Polkadot (DOT) experienced an incredible surge in December, gaining 47% in value. Considering the price at the time of writing, it has risen over 20% in just the last two days. There was also a significant increase in blockchain revenue, indicating increased usage of DOT.

The recent rally that allowed DOT’s price to surpass $7.9 was signaling the highest level DOT has reached within 2023. Technical analysis suggests that there might be potential for larger price increases following a small retracement in the coming days.

Polkadot (DOT) Price Movement

Despite a slight decrease in DOT’s price at the time of writing, it closed the 24-hour trading period above $7.9. It is expected to fluctuate between $7.2 and $7.9 over the next few days and could retest the $7.2 level. Following this retest, DOT could continue its rally influenced by the broader market, potentially leading to new price peaks.

The area between $7.2 and $7.9 reflects a sell order block in the 24-hour chart analysis. The price chart above is from a three-day chart that emphasizes DOT’s strong bullish structure compared to higher timeframe charts.

Additionally, the chart highlights the next key resistance level at $9.65, which was the highest level in August 2022. Predicting the start of such a rally may not be feasible. During this period, the OBV metric continued its rapid ascent, and the RSI rose to 75, emphasizing the intense surge.

The Future of Polkadot (DOT)

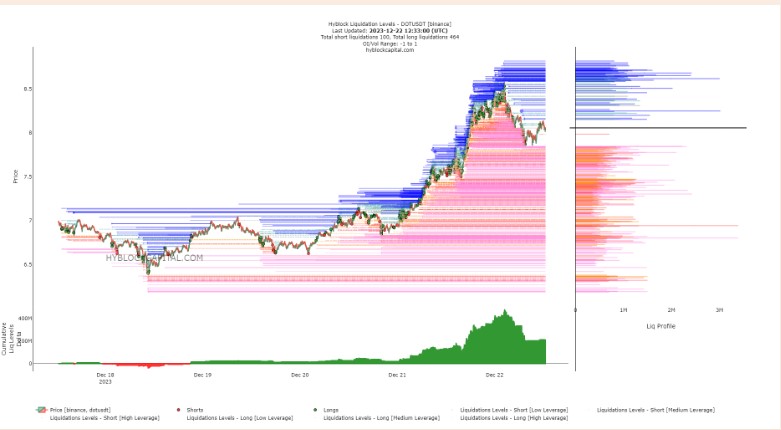

As known from the past, prices always tend to move towards liquidity. In this context, looking at the network’s chart can help understand where DOT might head next. Even after a drop from the $8.5 level in the last 12 hours, the chart shows it remains in a positive zone.

There are large liquidity pools both above and below the current price. Considering the positive structure, the bulls appear stronger, which could make catching them off guard more likely.

According to the chart, the notable level to watch is $6.93, where significant liquidation levels are present. Other points of interest include levels at $7.81, $7.5, and $7.3.

Türkçe

Türkçe Español

Español