Ethereum (ETH), the king of altcoins, which has attracted all the attention in the altcoin market with its rallies, is making silent moves against Solana (SOL), XRP (XRP), and Cardano (ADA). In the past 24 hours, ETH’s price has increased by 1.65% to reach $1835, with a market value of $220.8 billion, and the on-chain data of the largest smart contract platform supports the price increase.

Ethereum’s Network Growth

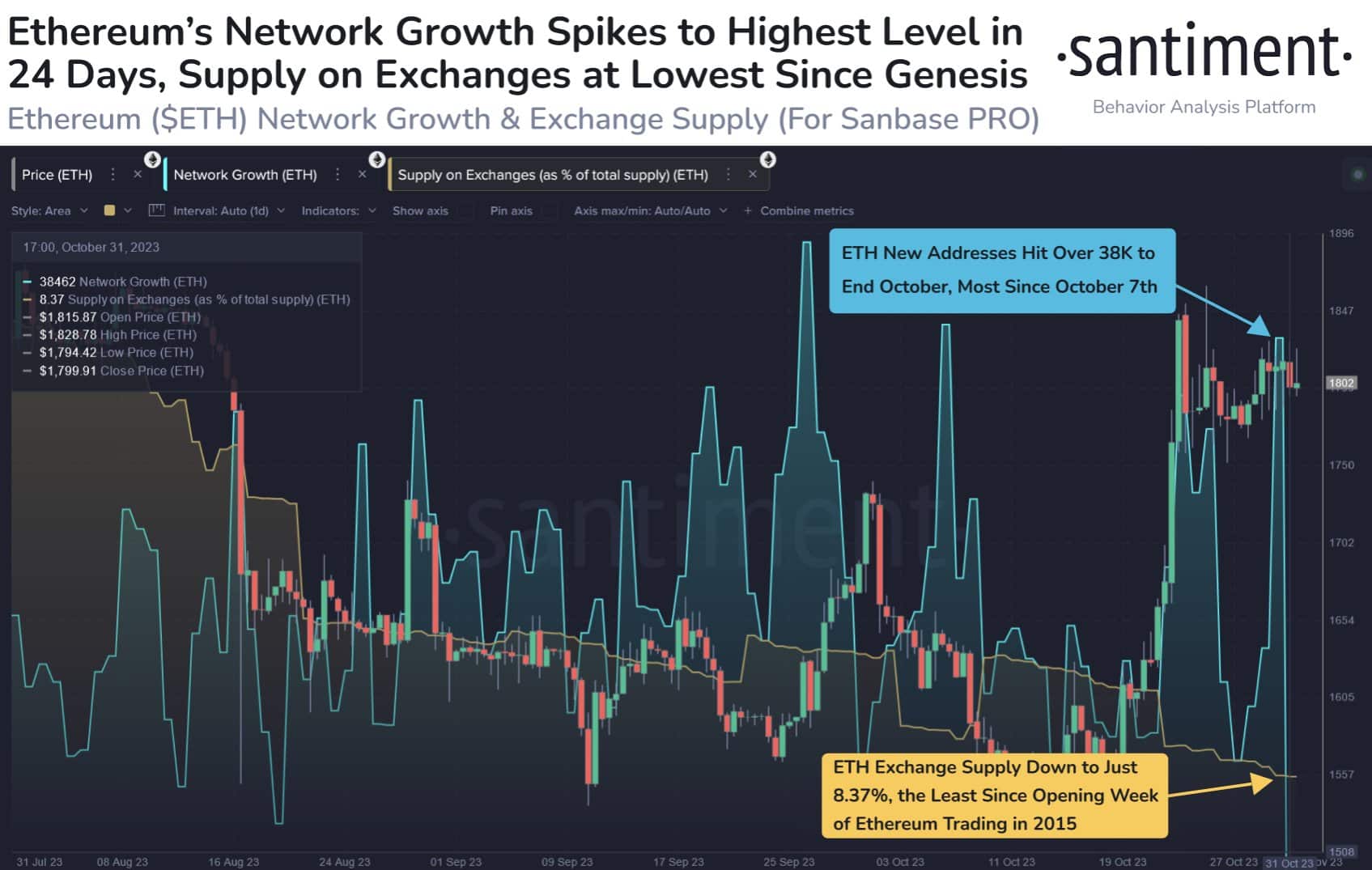

On-chain data from Santiment supports Ethereum’s price rise above $1800, as it shows the highest number of newly created wallet addresses on a daily basis since October 7.

Experts believe that if this long-term network growth trend continues and the decrease in ETH supply on cryptocurrency exchanges persists, the price of the altcoin king could surpass the $2000 threshold once again.

Ethereum’s Situation in the Derivatives Market

The continuous transfer of ETH by Ethereum’s co-founder Vitalik Buterin to the cryptocurrency exchange Coinbase has sparked debates about the expected price rally in the altcoin king. Although market observers speculate that Buterin’s ETH sales could hinder the expected rally, derivatives data indicates an increasing bullish trend in ETH despite the recent selling pressure. Two key derivatives metrics show a significant increase in investors’ bullish expectations, reaching levels not seen for over a year.

Firstly, the ETH futures premium, which measures the difference between two-month futures contracts and spot prices, has reached its highest level in over a year. In a strong market, the annualized premium, also known as the basis rate, tends to range between 5% and 10%. This data suggests an increased demand for long positions opened using futures contracts. The futures contract premium jumped from 1% on October 23 to 7.4% on October 30, surpassing the neutral-bull threshold of 5%. This significant increase corresponds to a 15.7% price increase in ETH over a two-week period.

Additionally, the Ethereum options market provides important findings for the altcoin king. The 25% delta skew in ETH options, which indicates when arbitrage desks and market makers can charge higher fees for upward or downward protection, serves as an indicator. During periods of price decline in ETH, the skew metric tends to rise above 7%, while during periods of optimism, it tends to drop to levels of -7% or lower.

Currently, the delta skew of ETH options stands at 25%, reaching its highest point in the past 12 months at -16% on October 27. During this period, put options were traded with a premium reflecting excessive optimism among investors. Furthermore, the current -8% skew for put options indicates a significant change since October 18, when there was a 7% or higher positive skew.