While 2024 is expected to be a good year for the cryptocurrency market, predictions continue about which tokens will rise and make significant gains, with this altcoin in particular drawing attention for its long-term upward trend.

Analyst’s Statement on LINK

Popular cryptocurrency commentator Quinten Francois X shared his thoughts with his followers in multiple posts, discussing the typical investor mentality towards cryptocurrency units. The senior analyst said the following:

I see a lot of hate for LINK because it’s not performing as expected. It’s always the same in crypto. I hate these kinds of tokens because they underperform. Everyone gets excited and that was expected because patience has run out.

This statement coincided with Chainlink‘s announcement on the same day that it has become the standard platform for seamless transactions between capital markets and Web3. Additionally, the company stated that without a single standard for cross-chain, data, and computation, such transactions could not occur. Furthermore, Chainlink launched the Cross-Chain Interoperability Protocol (CCIP) in July 2023 to ensure flawless cross-chain transactions. This development was one of the most significant launches of the past year, and the company continues to expand CCIP to include more chains and assets. The company made the following statements on the matter:

We will give high priority to CCIP to meet the demand fueled by the major trend of capital markets moving on-chain and transitioning from the proof of concept stage to production.

Notable Performance from LINK

Additionally, an analyst known as thenewyorker.eth on X highlighted the current real-world capabilities provided by Chainlink, emphasizing the token’s value and long-term viability:

It also shows how narrow-minded most people are. Benefits and fundamentals, in the long run, LINK performs the best.

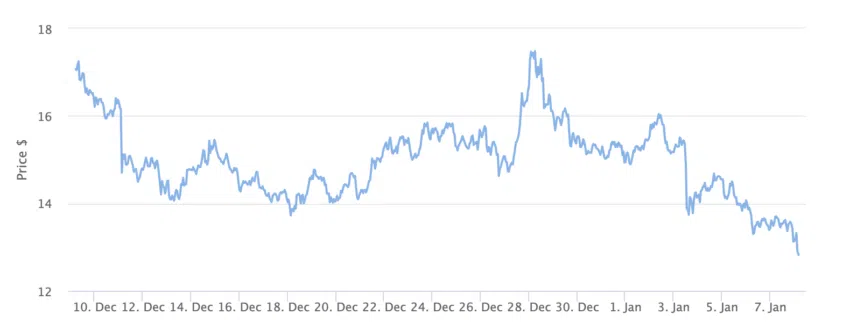

At the time of writing, Chainlink’s price was trading at $12.85. It was noted that LINK could not break out of its long-term descending resistance trend line. However, it managed to rise above this level in September. The upward movement reached $16.58 in November but has since slowed down. After just over a month of consolidation, LINK’s price finally began an upward movement at the end of December 2023, reaching the annual high of $17.68.

Türkçe

Türkçe Español

Español