An analyst using the name qw in X provides a nuanced perspective on the current state of Bitcoin and the crypto market in a recent analysis, drawing parallels with historical events and highlighting fundamental factors that could influence Bitcoin’s trajectory. Let’s take a look at the analyst’s approach and evaluations.

Analysis of Bitcoin ETF: A Familiar Narrative

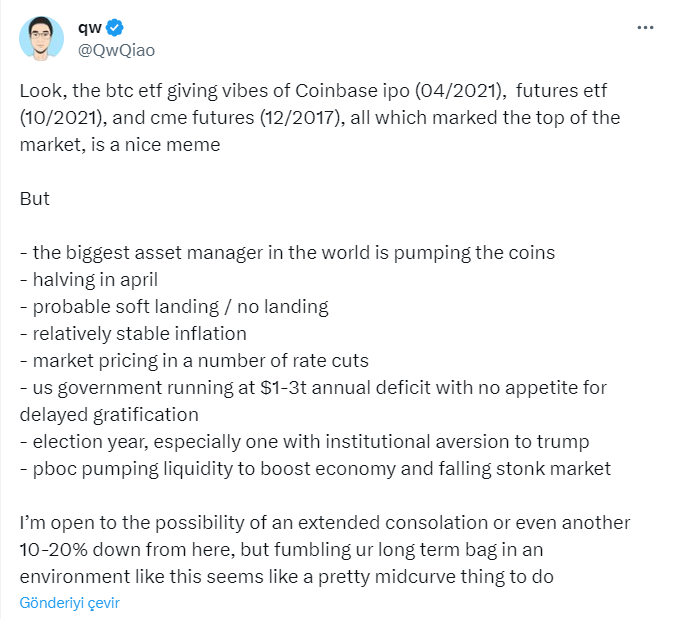

Analyst qw begins by comparing the current Bitcoin Exchange Traded Fund (ETF) scenario to past market events, specifically referring to the Coinbase IPO in April 2021, the launch of the futures ETF in October 2021, and the start of CME futures in December 2017.

According to the analyst, these examples point to significant market peaks. However, qw suggests that given the current conditions, this comparison may be more of a meme than a reliable indicator.

Fundamental Factors Challenging ETF Sentiments

Contrary to the potential negative signals associated with past events, qw points to several factors that challenge the downward trend. The analyst notes that the participation of the world’s largest asset manager in actively supporting and investing in cryptocurrencies indicates a shift in institutional interest.

On the other hand, the Bitcoin halving event scheduled for April is highlighted as a bullish factor historically associated with positive market movements. Analyst qw emphasizes a scenario that creates a favorable environment for Bitcoin, with relatively stable inflation and a soft landing or no landing at all.

The market is currently factoring in potential interest rate cuts, which contributes to a positive outlook for Bitcoin. Even without a rate cut, the US government’s annual deficit of 1-3 trillion dollars is seen as a supportive factor for Bitcoin.

In an election year, qw sees a unique political landscape that could influence Bitcoin’s trajectory, especially with institutional reluctance against the Trump administration. Lastly, the injection of liquidity into the economy by the People’s Bank of China (PBOC) amidst a falling stock market is considered an additional factor supporting Bitcoin.

Optimism Amidst Bitcoin: Long-Term Holdings Not to Be Hastily Abandoned

While acknowledging the potential for a prolonged consolidation or a 10-20% drop, qw advises against hastily abandoning long-term Bitcoin assets in the current environment. The analyst suggests that such a move may not be consistent with a strategic approach, especially when considering complex and multifaceted factors.

As the Bitcoin market grapples with uncertainties, qw’s analysis promotes a measured and informed approach. While historical comparisons provide context, the unique dynamics of the current economic environment and geopolitical factors require careful evaluation for those involved in the crypto space.

Türkçe

Türkçe Español

Español