As the Federal Reserve meeting is less than 24 hours away and Powell’s statements after the announcement will be crucial, Bitcoin (BTC) is currently hovering around $34,500. Although altcoins have made significant gains throughout the day, the upward momentum has temporarily stalled. So, what is the latest update on Cardano (ADA)?

Cardano (ADA)

It has been a while since any partnership or announcement came from the Cardano (ADA) front. With the markets starting to move, Hoskinson must have thought it was time to do something. Emurgo, the company behind the Cardano blockchain, announced today that it has partnered with the Institute of Blockchain Singapore (IBS). According to the announcement, the partnership will “support the educational process of Cardano” and contribute to the adoption of products within the network.

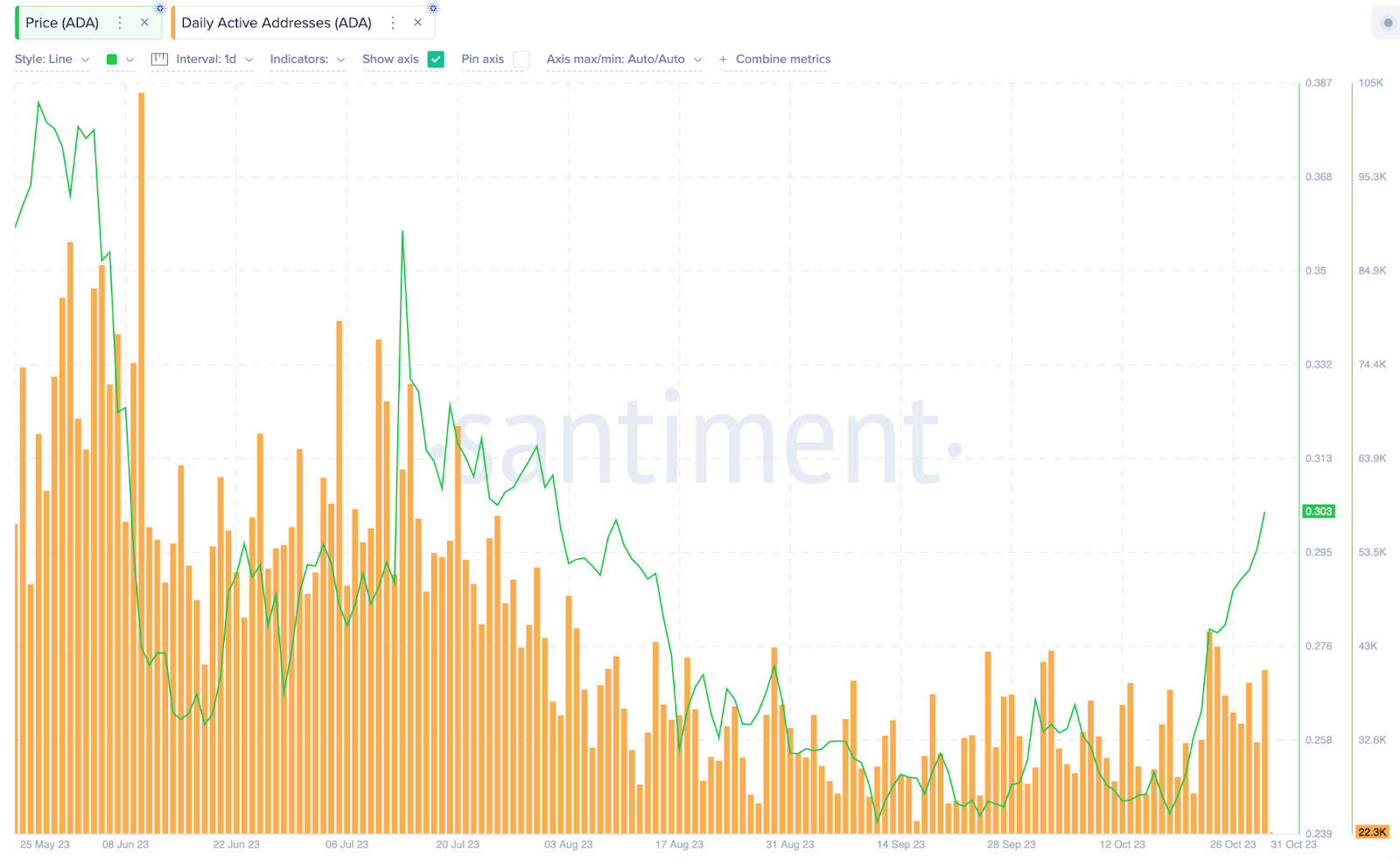

On-chain activity is increasing. The graph below shows that Cardano has around 30,000 daily unique active addresses. The active addresses metric represents the daily total of unique addresses that perform valid network transactions.

If the number of unique active addresses is increasing, it indicates strengthening interest in the network and a potential increase in demand for ADA Coin.

ADA Coin Price Prediction

Historically, when the number of active addresses is at these levels, an increase in the price of ADA Coin is expected. A similar scenario in July resulted in the price reaching $0.35. Under current conditions, the improvement in on-chain data may help solidify the support at $0.3.

Whale activities also appear promising for the ADA Coin price. According to Santiment, whales (addresses holding 1 million to 100 million ADA) bought approximately $43 million worth of ADA Coin between October 23rd and October 31st.

The whale demand and increasing on-chain activity suggest that the $0.3 support zone can be maintained. If closures above this zone continue, we may see a movement towards the $0.35 cost zone. Although the price briefly surpassed $0.3 today, it fell below the critical threshold again, and closures below $0.27 could reverse the bullish expectations.

Daily chart closures above $0.288 indicate the possibility of another price surge. However, it is difficult to talk about a strong reversal scenario without surpassing $0.305 on a daily basis. The upward targets are $0.33 and $0.38, followed by $0.42 and $0.46.