Bitcoin (BTC) is trading above $42,000 on December 5th and has gained over 2% in the past 24 hours. This increase, driven by expectations of a possible Bitcoin ETF approval and the upcoming Bitcoin halving in 2024, has brought smiles to investors‘ faces.

Current Situation of Bitcoin Holders

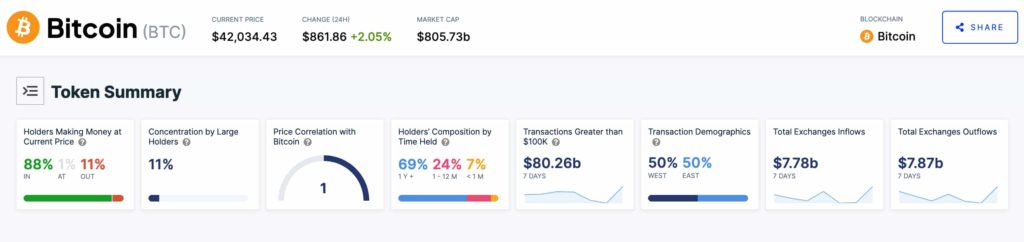

The increase in the leading cryptocurrency in 2023 is rewarding Bitcoin holders. Data from IntoTheBlock shows that 88% of all Bitcoin holders have unrealized profits. Crypto wallet addresses that bought BTC at lower prices are now in a position of profit. On the other hand, 1% of all Bitcoin holders have bought their tokens at prices, while 11% have unrealized losses. The data highlights the positive sentiment among investors who are benefiting from the price movements of the cryptocurrency market.

69% of investors are long-term Bitcoin holders, holding their coins for more than a year, while 31% hold them for less than 12 months, with 7% holding them for less than a month. It is also worth noting that only 11% of all circulating BTC is held by individuals defined as “Big holders” by IntoTheBlock, who hold more than 0.1% of the circulating supply.

Despite the recent price increase, IntoTheBlock summarizes Bitcoin signals as “Mostly Bearish”. Four indicators are neutral, two are bearish, and one is bullish. The Net Network Growth and Large Transactions indicators show a bearish outlook with -0.27% and -1.06% respectively.

Bitcoin in Focus for Investors!

Furthermore, an increase in the number of profitable Bitcoin holders could be a potential trend reversal signal. The larger the number of “In Profit” investors, the higher the chances of these holders selling their positions and taking profits. In October, 82% of Bitcoin holders were reported to be in profit, which increased to 85% in November.

This could also serve as evidence of Bitcoin’s ability to function as a store of value. Ultimately, the future performance of Bitcoin may depend on multiple factors rather than the ones mentioned above. Protocol development, decentralization of the network, adoption, and macro conditions could all play a significant role going forward.

Türkçe

Türkçe Español

Español