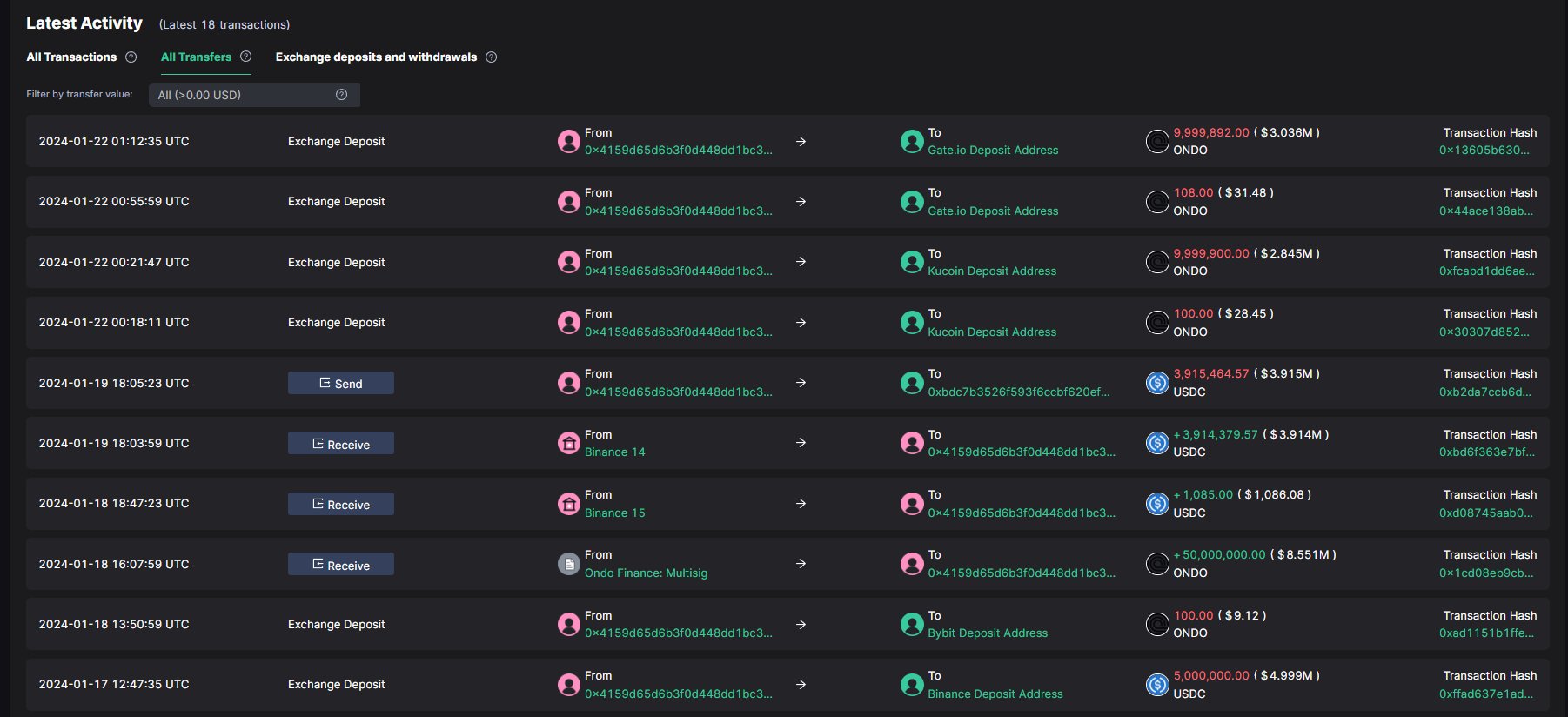

In a recent development, a wallet associated with a project’s multisig received a significant amount of 138 million ONDO. Specifically, in the last three hours, a transfer of 20 million ONDO worth $5.9 million took place, with funds moving to both Gate.io and Kucoin exchanges. This transaction was followed by a 20% drop in the price of ONDO. This situation raised questions about the possibility of the project team’s involvement in selling activities, necessitating a closer examination of the circumstances.

Transaction Details and Fund Movement for Altcoin ONDO

The wallet in question, linked to a project’s multisig, played a central role in the movement of 138 million ONDO tokens. Moreover, the recent transfer of 20 million ONDO worth a total of $5.9 million has raised suspicions within the cryptocurrency community. The funds were directed to two leading exchanges, Gate.io and Kucoin, within a relatively short three-hour time frame.

Following this notable transaction, the ONDO token experienced a significant 20% drop in price over the last three hours. Such a sharp decline led to speculation and concerns among investors and market observers, prompting a significant question: Is the project team behind this move?

Analyzing the Potential Involvement of the Team: Team Sale or Strategic Move?

The sudden drop in ONDO’s price increases the likelihood of the project team’s involvement in selling activities. Although this situation is perceived as a source of concern, it is very important to deeply examine the motivations behind such actions. If confirmed, a team sale could indicate various factors such as liquidity needs, developments in the project, or strategic maneuvers.

For investors and market participants, overcoming such situations requires a balanced approach. Considering multiple factors, including project updates, team communications, and broader market conditions, is important. Sudden price movements can be triggered by various elements, and a comprehensive analysis helps in making informed decisions.

Navigating Uncertainties: A Call for Vigilance

ONDO community must be cautious while assessing recent developments. Monitoring the project team’s official communications, checking updates on project developments, and evaluating market sentiment can contribute to a clearer understanding of the situation. Understanding the context surrounding the fund transfer and its impact on the overall direction of the project is very important for informed decision-making.

In conclusion, the recent fund movements within the ONDO ecosystem and the subsequent price drop have created question marks about the project team’s involvement. While the possibility of a team sale exists, it should be noted that the reasons behind the move are not yet clear.