The price of Bitcoin dropped towards $34,500 on November 7th. As of the time of writing, Bitcoin is trading at $34,824, and the inability to break the $35,000 resistance level continues to create pressure in the market. Famous analysts in the industry are currently focusing on the increase in futures contracts.

New Data Draws Attention in the Bitcoin Front

According to data from TradingView, Bitcoin is putting up a serious fight to reclaim the $35,000 level as support. BTC did not provide a clear direction for investors based on Wall Street’s opening, but market participants expect volatility to return soon.

The reason for this expectation is a sharp increase in open interest (OI), which represents the total number of futures contracts in the futures market. Financial commentator Tedtalksmacro shared his thoughts with his followers:

“Nearly $350 million worth of 10,000 Bitcoins were added to open interest today. Fireworks will soon be ignited.”

A 20% Move is Expected

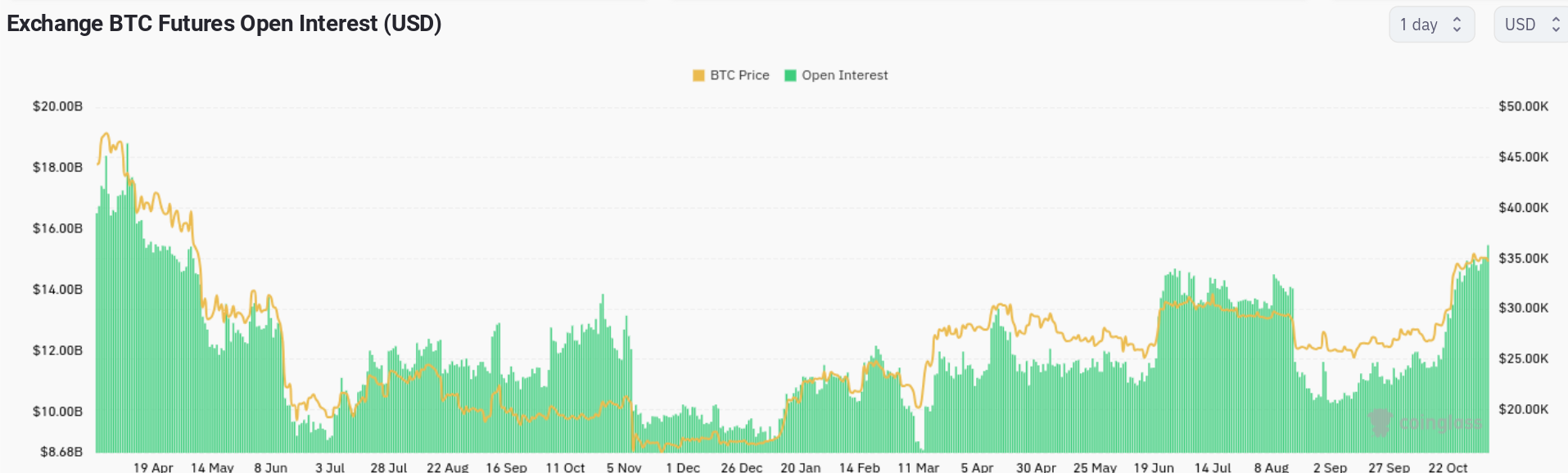

The high level of open interest coincides with periods of volatility in recent months. James Van Straten, a research and data analyst at crypto analysis firm CryptoSlate, commented on the current levels, which were approximately $15.5 billion at the time of writing, describing the volatility level as noteworthy:

“The CME exchange, preferred by institutional investors, set a new record in open interest with $3.68 billion worth of 105,380 BTC contracts. Binance surpassed this figure with approximately 113,500 BTC in open interest. This trend indicates an increase in participation in Bitcoin futures, suggesting either a positive change in market sentiment or investors turning to protective strategies.”

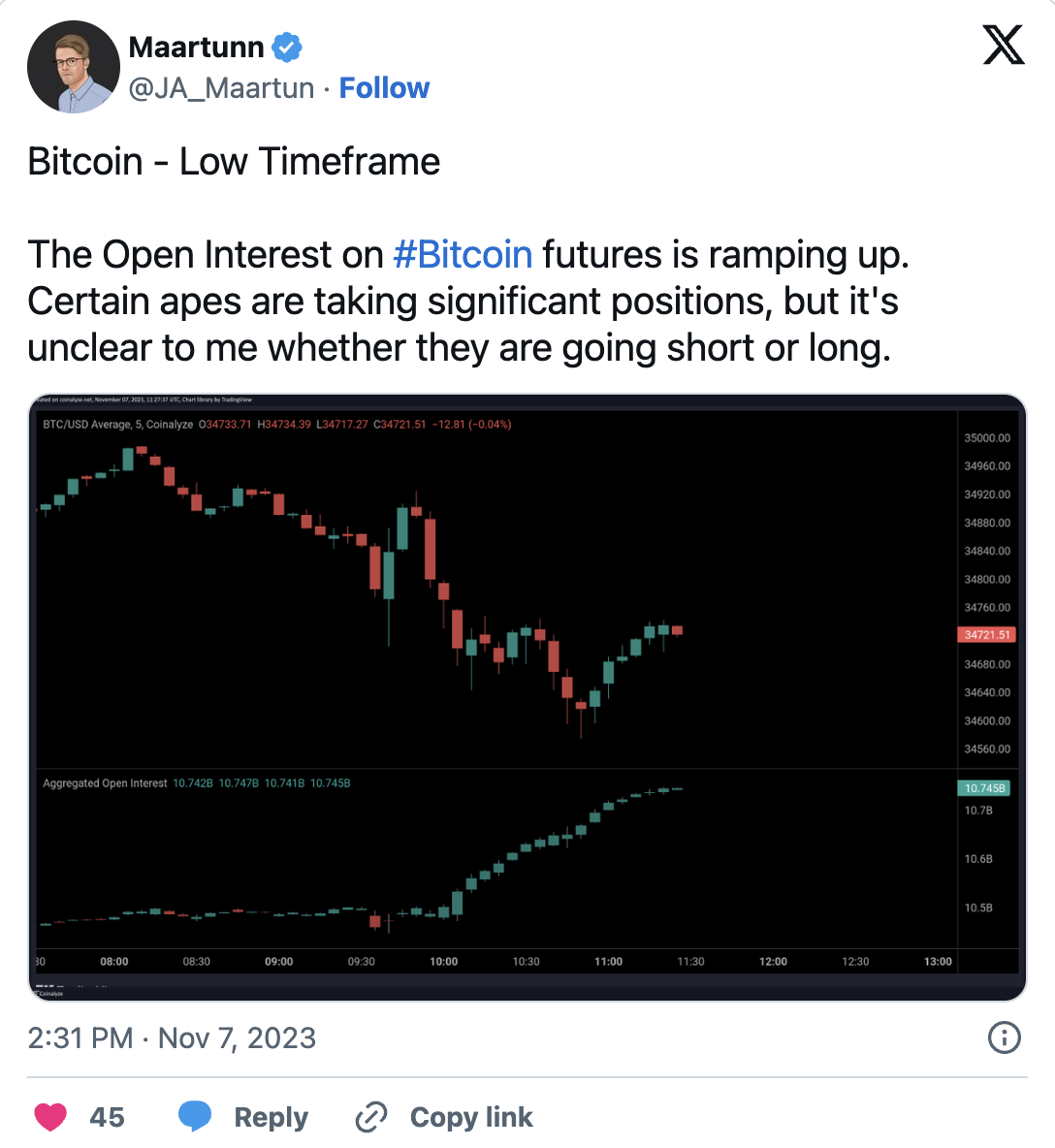

Concerns about the uncertainty of the outcome of the OI metric were shared by J. A. Maartunn, who supports the on-chain analysis platform CryptoQuant.

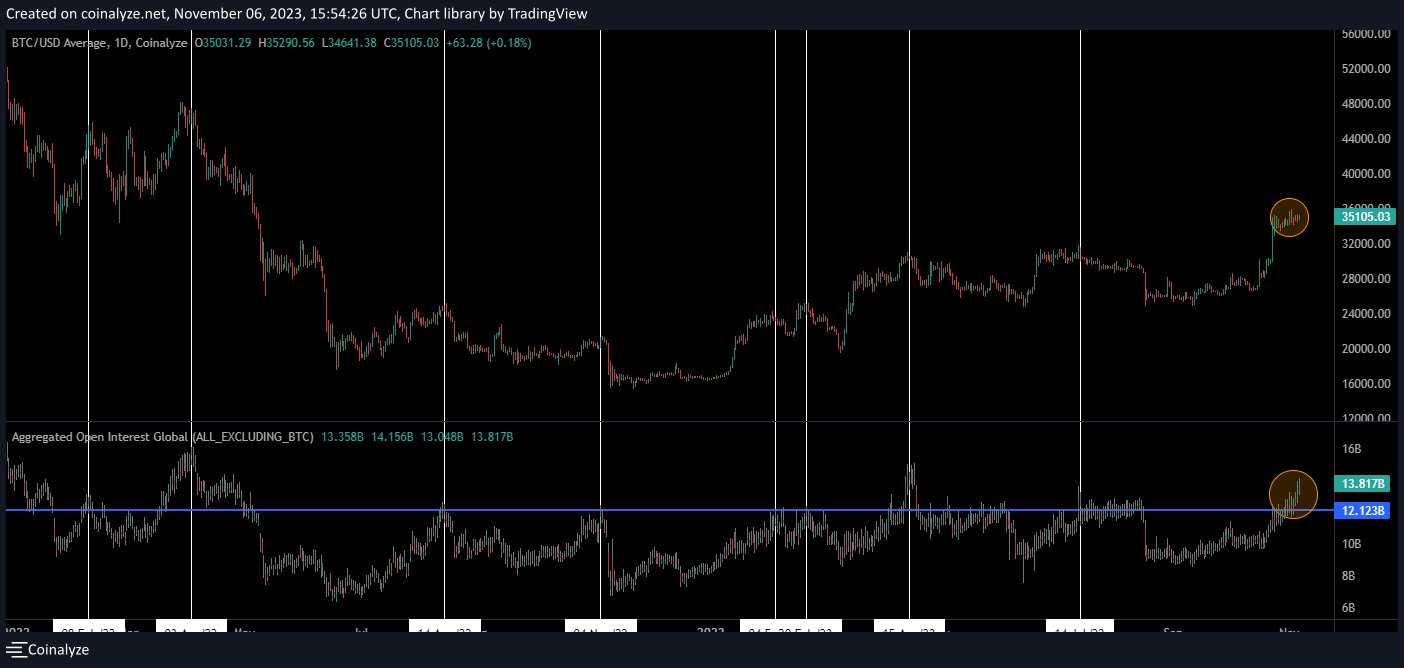

In an analysis shared with his followers on November 6th, Maartunn claimed that the OI is currently in the range where a 20% drop in the Bitcoin price has been seen before. The renowned analyst wrote that when this metric exceeded $12.2 billion in the past, Bitcoin experienced at least a 20% drop and emphasized the significance of the OI metric.

Türkçe

Türkçe Español

Español