The entire world has now realized that cryptocurrencies have grown too large to be eradicated and are trying to regulate them. The efforts for the future of the global cryptocurrency markets are quite significant. Some of the concrete steps taken are promising, and some regions are seriously striving to seize the growth opportunities brought by innovation.

World Cryptocurrency Markets

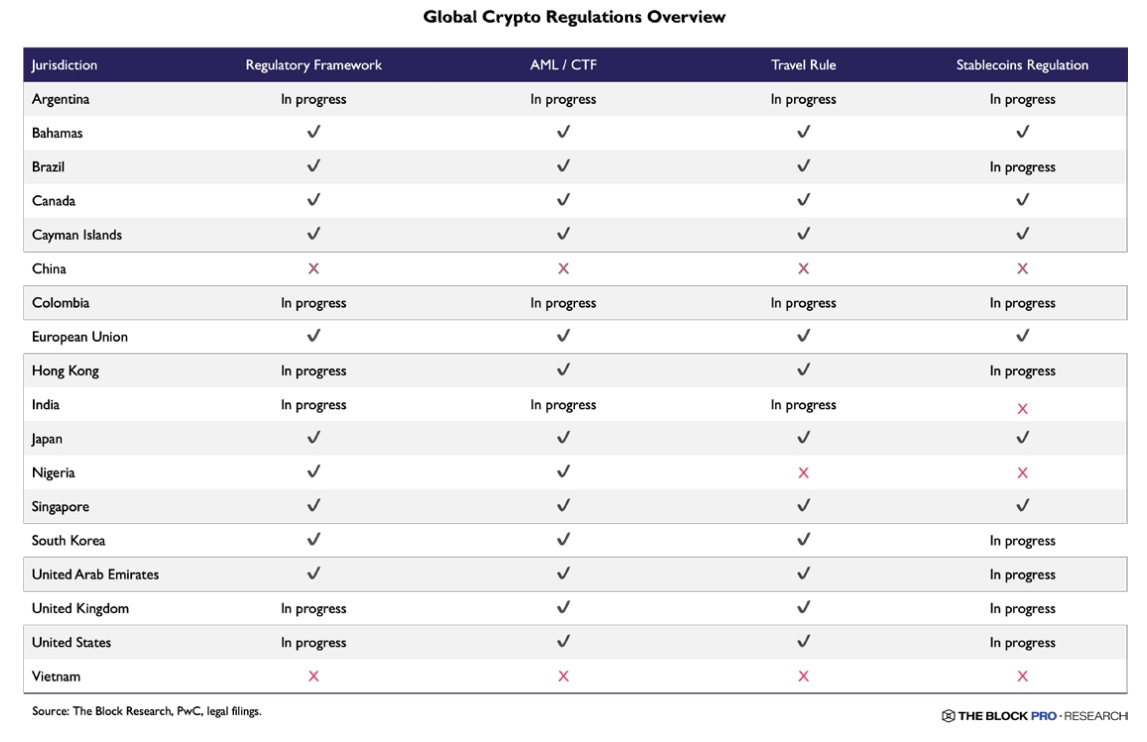

This year, we have seen significant regulatory steps taken around the world. The embracing stance in the Asian region occupied the agenda extensively in June. The world’s cryptocurrency markets need comprehensive rules on a global scale for growth. Let’s now look at what’s happening in different regions.

Middle East

In this region, especially the Emirate of Dubai, is embracing cryptocurrencies with great appetite. They are also attracting interest for facilitating the work of numerous companies with a future economy perspective. In 2022, the Dubai Virtual Assets Regulatory Authority (VARA) was established with the authority to regulate all activities related to the virtual assets sector. By February 2023, VARA announced comprehensive rules with the Virtual Assets and Related Activities Regulation 2023.

Approximately 10 companies in the region have received or are about to receive the Virtual Asset Service Provider (VASP) license.

In October, Qatar started a consultation process for crypto regulations within the Qatar Financial Centre (QFC). Qatar, joining the race to be the biggest player in the Middle East, could accelerate to make up for the delay.

European Union

Throughout the year, the most important and comprehensive step mentioned was MICA in the region. In 2023, the European Union (EU) published the Markets in Crypto-Assets (MiCA) regulation. This comprehensive framework for crypto regulation aims to increase transparency, protect investors, and create uniform rules across the EU’s 27 member states.

This step by the EU is also significant in setting global standards. Financial regulations are built by the US and EU, and then other states adapt them to themselves.

Additionally, the Transfer of Funds Regulation (TFR) was published in June 2023 to combat money laundering. The TFR rules will start to be implemented in the coming year. The DAC8 step for tax transparency in crypto will come into effect in January 2026.

United Kingdom

We’ve read news throughout the year that created a sense of déjà vu related to the harsh approach of banks in the country towards cryptocurrencies. Here too, steps were taken to ensure that crypto firms get FCA (Financial Conduct Authority) approval by 2024. Various studies were conducted regarding crypto advertisements. New rules for staking services are also targeted.

For stablecoins, additions to the existing financial system’s regulatory rules are expected. Sunak arrived, but the United Kingdom did not take the big crypto-friendly steps that were envisioned, which is another detail.

Asia-Pacific (APAC)

Singapore took a significant step with VASP. Hong Kong made embracing rule changes for individual crypto services in June, which we reiterated hundreds of times. Australia is in the early stages of comprehensive regulation for crypto companies, CBDC, and other issues. Taiwan is prioritizing customer protection through non-binding principles for virtual asset platforms. Japan is preparing to implement stricter AML/CFT measures from June 1, including the “Travel Rule”.

Türkçe

Türkçe Español

Español