Bitcoin price continues to rally after FED Chairman Jerome Powell’s statement on interest rates last week. The increasing positive expectations for spot Bitcoin ETF applications also continue to have a positive impact on Bitcoin’s price. So what’s next for Bitcoin, which is currently trading at $42,205? Let’s take a look together.

Why is Bitcoin Rising?

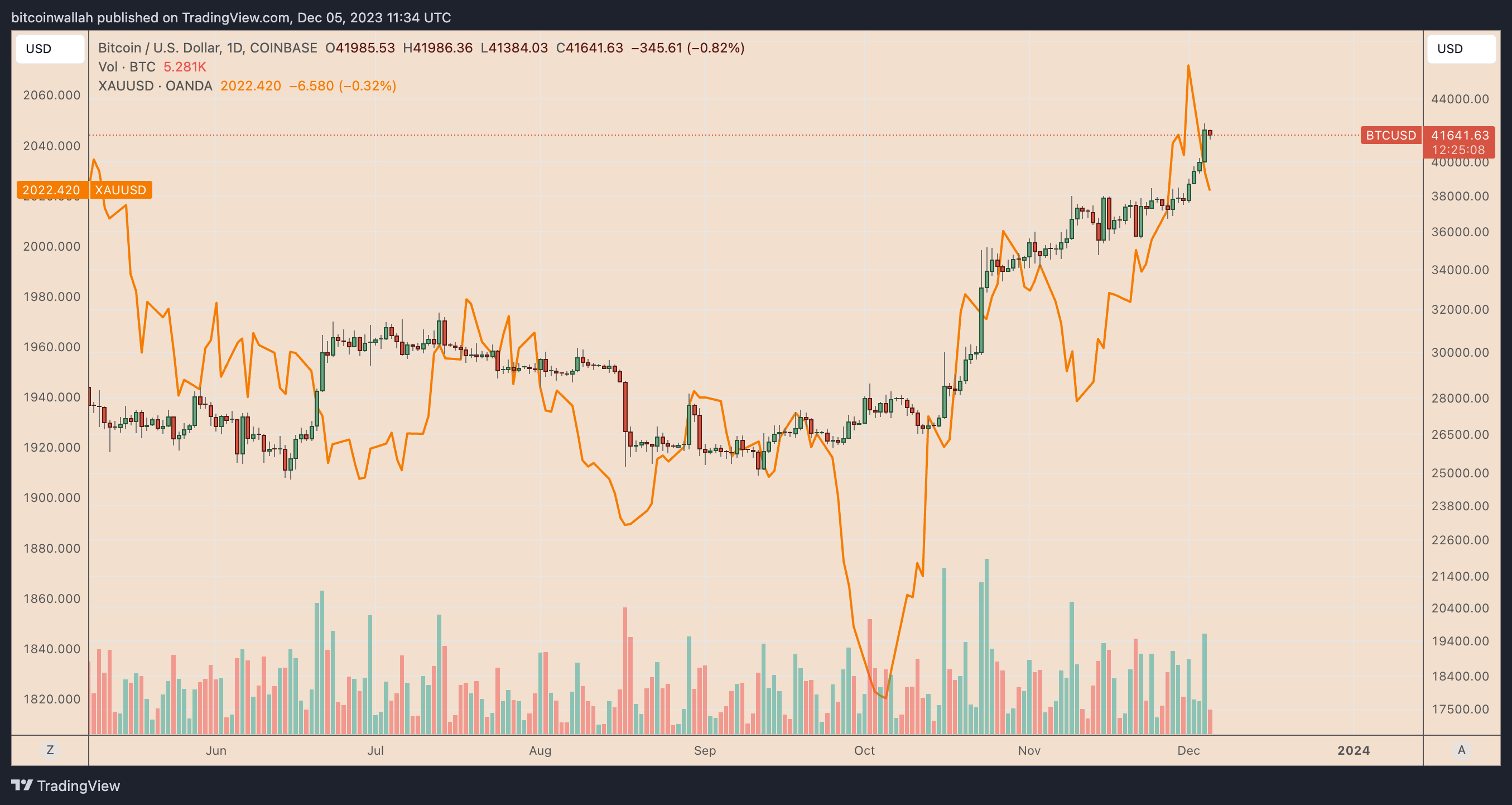

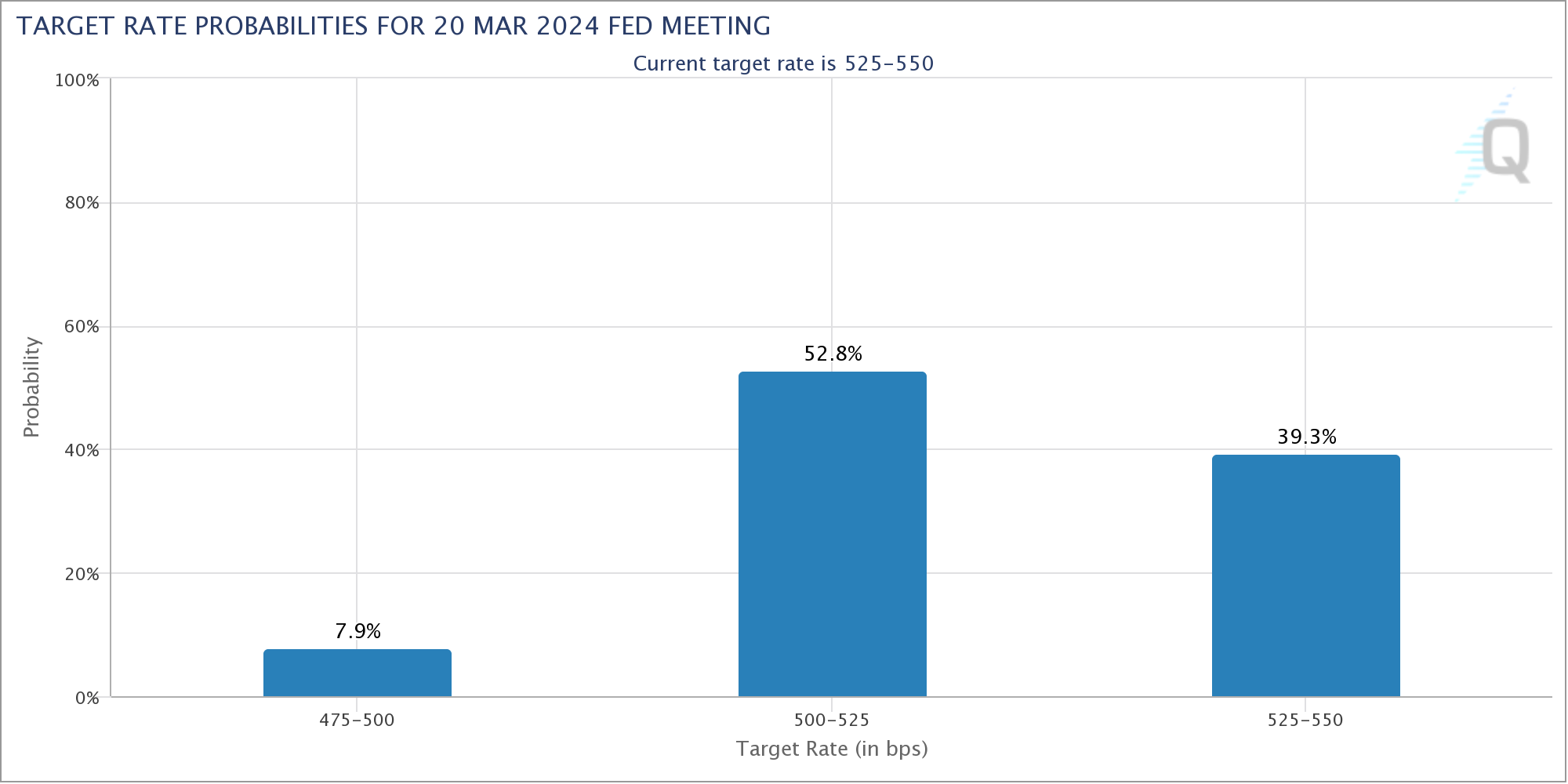

Bitcoin price reached above $41,400 for the first time in 17 months, starting the new week. Following this, gold, which reached a new record level on December 1st, followed Bitcoin’s price increase. The expectations of interest rate cuts may have been the common factor for the rise in Bitcoin and gold prices this week. Investors became more confident that the Federal Reserve would change interest rates after Jerome Powell’s speech on December 2nd.

The Federal Reserve Chairman had announced that they had raised interest rates enough to combat inflation. However, the markets clearly ignored Powell’s words, emphasizing that it is too early to speculate on when the tightening policy will ease.

Interest rate cuts have often been observed to lead to an increase in Bitcoin in recent years. At the same time, low interest rates increase investors‘ appetite for riskier and less profitable assets such as gold, Bitcoin, and stocks. The price of Bitcoin continues to gain momentum with the increasing likelihood of approval for the ongoing spot Bitcoin exchange-traded fund (ETF) application process in the US until January 2024.

Current Situation on Bitcoin’s Chart

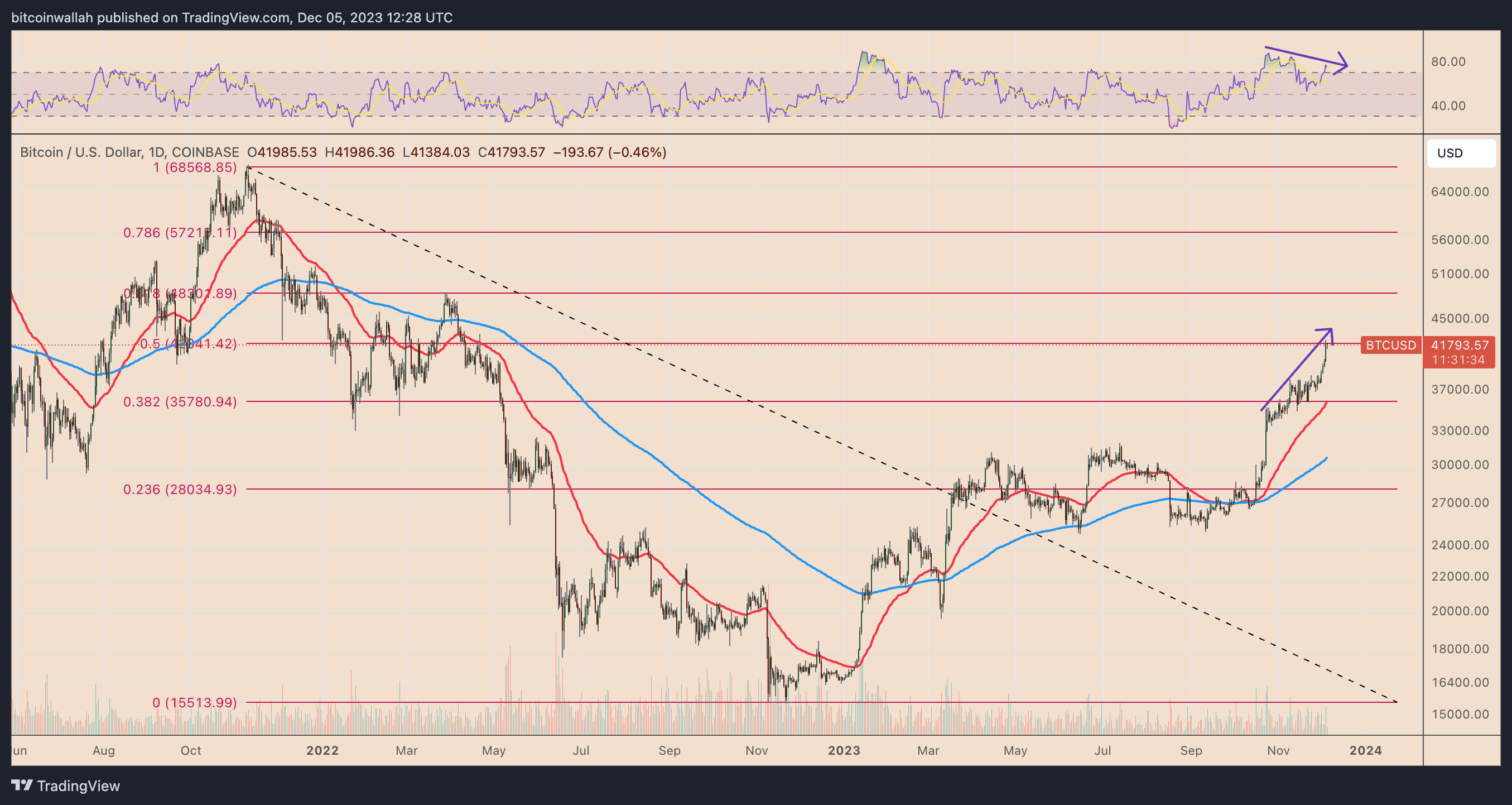

The price increase in Bitcoin in recent months has caused a significant divergence with the daily relative strength index (RSI), indicating a slowdown in buying momentum at the highest levels for Bitcoin’s price. From a technical perspective, a downward divergence can increase selling pressure.

The selling risks seen in Bitcoin are further increasing near the 0.5 Fib line in the $42,000 region, which has turned from support to resistance. As a result of the combination of these bearish signals, there is a high possibility that Bitcoin’s price could drop to $35,780 by the end of December. The downside target intersects with Bitcoin’s 0.382 Fib level and the 50-day exponential moving average (red wave).

Türkçe

Türkçe Español

Español