In just a few hours, we will all be informed about the SEC’s final decision on the spot Bitcoin ETF by the end of Wednesday. The final decision date for the application made by Ark and 21Shares is January 10. The SEC will now make its first serious decision following a court defeat. So, what will be the consequences of this?

Spot Bitcoin ETF

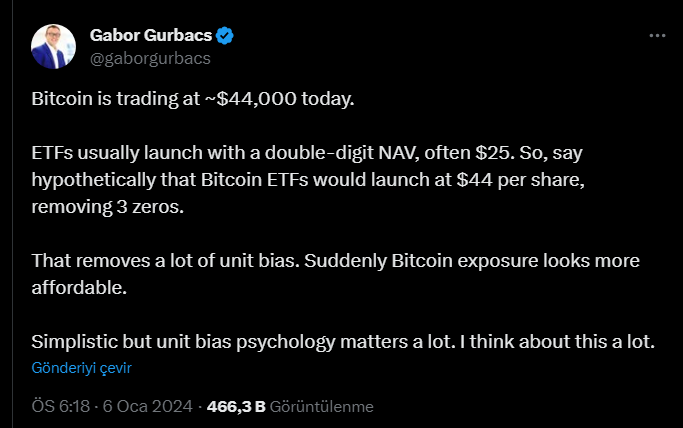

According to VanEck advisor Gabor Gurbacs, with the approval of the spot Bitcoin ETF, we will see a change in the perception of owning full units in favor of cryptocurrencies. The price of Bitcoin deters a portion of potential investors due to a unit bias that prefers owning full units. Gabor, an advisor for the company VanEck that applied for the ETF, says this will change.

According to the advisor, a significant portion of potential investors wants to stay away from fractional investments below 1 BTC.

“I am surprised that many people do not know that a part of a Bitcoin can be owned, and even more frequently, people do not want to own a part of a cryptocurrency. Owning a full share feels better than owning 0.001 Bitcoin. It seems like a small thing, but it’s a big deal.”

Gurbacs admits that this discussion is not new, but argues that biases represent one of the most valuable tools for understanding markets.

Approval of Spot Bitcoin ETF

There is a widespread belief that approval is coming soon. This is a sentiment that envelops everyone because we have gone through a process filled with signals that the green light will finally be given. More than 30 meetings with issuers were held in December. The SEC spoke with exchanges, and on Friday, they also uploaded the necessary documents to the SEC system.

Many inside sources say that companies applying for the ETF are hinting, openly or covertly, at an upcoming approval. We saw a leak on Monday that the paperwork would be completed, and since Wednesday is the final decision date, all these steps (AP agreements, changes supporting only cash transactions, and many more steps) indicate that the optimism is not unfounded.

Of course, it is not possible to see the future, and despite all the signals feeding optimism, the SEC could still issue a rejection. We will only know by experiencing it.

Türkçe

Türkçe Español

Español