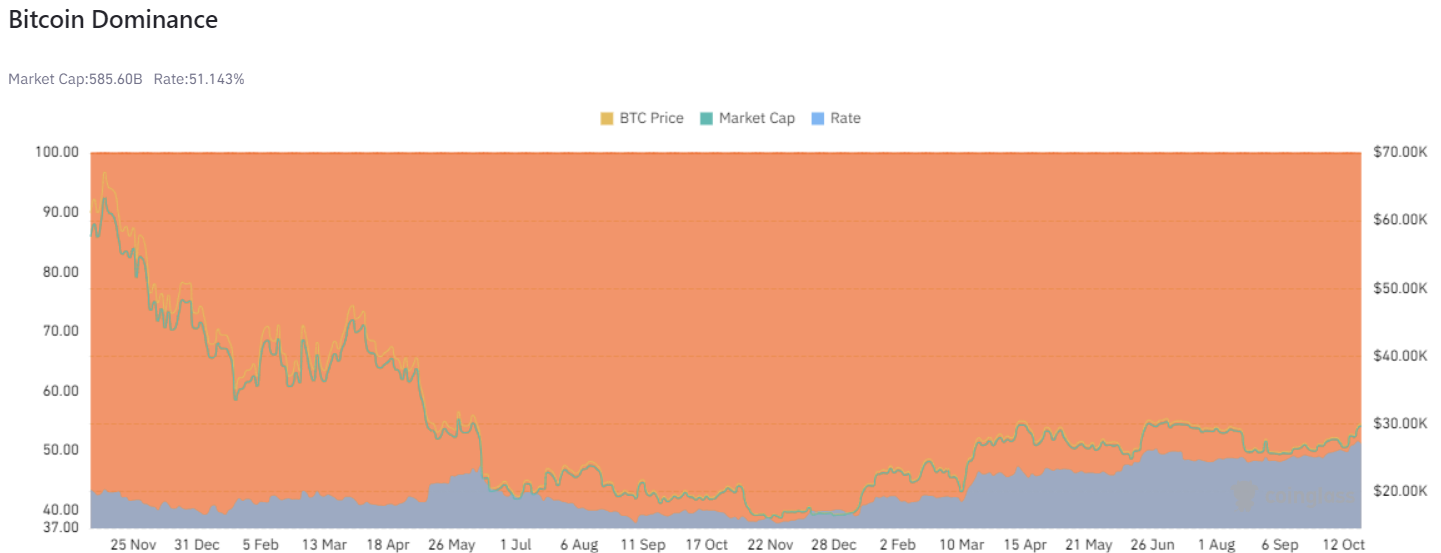

Bitcoin. is regaining its dominance in the cryptocurrency market ahead of the halving event scheduled for April 2024. For the first time since June 28, Bitcoin’s market share is above 50% compared to the total cryptocurrency market value. Bitcoin dominance surpassed 51% on October 23.

Typically, when Bitcoin’s market dominance ends, the focus turns to altcoins. This dominance comes immediately after Bitcoin models indicating the potential for reaching $130,000 following the 2024 BTC halving event. Despite these models, analysts suggest that for Bitcoin to avoid the bearish fractal indicated in the charts, it needs to surpass the $31,000 resistance level.

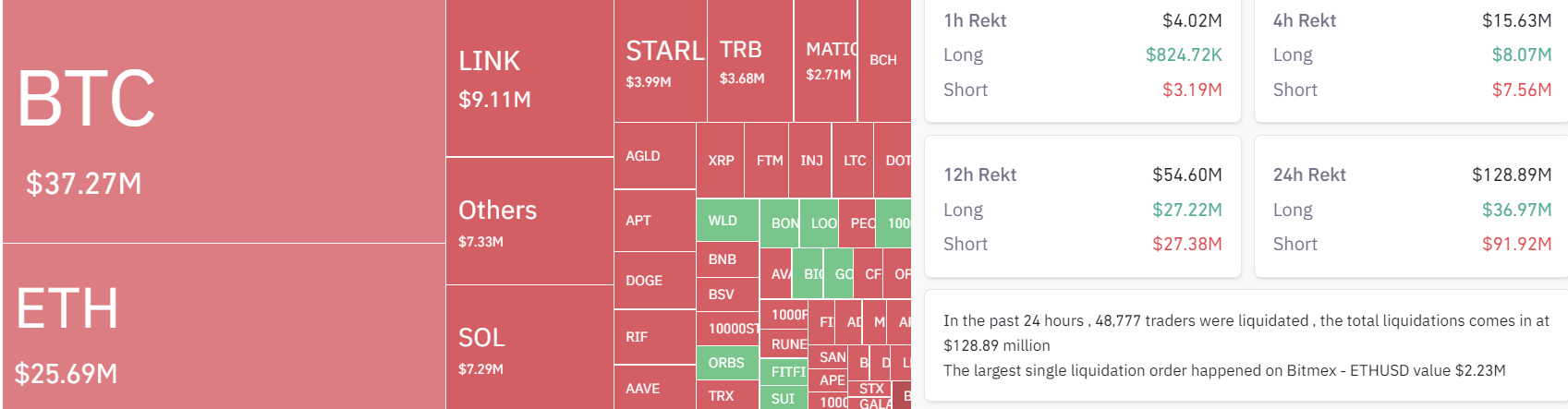

Losses Increase in Futures Trading

With the rally in the cryptocurrency market, over $91 million worth of short positions were liquidated within 24 hours. Bitcoin had the highest number of short position liquidations, with $37.3 million worth of short positions being wiped out, while the largest single liquidation occurred in the Bitmez exchange with a $2.23 million Ethereum short position.

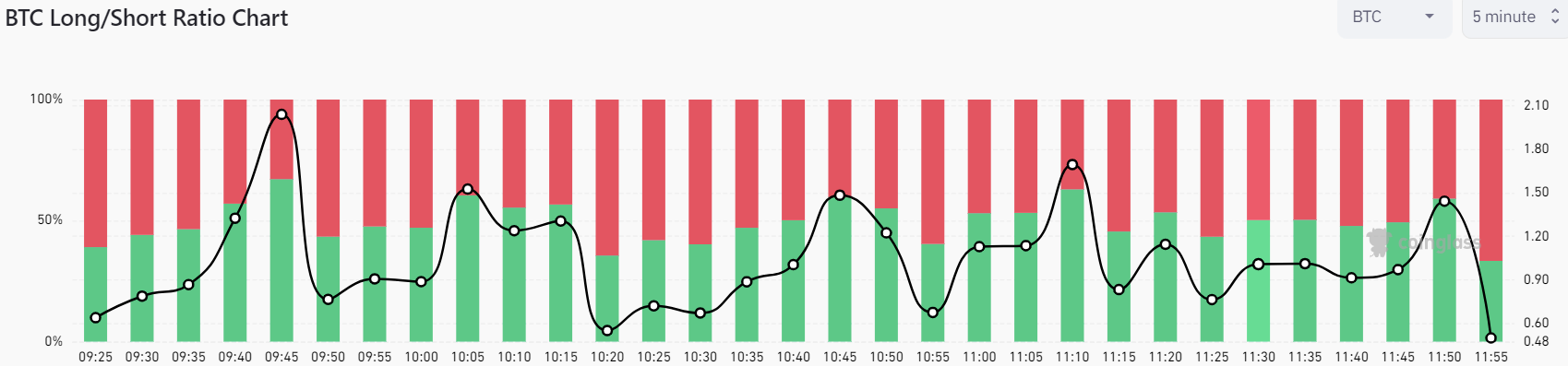

Despite the losing streak of investors who prefer short positions in the futures market, 66% of the futures market is taking a long position. The continuation of short positions could potentially lead to a short squeeze and further price increases.

Türkçe

Türkçe Español

Español