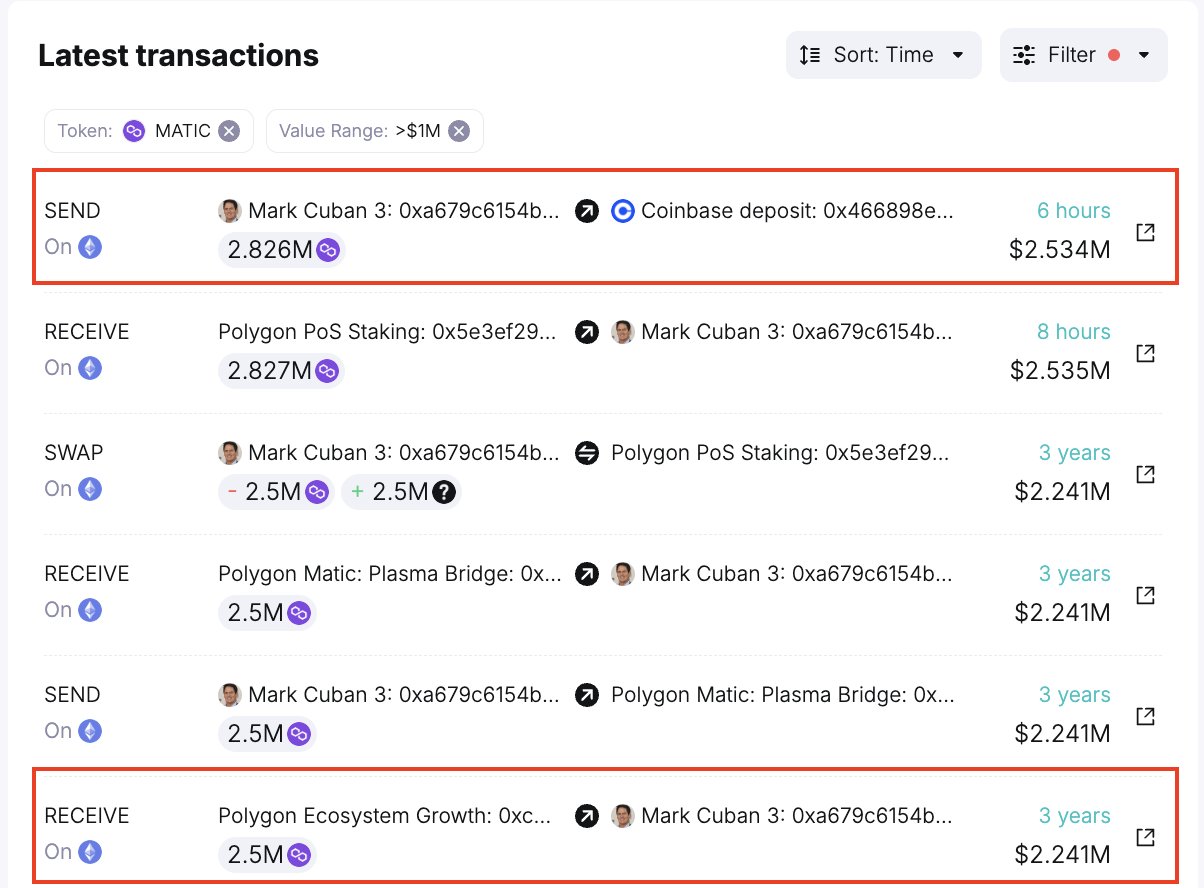

In a notable crypto move, American billionaire Mark Cuban recently invested the equivalent of $2.56 million at the current price of $0.91 in 2.82 million MATIC on the popular cryptocurrency exchange Coinbase. This strategic financial decision adds an intriguing layer to Cuban’s crypto portfolio. On the other hand, it is interesting in terms of showing which cryptocurrency the famous billionaire prefers in his financial choice.

Unlocking Value: Cuban’s History with MATIC

Mark Cuban’s relationship with MATIC dates back to May 24, 2021, when he received 2.5 million MATIC tokens from the Polygon Ecosystem Growth initiative. At that time, the value of these tokens was $4.25 million. Cuban, with a savvy move, chose to stake these tokens, contributing to the network’s security and earning additional MATIC tokens over time.

Cuban’s recent divestment of 2.82 million MATIC points to a calculated financial strategy and raises questions about his next moves in the dynamic world of crypto investments. As a high-profile figure in both traditional finance and the crypto space, Mark Cuban’s maneuvers often attract the community’s attention by providing insights into potential market trends and strategies.

Billionaires’ Pivot to Cryptocurrency

The pivot of billionaires to the cryptocurrency space can be interpreted as a combination of financial opportunity, technological intrigue, and a strategic response to the evolving economic landscape. Many billionaires view cryptocurrencies as a high-yield investment and a means to diversify their portfolios, capitalize on the market’s significant return potential, and hedge against traditional financial risks.

Additionally, the underlying Blockchain technology often draws their interest as it promises innovative solutions to long-standing challenges across various sectors. The orientation towards cryptocurrencies may also reflect a forward-looking perspective as billionaires position themselves at the forefront of a transformative financial environment.

Whether driven by profit desire, technological curiosity, or belief in the decentralization of financial systems, the increasing participation of billionaires in the cryptocurrency space indicates an awareness of the disruptive potential and lasting significance of this emerging asset class.

In conclusion, Cuban’s strategic play serves as a reminder of the continuous evolution in the crypto world and the importance of remaining agile in response to market dynamics. As the crypto community closely watches Cuban’s activities, the emerging narrative can provide more information about the changing strategies and thoughts of influential players in the crypto investment arena.

Türkçe

Türkçe Español

Español