Cryptocurrency world seems to be excited about the Bitcoin ETF. James Butterfill, the Research Director at CoinShares, made a bold prediction that Bitcoin will reach $81,000 based on the speculation surrounding the approval of a Spot Bitcoin ETF in the US and the flow of funds.

The expectation surrounding the potential approval of a Bitcoin Spot ETF triggered a bullish sentiment in the cryptocurrency market. Analysts believe that such an approval could inject billions of dollars into the Bitcoin market and pave the way for a significant price rally.

James Butterfill’s Analysis Using Fund Flows

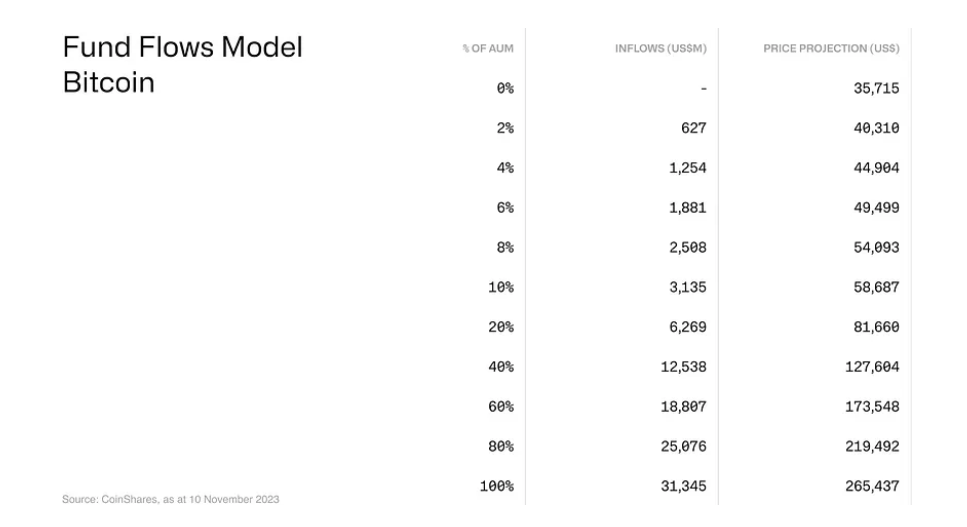

Butterfill’s analysis focused on the complex relationship between Bitcoin prices and flows of Exchange-Traded Products (ETPs) on the stock market. By examining past data, Butterfill highlighted the correlation between rising prices and increasing inflows, suggesting a momentum-driven approach among ETP investors. Using a quantitative approach, Butterfill presented a prediction model that relates 45-day price changes to weekly flows as a percentage of Assets Under Management (AuM). The model proposed a potential increase towards $141,000 for Bitcoin with an estimated inflow of $14.4 billion.

Acknowledging the difficulty of accurately predicting future inflows, Butterfill presented an approach that considers various inflow scenarios and their potential effects on Bitcoin prices. With speculation increasing around a Bitcoin Spot ETF in the US, Butterfill emphasized that a $2.5 billion inflow could push BTC prices to $54,000, while a $6.2 billion inflow could potentially drive prices up to $81,000, based on fund flow data.

Bitcoin Price and Recent Performance

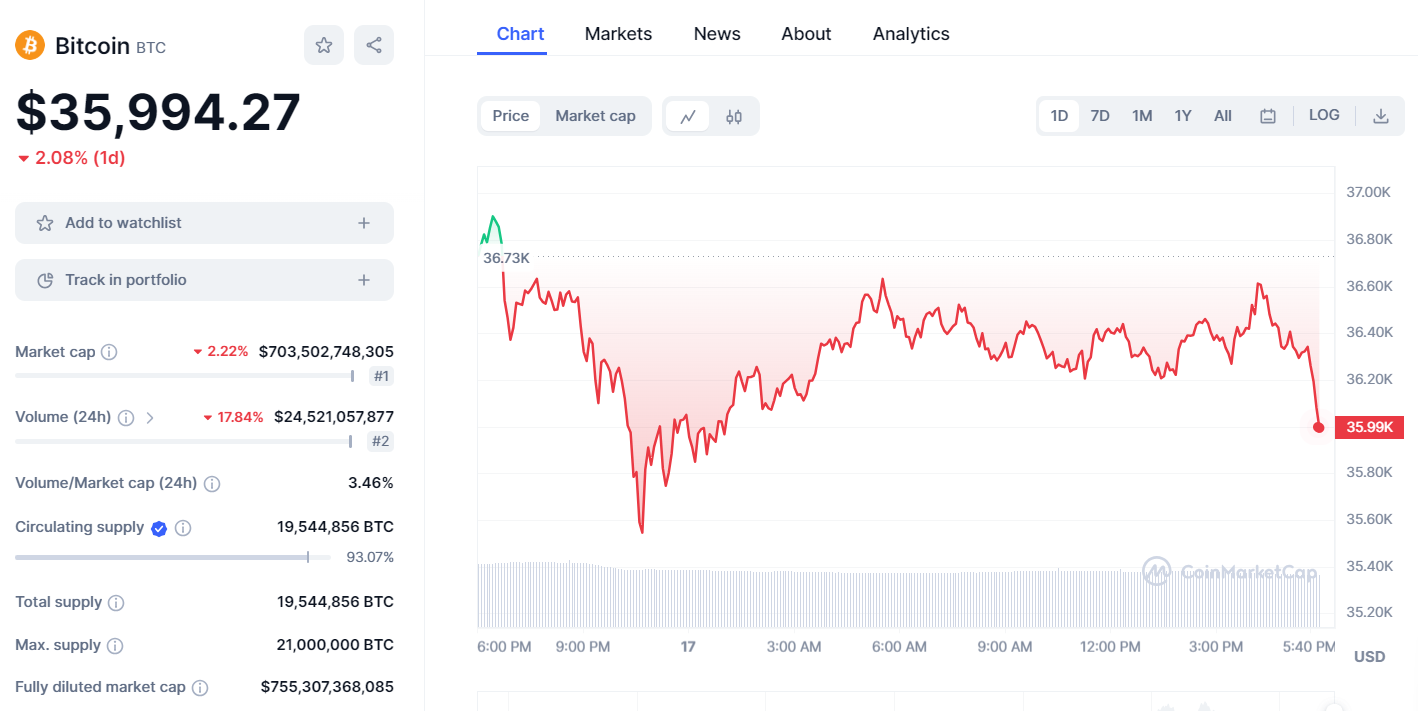

As of the latest update, Bitcoin experienced a 2.08% decrease in price in the last 24 hours. At the time of writing, it was trading at $35,994. This decline coincided with a broader market sell-off following BlackRock’s official application for a Spot Ethereum ETF to the SEC. However, Bitcoin resisted and gained over 29% in the past seven days, reflecting a rising trend in risky assets.

Nevertheless, Butterfill highlights the regulatory approval and institutional acceptance as challenges for a Bitcoin ETF. Overcoming these obstacles and eliminating the perceived complexity of Bitcoin as an investment asset could lead to a rise in Bitcoin prices due to increased institutional and fund participation.

Türkçe

Türkçe Español

Español