Solana price increased by more than 60% in the week ending December 24, reaching the $118 level for the first time in eighteen months. This week’s price increase for Solana coincides with a rise in gas fees in the ecosystem of its biggest competitor, the altcoin king Ethereum. So, what could happen in the coming period? Let’s examine together.

Solana Ecosystem Continues to Gain Momentum

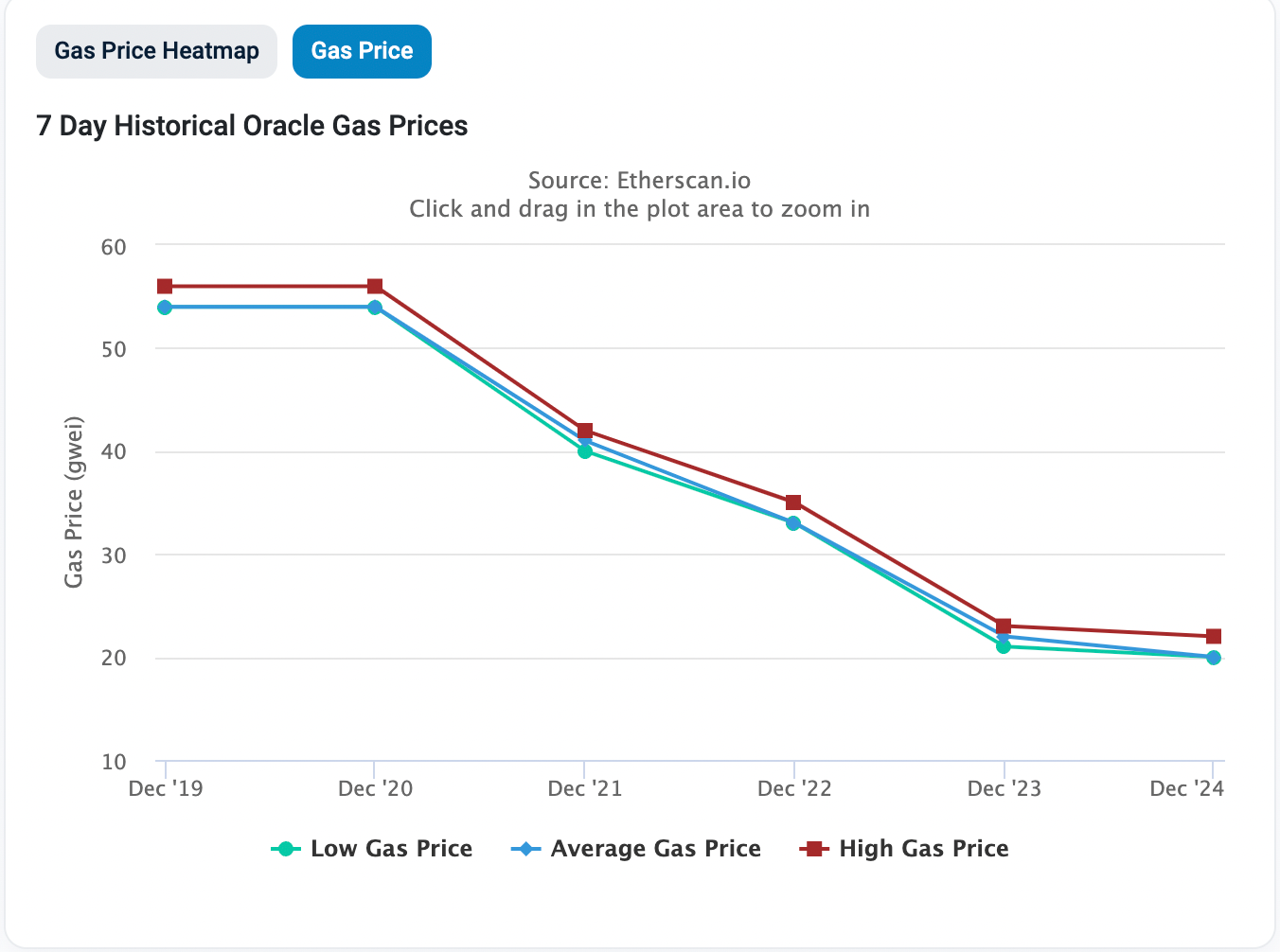

Ethereum blockchain ecosystem saw a spike in the cost of conducting a transaction earlier this week, briefly exceeding $10, leading some users to pay $150 in transaction fees for a $50 transaction.

Ethereum transaction fees have shown a decrease of more than 50% from their highest level in a week. However, this short-term spike has encouraged users to explore alternative blockchain platforms with lower transaction costs. The increase in user activity over the past few months has had a positive impact on the price of Solana. According to data from the analytics platform Messari, active addresses in the Solana ecosystem have increased by approximately 400% in the last three months, compared to a 3% increase in the Ethereum ecosystem.

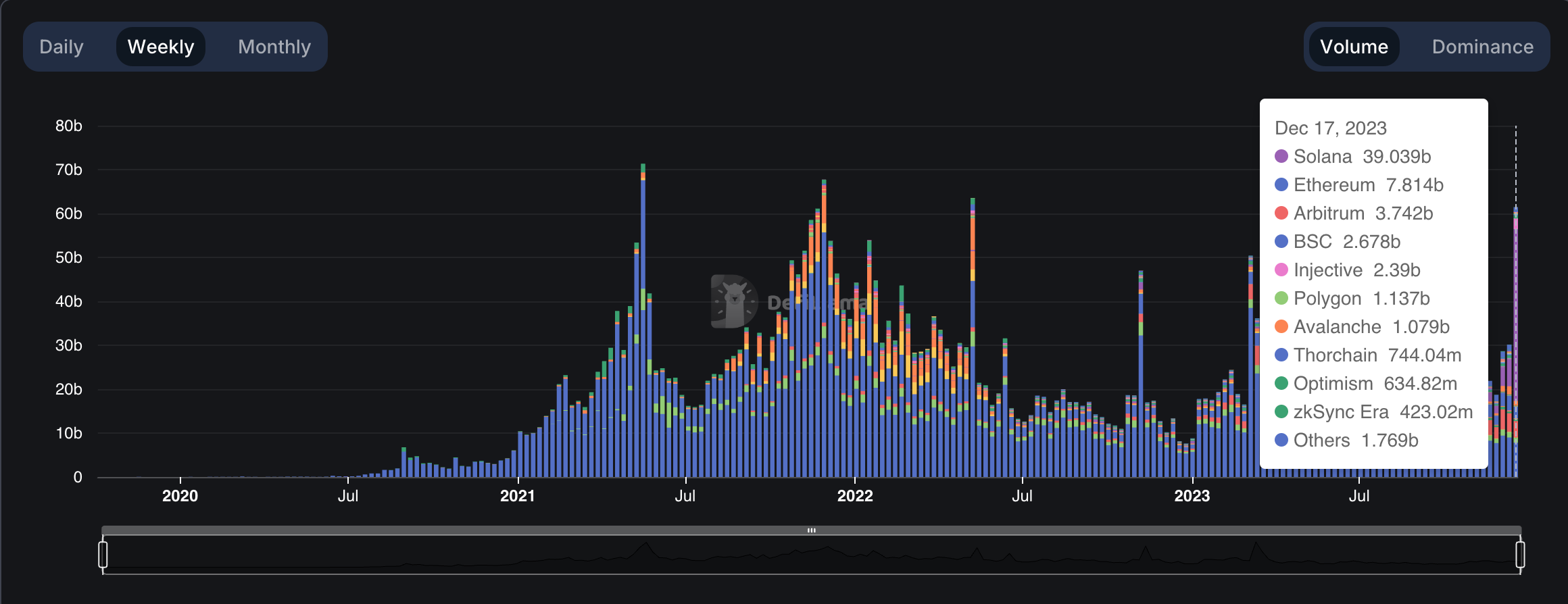

In particular, recent airdrop events in the Solana ecosystem are largely responsible for the increase in daily active addresses and the rise in SOL price. Additionally, the trading volume on Solana’s decentralized exchanges also peaked this week.

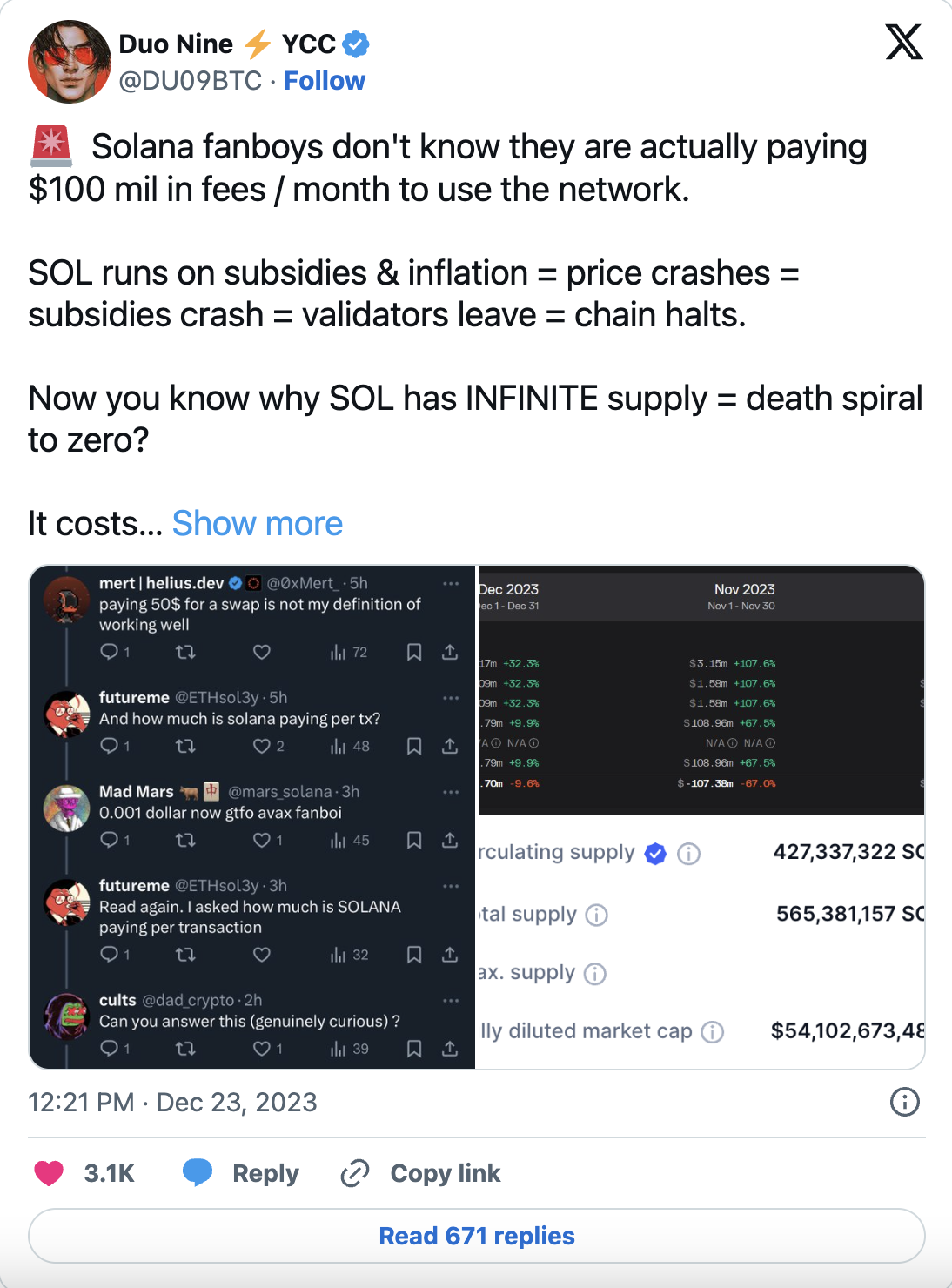

The low transaction costs in the Solana ecosystem facilitate the creation of new addresses, which is beneficial for users, especially airdrop hunters. For instance, according to blockchain data analytics platform CoinCodex, transaction fees in the Solana ecosystem have consistently been below $0.01. However, some criticisms on social media suggest that lower fees are causing congestion in the ecosystem.

What to Expect for Solana’s Price?

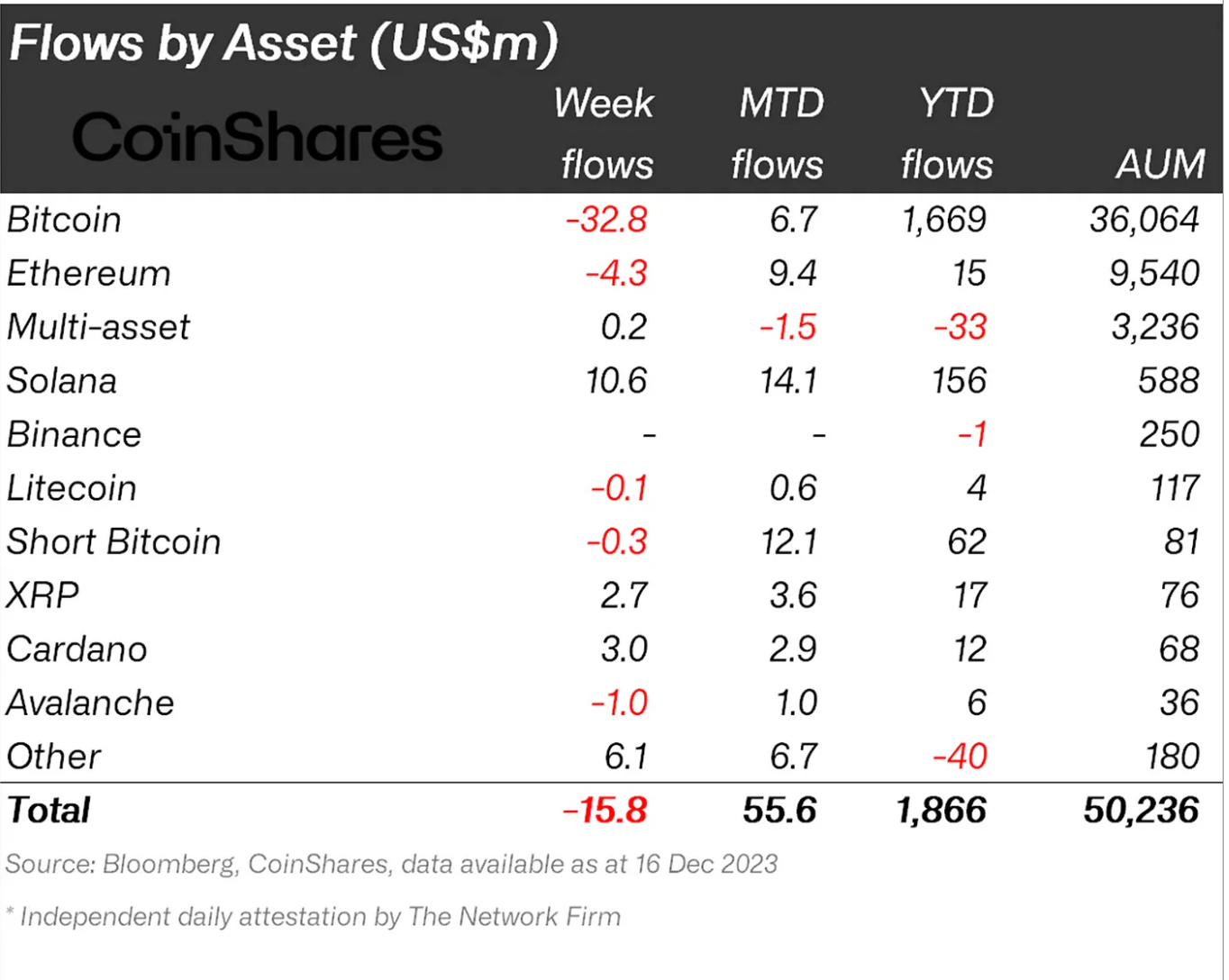

Solana has had a profitable week in terms of fund flows. Solana-based investment funds attracted $10.6 million in the week ending December 16, outperforming the inflows of their biggest competitors, Bitcoin and Ethereum. In December, Solana funds witnessed an inflow of $14.1 million, which was recorded as the highest figure in the crypto sector.

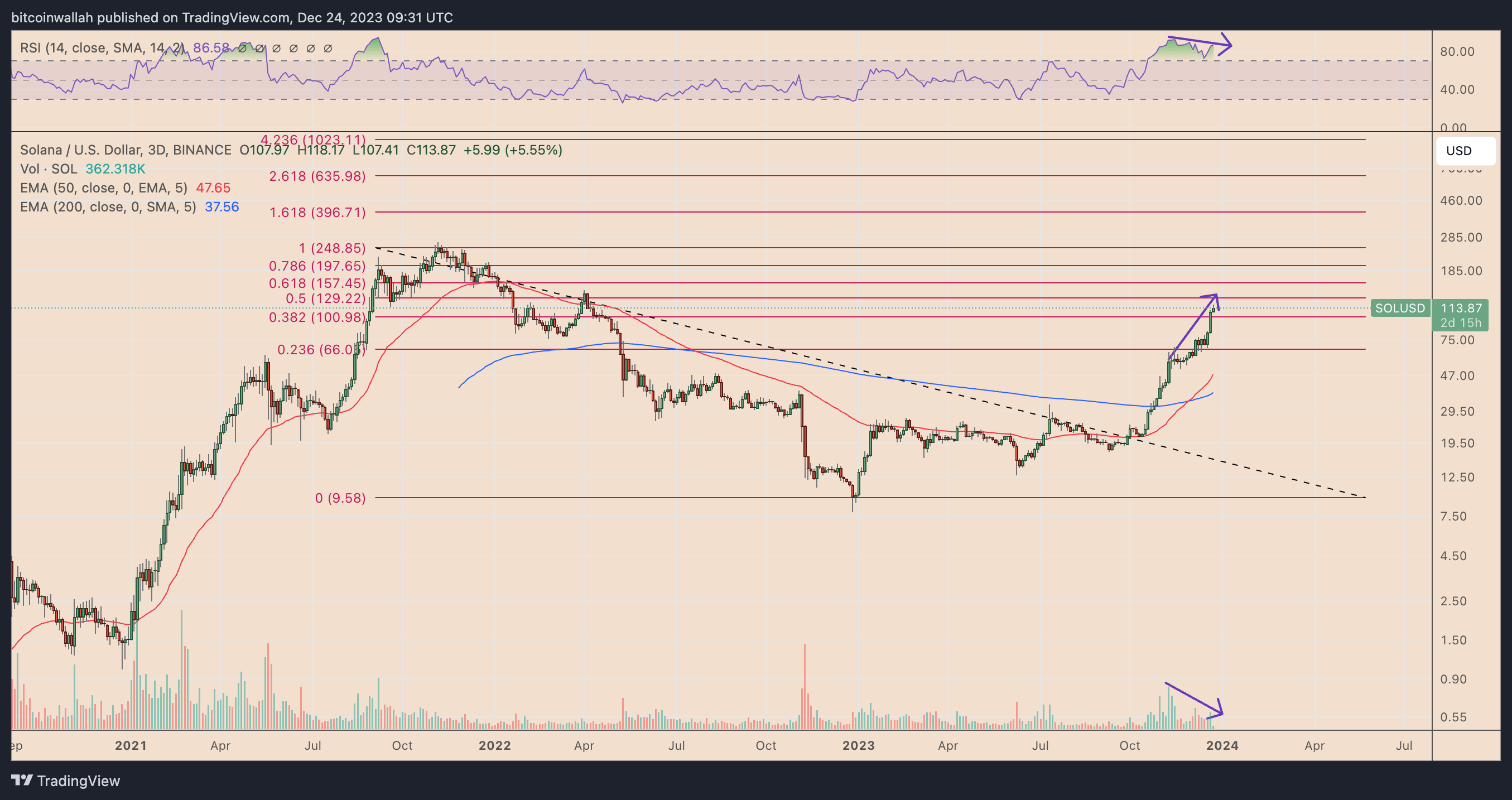

Despite all these developments, technical indicators suggest that the price increase of Solana this week may slow down. For example, on the three-day chart, SOL’s price created higher peaks, but the relative strength index (RSI) and volumes made lower peaks. Technically, this divergence indicates an increasing bearish trend and signals a potential future sell-off.

If sellers prevail, SOL’s price risks falling towards the 0.382 Fibonacci line near $100 by the new year. A close below $100 could send the price towards the 0.236 Fibonacci line near $66. However, a close above the 0.5 Fibonacci line around $130 could lift the price towards the 0.618 Fibonacci line near $157.50.

Türkçe

Türkçe Español

Español