The banking giant Hong Kong and Shanghai Banking Corporation (HSBC), which operates in traditional financial markets, participated in an event organized by the Hong Kong Monetary Authority. In this event, deposit products were tested through a collaborative process with Ant Group, the China-based bank founded by Jack Ma. This development has once again turned the spotlight on the blockchain field.

What Happened During the Test Phase?

The initiative led by major banking institutions aims to explore the potential of enabling open and real-time treasury fund movements between accounts held by a company in the HSBC network through deposit tokenization.

During the test, HSBC connected to the blockchain platform developed by Ant Group and supported by Ant Group’s banking partners. In an official announcement shared with the public, HSBC stated that the test covered the issuance, transfer, and redemption of deposit tokens, and added:

“Future research on how blockchain and tokenization can enhance efficiency in corporate treasury management and promote innovation will be facilitated.”

Financial Companies’ Interest in the Web3 Sector Continues

The participation of Ant Group’s banking partners in the conducted test phase enhances treasury fund transfers with improved turnaround time, cost efficiency, and visibility. Vincent Lau, Global Head of Payment Solutions and Emerging Payments at HSBC, confirmed the bank’s interest in leveraging tokenized deposits and other financial innovations to facilitate and optimize treasury management for customers.

HSBC is also notable as an active participant in various central bank digital currency (CBDC) initiatives, including the Swift cross-border central bank digital currency project, Project mBridge.

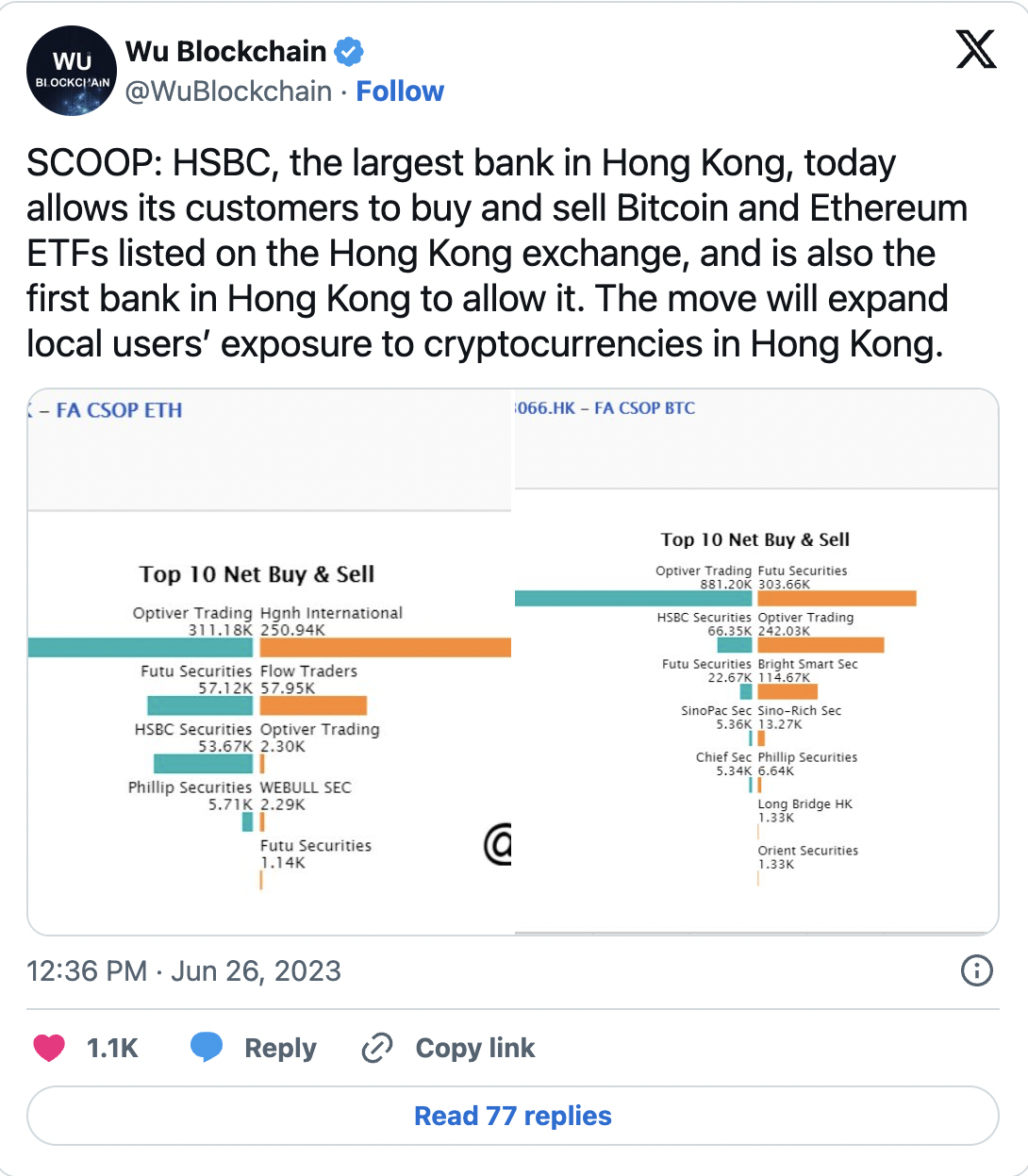

HSBC had previously announced its first local cryptocurrency services in June 2023. According to the report, HSBC will offer cryptocurrency ETFs listed on the Hong Kong Stock Exchange, including CSOP Bitcoin Futures ETF, CSOP Ethereum Futures ETF, and Samsung Bitcoin Futures Active ETF.

With these developments, financial companies actively involved in traditional fiat markets continue to enter the Web3 world. The inability of crypto companies to comply with regulatory requirements, especially those related to the crypto market, continues to pique the interest of traditional companies in this field.