The technical outlook shows that Ethereum (ETH) is on the verge of breaking and closing above the highly anticipated $2,000 resistance level, which has caused excitement among investors. The interest of investors in ETH, the largest altcoin and also the largest smart contract platform, is increasing as Bitcoin (BTC) recovers the $31,000 resistance/support level. Most investors expect ETH to follow in the footsteps of the largest cryptocurrency, enter the second phase of recovery beyond $2,000, and continue the upward action in the market by targeting the regions of $2,500 and $3,000 respectively.

Ethereum Prediction: ETH on the Verge of Confirming a 12% Price Movement

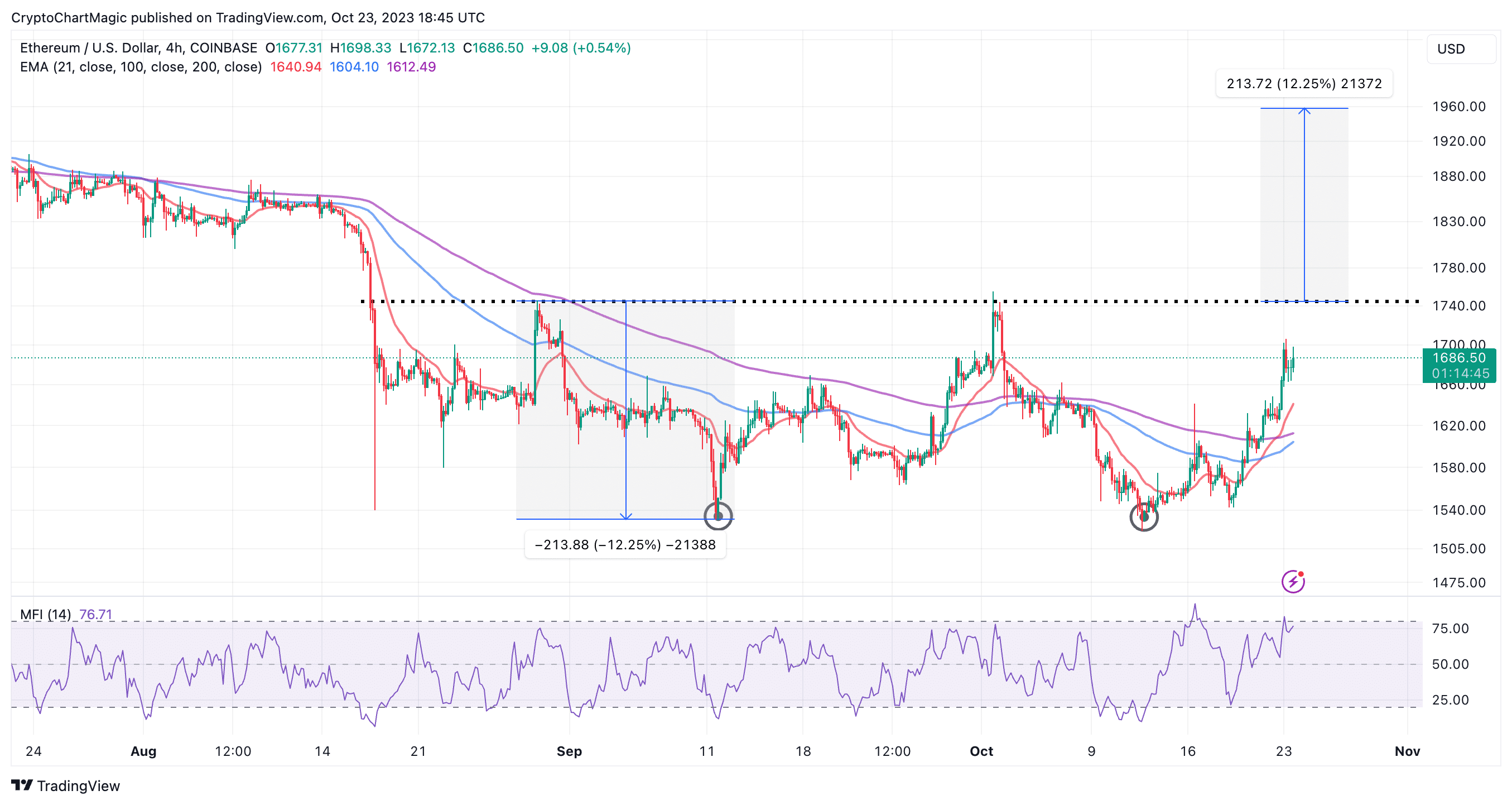

After recovering from the $1,530 support level, ETH has completed the formation of the Double Bottom Formation and is currently waiting to confirm its breakout at $1,745 (neckline resistance). The presence of two Golden Cross Formations, read as the 21-day Exponential Moving Average (EMA) (red) crossing above the 1,000-day EMA (blue) and then the 200-day EMA (purple), also indicates that the uptrend will continue.

If investors continue to keep their buying orders open in ETH, an acceleration up to $1,958 could be triggered, resulting in a 12.25% increase. After the breakout, it is expected that investors will turn to ETH, surpassing the neckline resistance, and the trading volume will increase significantly. Currently, the Relative Strength Index (RSI) stands at 75, indicating that Ethereum’s price is in a strong upward trend. However, investors need to be cautious as it may encourage profit-taking or selling ETH to protect their capital due to the possibility of oversold conditions.

According to the Money Flow Index (MFI), bulls have the upper hand. The index tracks the inflows and outflows of money into the ETH market, so a continuous increase in the index means that control of the uptrend is in the hands of buyers. The MFI, currently at 76, has not yet entered the oversold zone, indicating that there is still room to rise. To secure the current uptrend of Ethereum’s price and allow it to continue up to $2,000, a candlestick close above $1,700 is required on the 4-hour time frame.

Breaking above $2,000 will be a game-changer for Ethereum bulls and could be the catalyst the largest altcoin has been waiting for to start a bull run. On the downside, the failure to hold the support at $1,670 and $1,630 could trigger a new sell-off down to $1,550. However, it is important to emphasize that as long as Ethereum’s price remains above all moving averages, the path of least resistance is upwards.

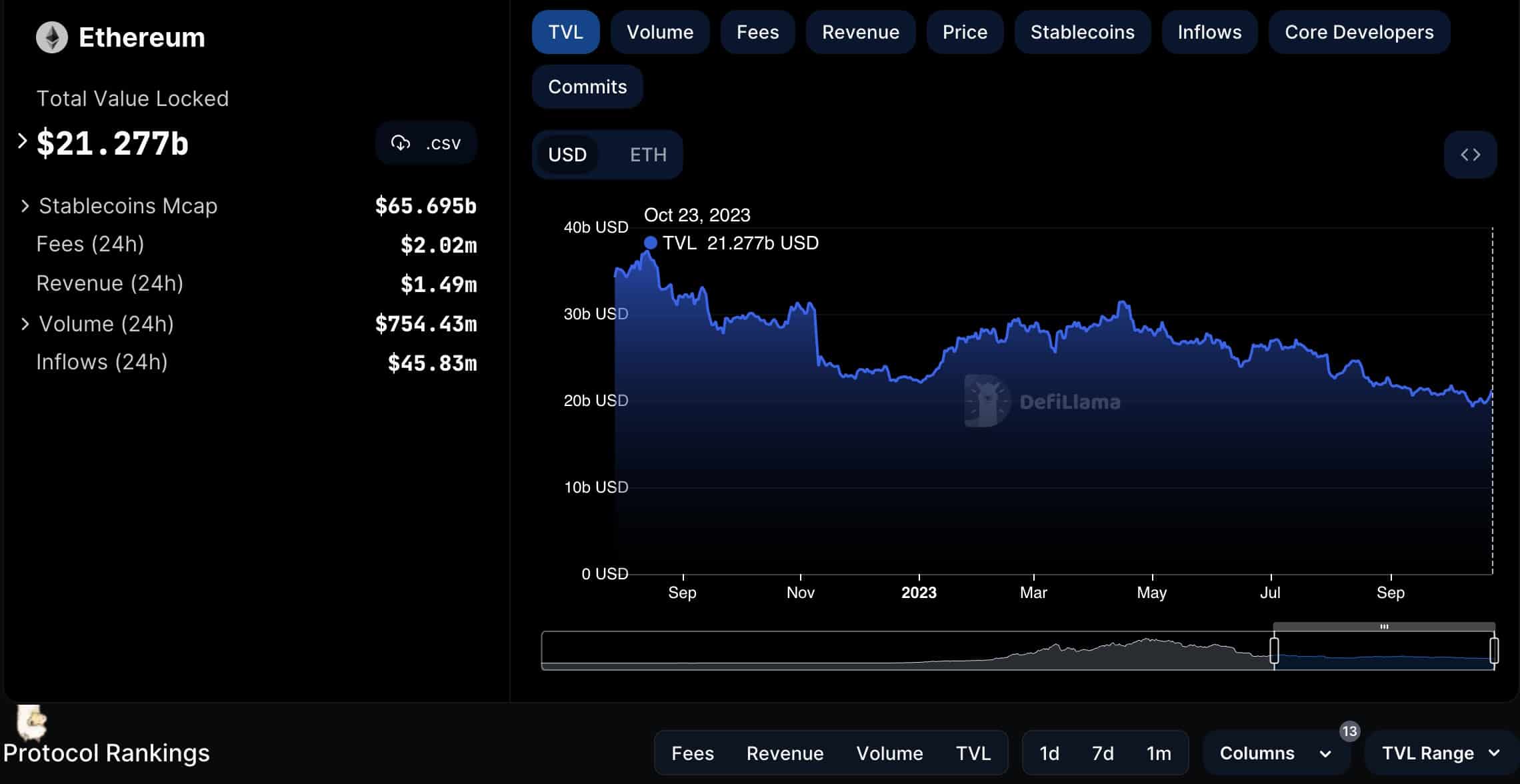

Ethereum TVL Reaches $21 Billion

The transition from the Proof of Work (PoW) consensus mechanism to the Proof of Stake (PoS) consensus mechanism has opened the door for Ethereum to a brand new decentralized finance (DeFi) world supported by liquid staking tokens such as Lido DAO and Rocket Pool.

Despite the prolonged crypto winter, investors have driven the TVL of the Ethereum ecosystem to reach $21.27 billion by turning their attention to DeFi products on the network. While the inflow to the ecosystem was recorded as $45 million in the past 24 hours, the outflow was recorded as $1.49 million.

Türkçe

Türkçe Español

Español