Bitcoin and the recent rise in altcoins have led to the emergence of varying opinions. The diversity of views among analysts is actually a sign of the market’s richness. As part of this richness, today we received views from Peter Brandt that are completely opposite to some analyst comments. Let’s take a look at the analyst’s comments.

Contrary Views on Bitcoin’s Overbought Condition

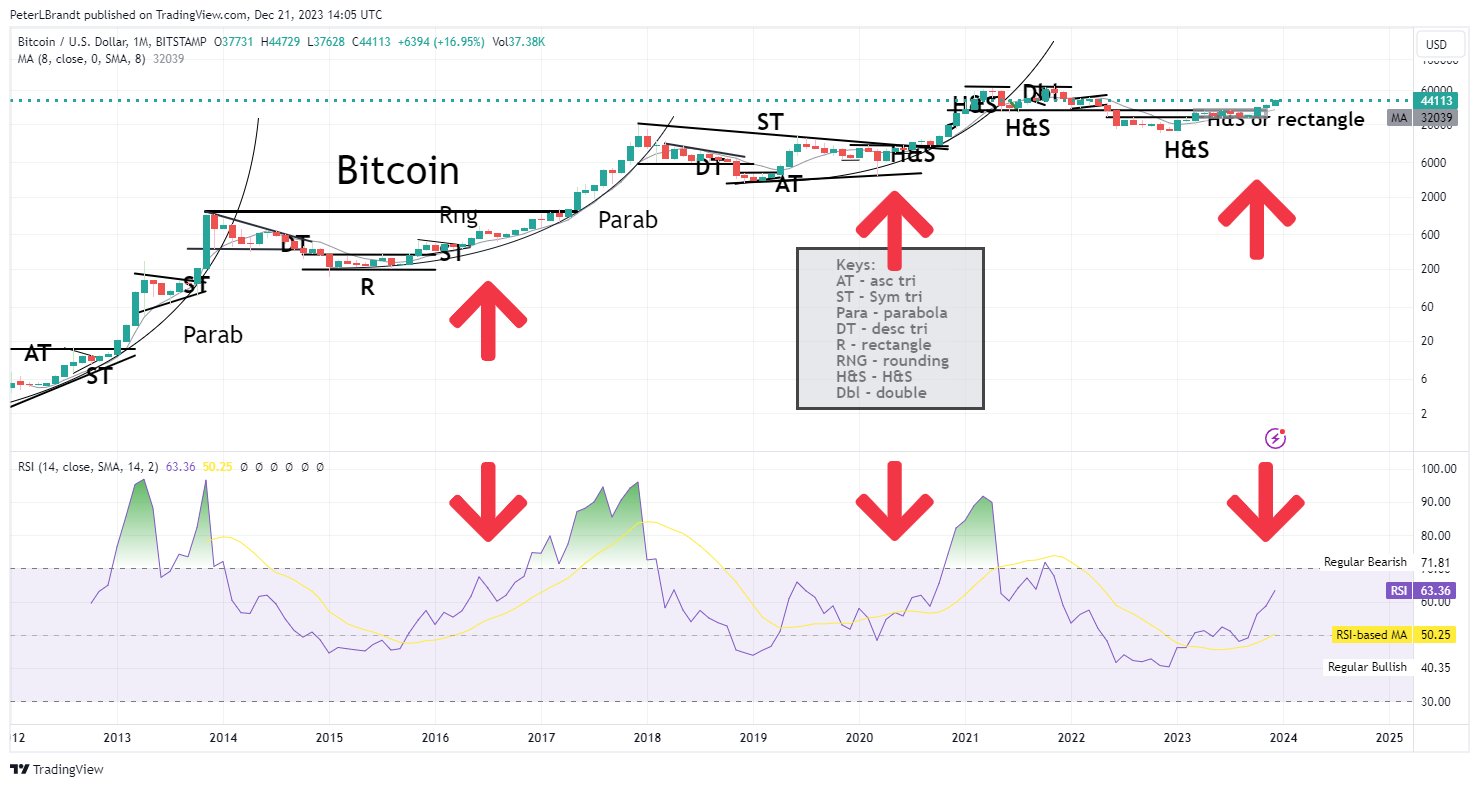

One point Peter Brandt emphasizes is the RSI indicator. The recent performance of Bitcoin has led to conflicting views among analysts, with some claiming it is overbought.

However, leading analyst Peter Brandt offers a different perspective, pointing to the monthly Relative Strength Index (RSI) as an indicator consistent with historical bull market patterns.

Monthly RSI Indicates Sweet Spot for Bull Market Progressions

Brandt emphasizes that the monthly RSI, a significant technical indicator, is currently at the sweet spot where previous bull markets experienced significant acceleration. While avoiding predictions, he underlines this observation, suggesting that Bitcoin’s trajectory could be consistent with historical patterns of strong advances during similar RSI levels.

In the dynamic world of cryptocurrency analysis, different perspectives add layers to the ongoing narrative. Brandt’s nuanced approach leads to a closer examination of the monthly RSI and its potential impact on Bitcoin’s market trajectory.

What Can Be Expected for Bitcoin’s Price?

It is necessary to mention that there is currently an optimistic atmosphere in the market. Following yesterday’s rise, we see a positive momentum reflected in altcoins. In the next phase, for cryptocurrency BTC, the $45,000 level appears to be an important resistance.

In the comments made, there is a prevailing expectation that BTC will close the year, or the upcoming week, at a $50,000 level. The coming days will likely make this narrative clearer. Looking at the price of the cryptocurrency BTC at the time of writing, we see it trading at $44,076.

Today, it’s interesting to note that altcoin rally was not accompanied by Ethereum. ETH is trading at $2,218 with a 1% decrease at the time of writing.