The world of cryptocurrency encompasses a variety of different dynamics. Each price tag carries its own significance. As price tags change, analysts adjust their projections accordingly. Therefore, expectations can evolve over time. We will present new views from three analysts on Bitcoin and then briefly touch upon the European Central Bank’s report on cryptocurrency.

Analyst Mags Points to Bitcoin Cycle

In the cryptocurrency market, the Bitcoin halving occurs every four years, bringing with it four-year cycles. Many analysts are now comparing the current period to past cycles, including analyst Mags.

Analyst Mags emphasizes that each Bitcoin cycle is unique. However, by pointing out an exception, he notes the similarity between 2016 and 2023. According to the analyst, BTC could experience a parabolic rally in this cycle.

Bitcoin Predictions from Two Analysts

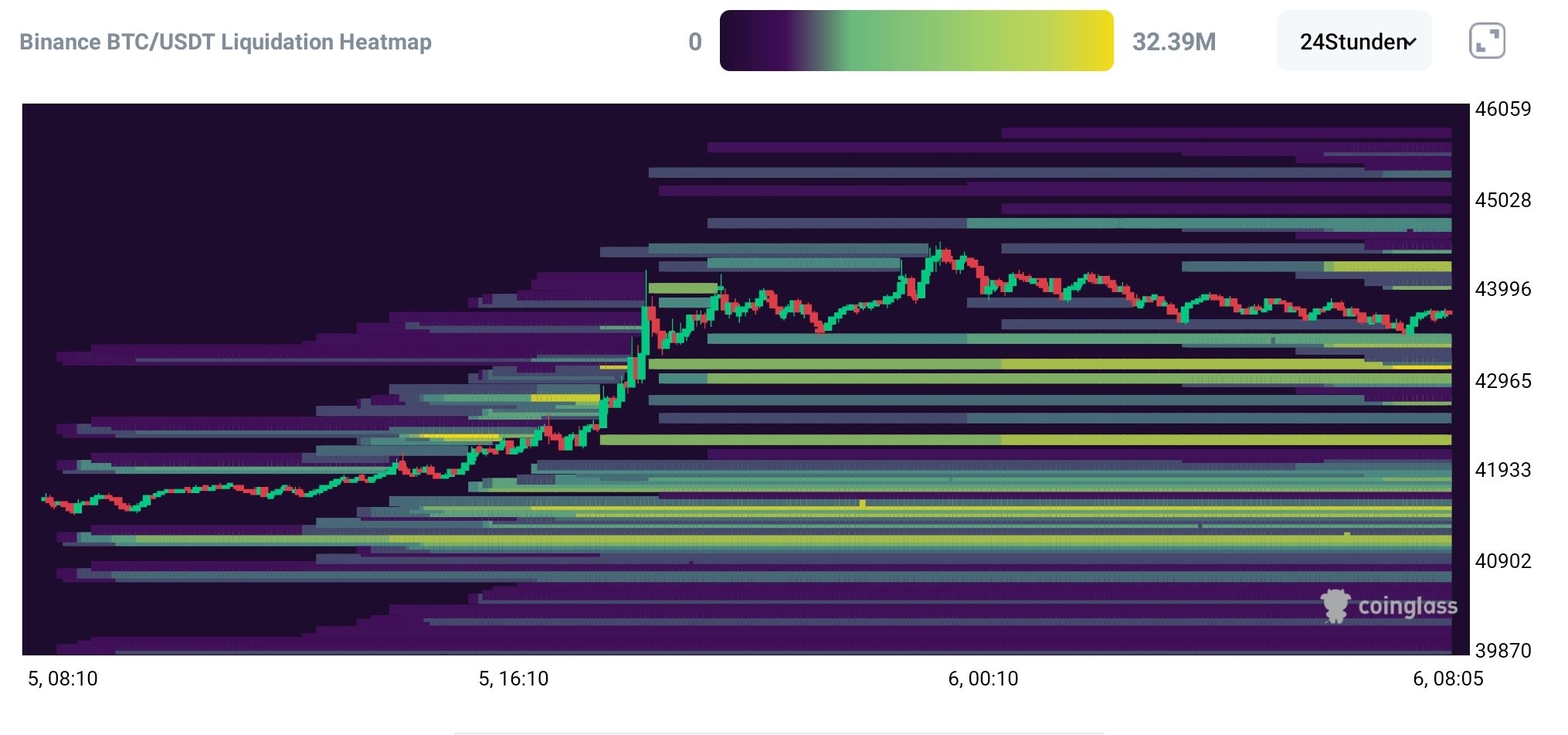

Crypto4Every₿ody focused on the Bitcoin liquidation heat map in a post today. According to the analyst, there is a considerable amount of liquidity for following the $40,000 direction. The next bull target is identified as important at the $44,240 level.

Analyst Michaël van de Poppe highlighted that Bitcoin has surpassed the $40,000 mark and has a chance to continue upwards. However, the analyst also pointed to the Bitcoin ETF, suggesting that there will likely be a short-term peak as Spot Bitcoin ETF approaches. The levels determined by the analyst range between $48,000 to $50,000, with a bearish prediction between $25,000 to $38,000.

European Central Bank’s Research on Bitcoin and Cryptocurrency

A study by the European Central Bank (ECB) has shed light on the role of cryptocurrencies in regions where access to traditional financial systems is not possible. The study suggests that in emerging markets with a young population, cryptocurrencies serve as speculative alternatives.

The devaluation of national currencies has contributed to an increase in Bitcoin transactions. Moreover, the study points to a potential increase in the use of stablecoins, which offer a viable financial alternative to individuals and businesses in the absence of traditional options.