SEC official Caroline Crenshaw stated on January 10th that the move to greenlight Bitcoin-based investment instruments is “unhealthy and outdated”. Additionally, other cryptocurrency critics have made bold statements.

Harsh Comments on Bitcoin!

SEC official Caroline Crenshaw, who is reported to have voted on ETF approval, addressed malicious activities in the cryptocurrency markets and stated:

I am concerned about these products flooding the markets and settling directly into the retirement accounts of U.S. households, who are least able to afford to lose their savings to fraud and manipulation prevalent in spot Bitcoin markets, and affecting ETPs. The global spot markets, which underpin Bitcoin ETPs, are overshadowed by fraud and manipulation, intensified, and lack adequate supervision.

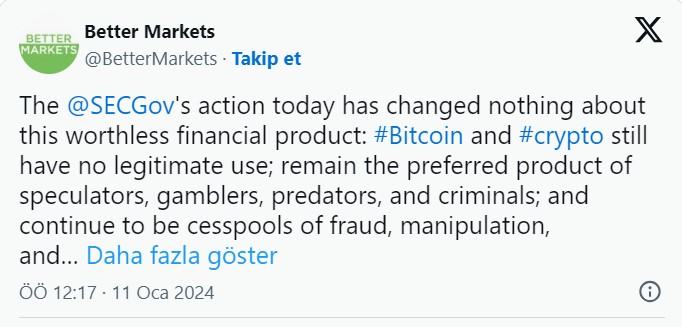

Better Markets, a non-profit economic organization, also made strong claims in its criticism of the ETF decision, stating that the nature of the cryptocurrency is inherently worthless and purposeless:

Today’s action by the SEC has not changed anything about this worthless financial product. Bitcoin and cryptocurrency still have no legitimate use. They will continue to be the product of choice for speculators and criminals.

Criticism of ETFs

Five days ago, Better Markets CEO Dennis Kelleher wrote a letter to the SEC requesting the rejection of Bitcoin ETF applications, claiming that the products would lead to “significant investor harm”. Longtime cryptocurrency critic Stephen Diehl also weighed in on his assessment of the cryptocurrency, suggesting that Bitcoin represents “a tyranny of serfdom, stagnation, and medieval discredited ideas” in the hours following the approval.

Gold advocate and Bitcoin critic Peter Schiff added his own interpretation to the mix, stating that the approvals are nothing more than new ways for speculators to invest in Bitcoin. Crypto researcher and decentralization advocate Chris Blec explained that the introduction of institution-focused ETFs would ultimately harm the decentralized nature of the Bitcoin network in the long run.

Türkçe

Türkçe Español

Español