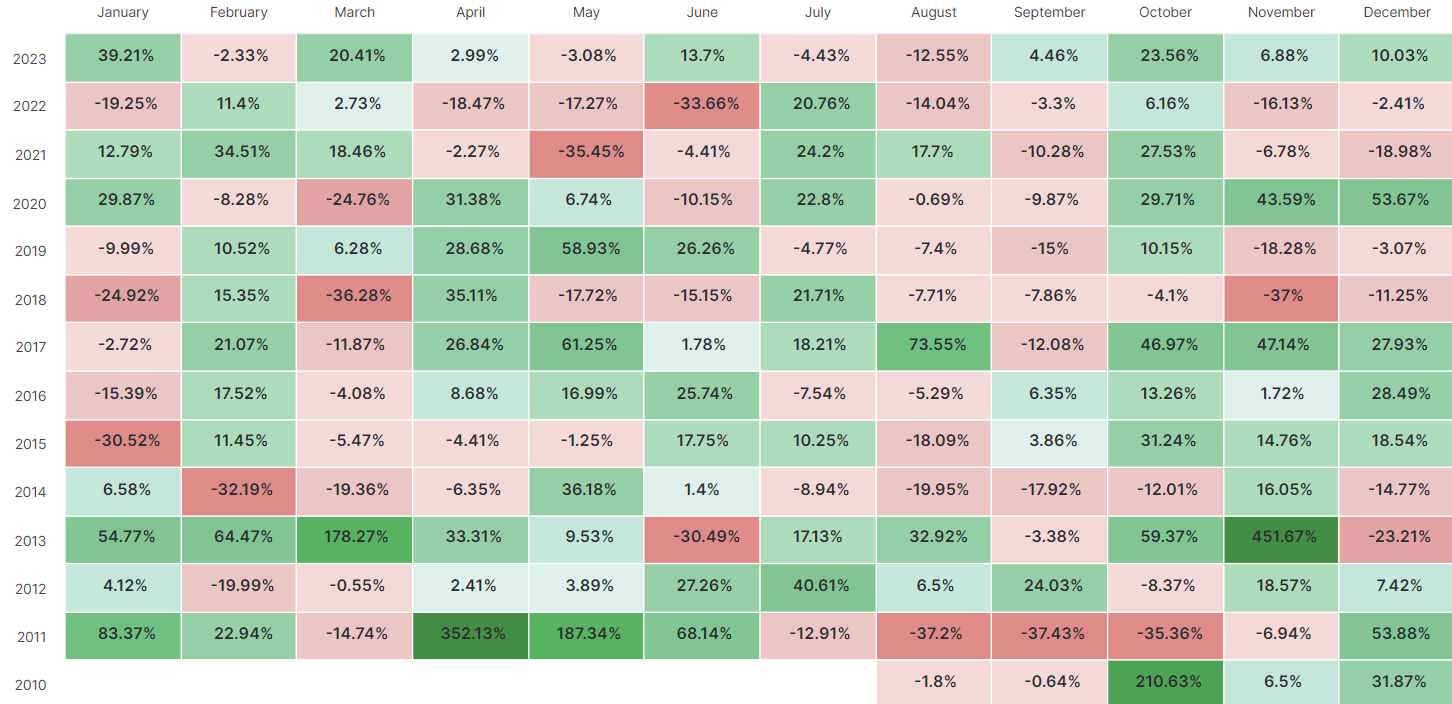

Bitcoin‘s price is once again over $43,000, and there’s movement in altcoins. So, why have the markets turned positive? There are several reasons. We had mentioned early on Sunday that negativity could persist until a few hours after the Fed’s decision on Wednesday. It happened as expected, and now we’re moving into the second phase.

The fluctuation in Bitcoin’s price could continue until the Asian markets open in a few hours. There’s a daily closing in about 1 hour, and it’s important to close it above $43,000. However, our current topic is beyond short-term movement; it’s about the changing market sentiment. Peaks are now turning into temporary rest areas beyond profit-taking regions. BTC appears to have completed the recent correction for now and is focusing on its next target.

Exchange Volumes

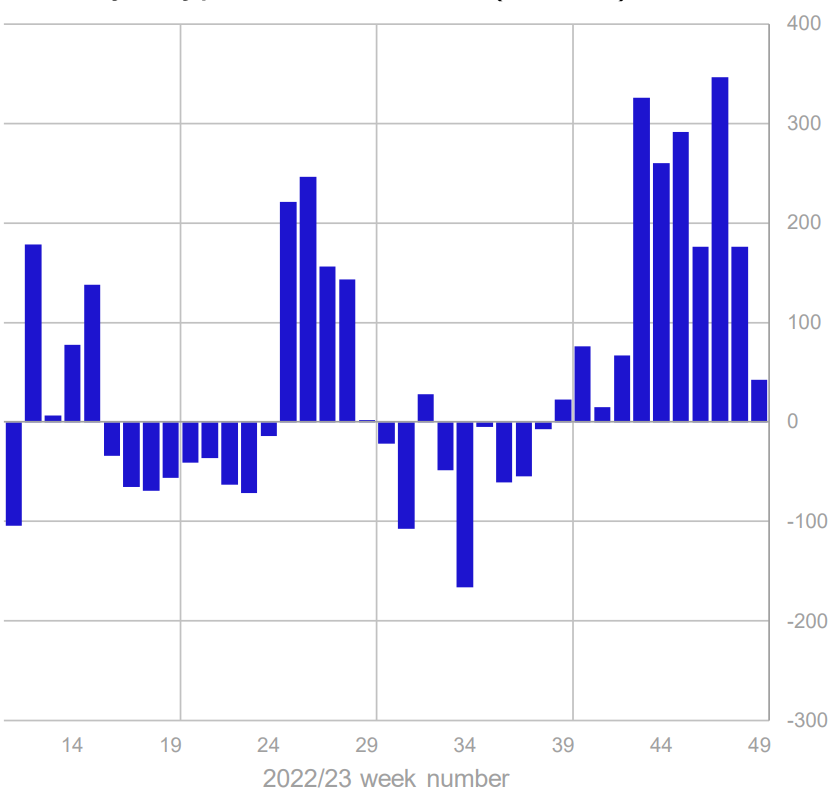

Bitcoin’s trading volume on exchanges reached its highest level in the last 6 months on December 11th. While the activity in BTC trades may not be at the desired level, the revival of demand after the withdrawal of major market makers is reminiscent of a significant return, which is positive.

Spot Bitcoin ETF

The macroeconomic fluctuations have calmed down for now, and Powell also mentioned that we’re approaching interest rate cuts. On the other hand, BTC, which has gained 153.5% since the beginning of the year, also positively priced in the recent Binance deal. Experts who say that this deal could pave the way for a spot Bitcoin ETF approval are very hopeful for January 10th. We will have reached the big day in about 26 days.

CryptoQuant analysts said some very nice things about the early results of the ETF approval. If the approval comes in January, analysts believe BTC’s market value could increase by approximately $1 trillion. This could mean the price could rise above $85,000. Galaxy Digital forecasts a 74% price increase in the first year following the launch of a spot BTC ETF.

Both predictions tell us that the cumulative market value of cryptocurrencies could increase by over 100%. This could mean gains exceeding 10 times for some altcoins.

Institutional Entries

While some investors anticipate that a spot ETF approval could increase liquidity, institutional investors have already started to enter Bitcoin and crypto. We draw attention to the CoinShares reports every Monday, and the steady entries are excitingly continuing. Last week, the institutional entry of $39.9 million was solely into Bitcoin, and net entries have been continuing for 11 weeks.

This year, the net entry into cryptocurrencies was $1.88 billion.

Türkçe

Türkçe Español

Español