Glassnode, the on-chain data analysis platform, has released its latest analysis to the public. According to the company’s analysts, Bitcoin, which gained nearly 30% in October, will end 2023 as it began. The analysts argued in the latest edition of Glassnode’s weekly bulletin, The Week On-Chain, published on October 24th, that the rising trend in <a href="https://en.coin-turk.com/cryptocurrency-market-update-the-latest-on-bitcoin-xrp-and-litecoin/”>BTC prices last week formed the basis for this prediction. Let’s examine the important data highlighted in the bulletin together.

Bitcoin in October

Bitcoin, reaching up to $35,200 this week, surpassed various important trend lines that had previously served as support for months. These lines include various moving averages, including the 200-week simple moving average at $28,400, which is the classic bear market support level. Glassnode analysts commented on the matter:

“The cluster of long-term simple moving average price levels is around $28,000 and provided resistance to the market throughout September and October. After a month of gains, the bulls found enough strength this week to convincingly surpass the 111-day, 200-day, and 200-week averages.”

Increased Investor Profitability

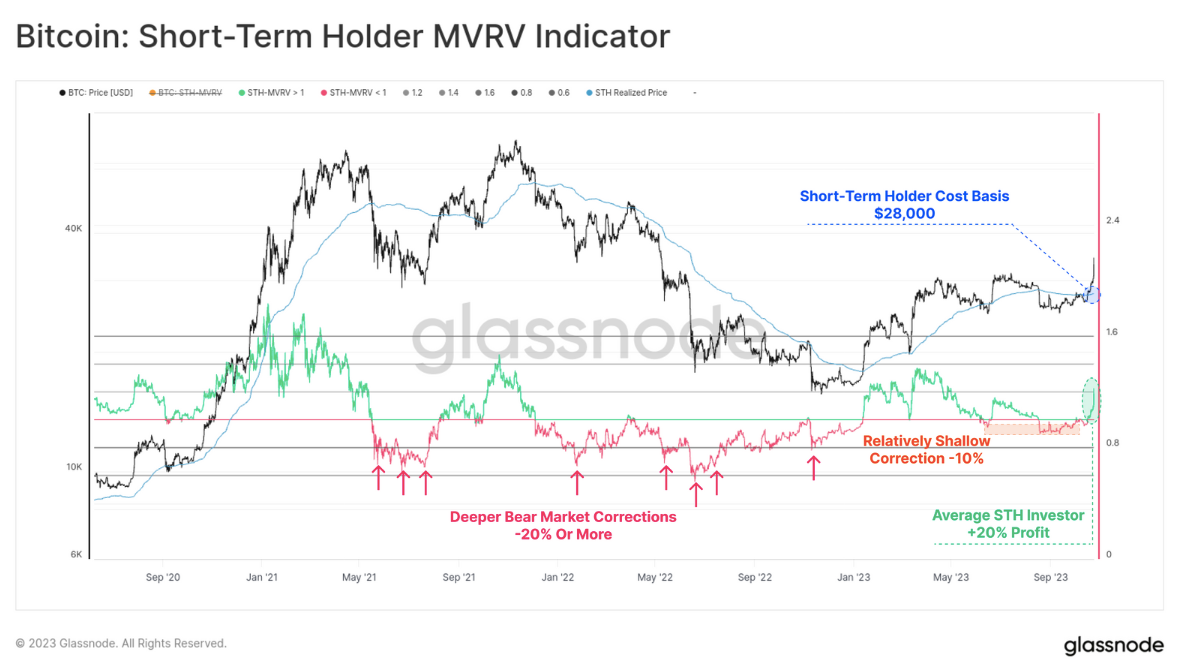

During this period of significant movement, the rise of Bitcoin has led to a substantial increase in the profitability of various investor groups. The cost base of market makers and investors who entered the market during the rise is around $28,000. The Week On-Chain summarizes this topic as follows:

“The cost base of Short-Term Holders (STH) is currently at $28,000, which puts the average new investor at an average profit of 20%.”

Glassnode analysts uploaded a chart of the Short-Term Holder Market Value to Realized Value (STH-MRVR) ratio, which tracks the profitability of STH assets. According to researchers, even before the rise in October, no capitulation behavior was observed.

“Between 2021 and 2022, we can see examples of STH-MVRV reaching relatively deep corrections of 20% or more. Although the sell-off in August reached as low as -10%, it is noteworthy how shallow this MVRV drop was compared to previous ones. This indicates that the recent correction found significant support and serves as a precursor to this week’s rally.”

Türkçe

Türkçe Español

Español