The potential approval of a spot Bitcoin ETF in the cryptocurrency market is leading to notable developments, resulting in a significant increase in stablecoin inflows to centralized crypto exchanges. In particular, the exchange entries of Tether and USD Coin clearly indicate that investors are preparing to enter the market.

Stablecoin Inflows and the ETF Process

According to data from the market data analysis platform CryptoQuant, stablecoin assets in centralized crypto exchange wallets increased from $18.05 billion on January 1st to over $19.99 billion on January 7th. The total stablecoin market value is currently just over $133.4 billion, according to data from CoinMarketCap.

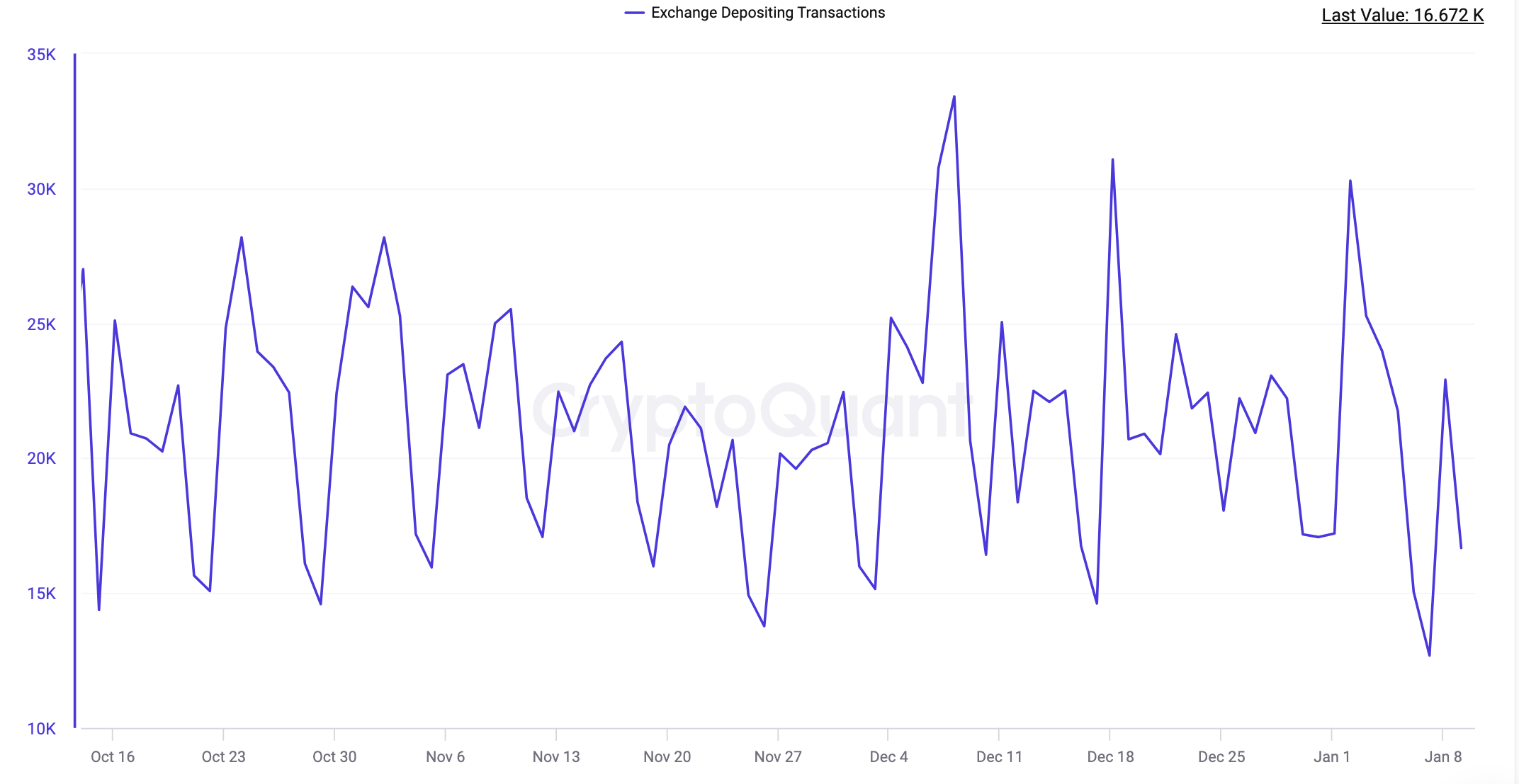

The total transaction volume of all stablecoin projects is currently around $70 billion, with Tether alone accounting for $55.86 billion of this volume. A closer look at the data provided by CryptoQuant shows that the amount of stablecoins held in crypto exchanges increased sharply in the first eight days of 2024, and the volume of incoming stablecoin transactions is contributing to the rise in Bitcoin’s price. On January 8th, when Bitcoin rose above $47,000, the number of stablecoin transactions increased from approximately 22,900 to about 33,000.

The increase in stablecoin market value and the inflows and outflows of stablecoins to exchanges are important indicators for assessing how participants are positioned in the market. The acceleration of stablecoin exchange inflows, with the possibility of the SEC approving the first spot Bitcoin ETF application, has continued to increase since the beginning of January as the bullish momentum takes over the market.

Notable Chart from a Prominent Figure

Large stablecoin inflows into crypto exchanges are generally considered a short-term factor for Bitcoin price movement and indicate that sidelined capital is returning to Bitcoin. Further evidence of activity for stablecoins was provided by independent analyst Cole Garner. Garner highlighted the issue once again with a chart shared via X.

Therefore, the increasing stablecoin inflows into crypto exchanges could be a sign that investors are preparing for market volatility expected on January 10th, when the SEC makes a final decision on spot Bitcoin ETF applications.

Türkçe

Türkçe Español

Español