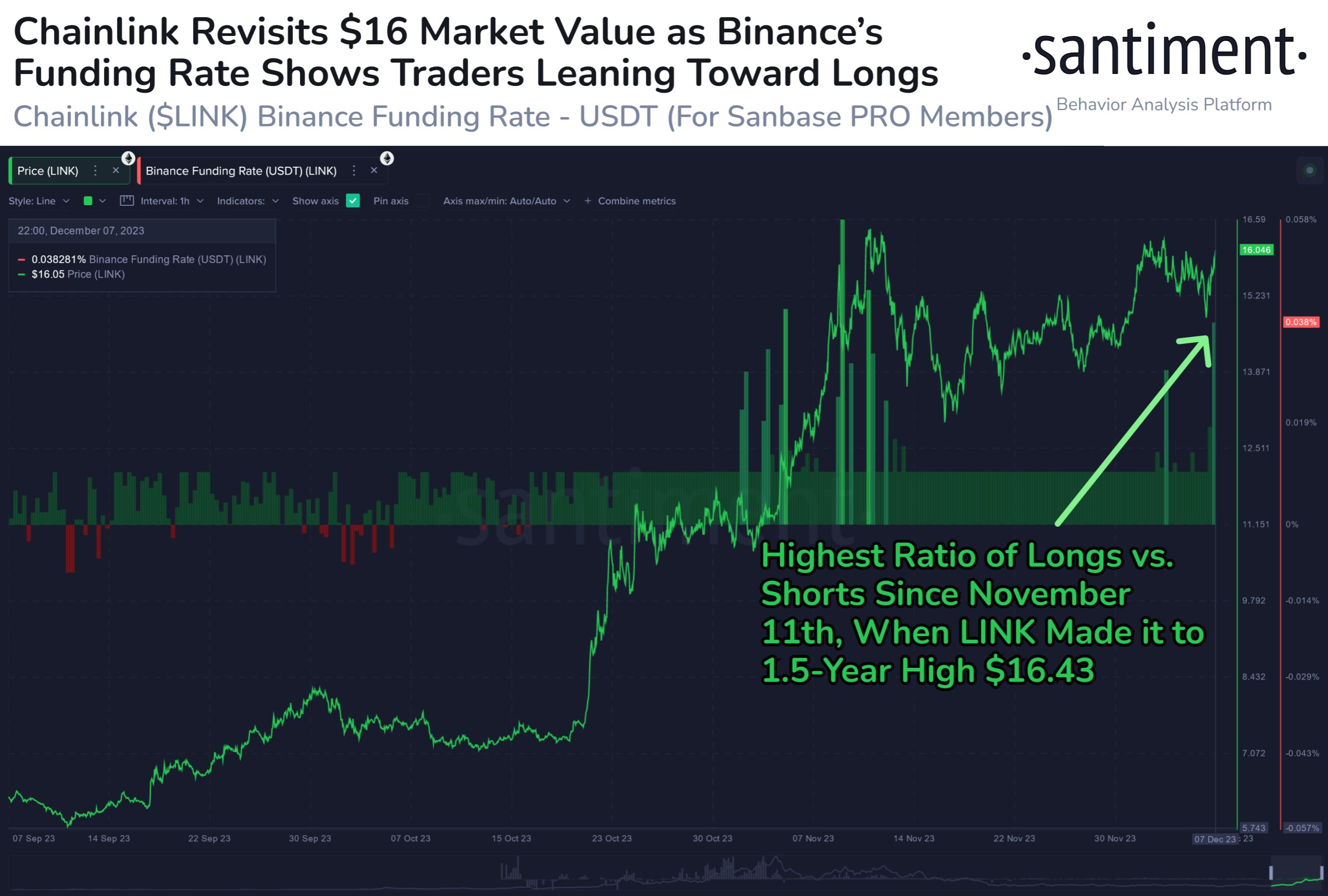

In the continuously evolving world of cryptocurrencies, deciphering market signals has become increasingly important. The recent activity of Chainlink on Binance, characterized by a significant tilt in funding rates towards long positions and reaching the highest level observed in the last four weeks, has revealed intriguing trends. A graph shared by Santiment highlighted this situation, with comments suggesting expectations of a price increase.

Navigating Long Positions: Chainlink’s Bullish Momentum

The token of Chainlink, LINK, has successfully reclaimed the $16 threshold while experiencing a notable increase in funding rates favoring long positions on the cryptocurrency exchange Binance. This surge in long positions reaching a four-week peak indicates a growing bullish sentiment among traders.

In the coming days, the crypto community is curious to see whether this increase in positive sentiment, possibly driven by Fear of Missing Out (FOMO), will pave the way for a local peak. Another point of interest is whether LINK will maintain its upward trajectory and potentially aim for the $20 mark with minimal resistance.

Analyzing Price Dynamics: Key Considerations for Investors

For traders and crypto enthusiasts closely monitoring Chainlink’s market movements, a strategic approach is becoming increasingly important. Observing the interaction between the funding rate and the price dynamics of the cryptocurrency LINK provides insights into potential market sentiment.

As LINK surpasses the $16 level, traders become alert, assessing the likelihood of FOMO-driven corrections or a sustained rise. The $20 threshold stands as a critical point where the absence of significant resistance could positively influence the altcoin Chainlink’s trajectory.

In conclusion, data from the crypto-focused platform Santiment clearly shows that in the dynamic environment of cryptocurrencies, understanding the nuances of market indicators has become a significant advantage.

The Binance funding rate for the cryptocurrency Chainlink is currently inclined towards long-term positions, providing valuable information for investors looking to navigate the market effectively. As LINK targets new milestones, the interplay between the bullish momentum and potential resistance points is becoming a focal point for strategic decision-making.

Türkçe

Türkçe Español

Español