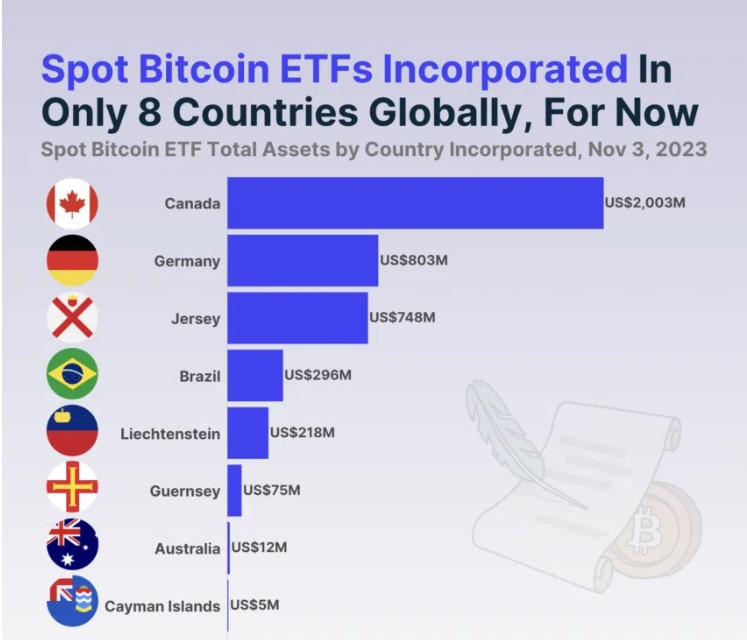

The crypto industry has entered a new era with the emergence of Spot Bitcoin ETFs (Exchange Traded Funds). According to the latest data, the value of Spot Bitcoin ETFs worldwide has reached $4.16 billion.

This can be seen as evidence of the increasing confidence in innovative financial instruments that offer regulated exposure to Bitcoin for both individual and institutional crypto investors.

Countries Embracing Bitcoin ETFs

Canada is leading the countries that have embraced Spot Bitcoin ETFs. With a total of seven Spot Bitcoin ETFs and $2 billion in investments, the country seems to prioritize Bitcoin investments.

Among the ETFs in the country, the largest one is the Purpose Bitcoin ETF, with an investment of $819.1 million. This ETF can be considered as an indication of Canada’s forward-thinking approach to the presence of cryptocurrencies in its financial structure.

In Europe, Germany, known for its strict regulations, takes the lead. The current value of ETCGroupPhysicalBitcoin, which emerged in June 2020, is estimated at $802 million, making it the second-largest Spot Bitcoin ETF globally.

Currently, only eight countries have approved Spot Bitcoin ETFs. G20 countries such as Canada, Germany, Brazil, and Australia are on the list, along with tax havens Jersey, Liechtenstein, Guernsey, and the Cayman Islands.

Meanwhile, the process continues to prolong in the United States. The Securities and Exchange Commission (SEC) has only approved Bitcoin futures-based ETFs. For example, the ProShares Bitcoin Strategy stands out with approximately $1.2 billion in investments.

The Significance of US Bitcoin ETF Approval

In the US, where the approval of 10 Spot Bitcoin ETF applications is expected, the path the SEC will take remains a subject of curiosity. Recently, SEC Chairman Gensler answered some questions during a program, and some of his responses were noteworthy.

“I won’t prejudge the staff’s work on those multiple ETF applications, but it’s also about these companies. When a company or an asset manager wants to go public, their securities have to be registered with the SEC and go through a filing akin to going public, and so it really is the job of our Division of Corporation Finance that gives feedback and reviews the filings, to really have that company financing function.”

As attention turns towards the potential US Spot Bitcoin ETF market, discussions about the outcome have started to gain momentum among investors. Experts believe that there could be price fluctuations on the first day of trading if the demand exceeds $1 billion.

The decision of the SEC regarding the pending Spot Bitcoin ETF applications is highly anticipated and has the potential to establish the US as a prominent player in this sector.

Once these ETFs are approved, we can expect around $155 billion to flow into the Bitcoin market. The total Assets Under Management (AUM) of these companies is around $15.6 trillion. If they allocate 1% of their AUM to these Bitcoin ETFs, the total amount of US dollars entering the Bitcoin market would be approximately $155 billion, which represents nearly one-third of Bitcoin’s current market capitalization, according to Blockchain analytics firm CryptoQuant.

Türkçe

Türkçe Español

Español