In the crypto market, investors continue to stay calm even if the SEC greenlights spot Bitcoin ETF applications, pondering what could happen to Bitcoin price movements. A popular theory suggests that the crypto market may experience a slower recovery after sudden losses. Investors are looking at this situation with a “sell the news” mindset.

Prominent Analyst Makes Noteworthy Statement

For Michaël van de Poppe, founder and CEO of crypto trade firm MN Trading, the long-term outcomes seem clear. The renowned analyst stated on social media platform X on January 7:

“Bitcoin ETF products will have a significant impact on the crypto market. Approximately 30-60 billion dollars of liquidity will flow into the markets, and as a result, Bitcoin will face a bull cycle similar to the Dot com bubble or the Gold rush between 2004-2011.”

According to TradingView data, the weekly close happened around the $44,000 level, and the BTC/USD pair has continued to move within a narrow trading range since the beginning of December. A rebound was seen near the $43,000 level at the opening of Asian markets, and at the time of writing, Bitcoin is trading at $45,190.

What is Expected for Bitcoin Prices?

Another popular analyst, Skew, emphasized the need to maintain the 200-period simple (MA) and exponential (EMA) moving averages on hourly time frames:

“The impulse swept the previous high and also the weekly open before the sell-off. The key is to reclaim the weekly open and hold the hourly 200EMA and MA as support, which are the first triggers to be on the long side.”

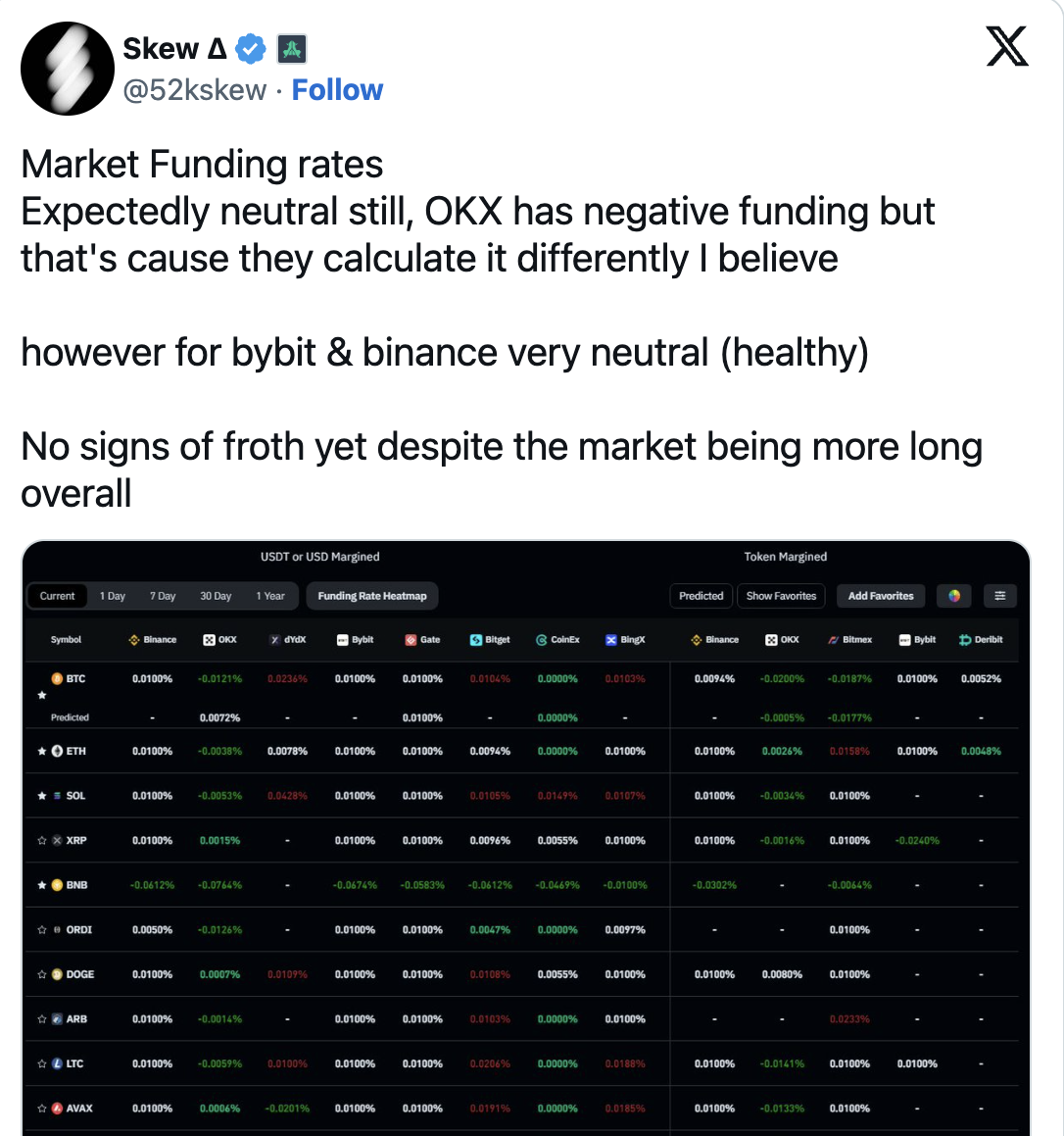

Skew also touched upon the current state of funding rates. They were overly positive before the liquidation volatility last week but have now retreated to sustainable levels:

“From now on, the spot will determine the price direction, but in terms of net positioning, there are probably a ton of long positions in the market right now, and therefore these long positions will require spot offers from here.”

Türkçe

Türkçe Español

Español