In the cryptocurrency market, especially during bear markets, crypto assets including Bitcoin have been declared ‘dead’ multiple times, yet some experts suggest it would take an extreme series of events for it to actually happen. According to 99Bitcoins, a website that tracks how many times Bitcoin has been declared ‘dead’ by mainstream media organizations, the largest cryptocurrency by market value has been declared dead 474 times since 2010.

Declaring The Crypto Market Dead Is Not Simple

Usually, such declarations are supported by crypto antagonists as proof that Bitcoin is not a viable asset, but declaring the crypto market dead might not be so simple, at least according to some experts in the field.

BNB Chain’s business development director Tomasz Wojewoda is confident that it would take more than a bear market or crypto winter to end Bitcoin and the crypto market, even if a particularly sharp drop has occurred since the all-time highs of 2021.

A bear market begins when crypto assets drop at least 20% and continue to drop, while a crypto winter is a period when asset prices in the market remain low for a long time. Tomasz Wojewoda commented on the issue:

“The crypto market moves in waves like any market in the economy and tends upwards or downwards depending on market sentiment. The market went through numerous bear markets, but historically we have seen the market recover from similar trends.”

Legal Regulations Can’t Kill Crypto

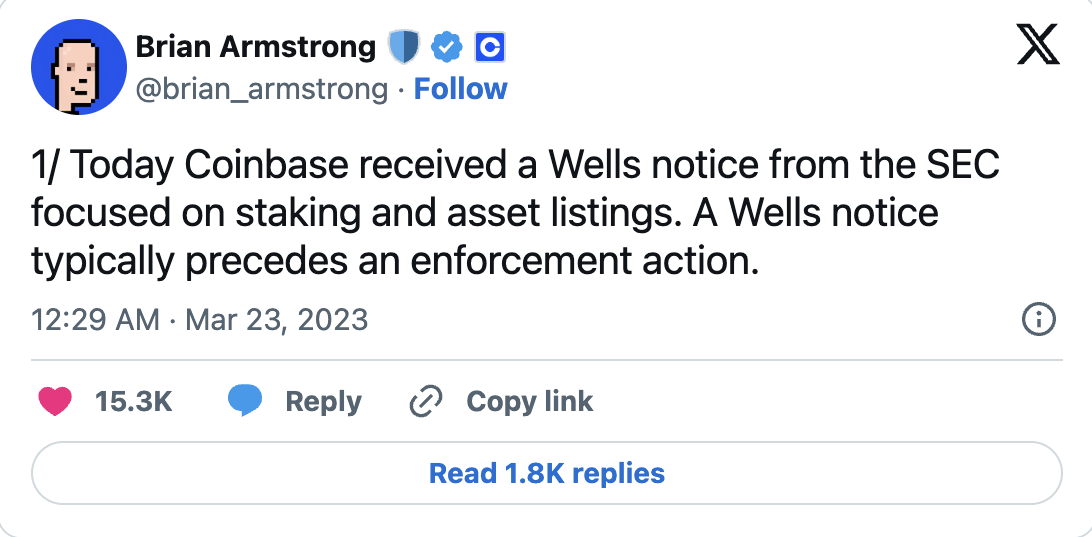

Banking regulators seem to be trying to destroy or break up the crypto market by creating a series of lawsuits and a daunting wave of regulatory measures. Fears that this could mean an apocalypse scenario for the sector are still ongoing.

Under the leadership of Chairman Gary Gensler, The United States Securities and Exchange Commission is particularly aggressive against crypto companies. According to Gensler, the institution has opened more than 780 enforcement cases, including more than 500 independent lawsuits, in 2023.

Despite these lawsuits and regulatory conditions, the crypto market and Bitcoin still survived. The arrival of legal regulations was slow and caused serious damage in some cases. Wojewoda believes that some form of regulation could ultimately be a good thing for the sector and the crypto market will not disappear:

“Global regulations can affect the growth of crypto, but with more countries worldwide adopting crypto, I don’t think this will be a reason for crypto to ‘die’. Regulations in the sector are a good thing. They keep users safe and a clear framework allows the sector to be built around this framework.”

Türkçe

Türkçe Español

Español