Cardano price has been falling since December 14, 2023, creating a lower peak on December 29. Cardano recently fell below a significant horizontal support area, which is now acting as resistance. So, what are the possible chart scenarios for ADA in the coming period? We examine with chart analyses and key levels.

Cardano Weekly Chart Analysis

The technical analysis of the weekly chart shows that the ADA price has been rapidly rising since October 2023. However, despite numerous attempts, it failed to break out from a critical horizontal resistance area that has been in place since May 2022. ADA formed six consecutive long upper wicks (red symbols), which are considered signs of selling pressure. It was followed by a sharp downward movement in January 2024. ADA price is currently approaching the previous breakout level.

The Weekly Relative Strength Index (RSI) shows a downward trend. Investors use the RSI level as a momentum indicator to assess whether a market asset is overbought or oversold and whether an asset might be accumulated or sold off.

If the RSI value is above 50 and the trend is upward, the bulls are still at an advantage, but if the value is below 50, the opposite is true. The indicator had dropped below 70 (red circle) at the time of writing and is declining, both signs of a bearish trend.

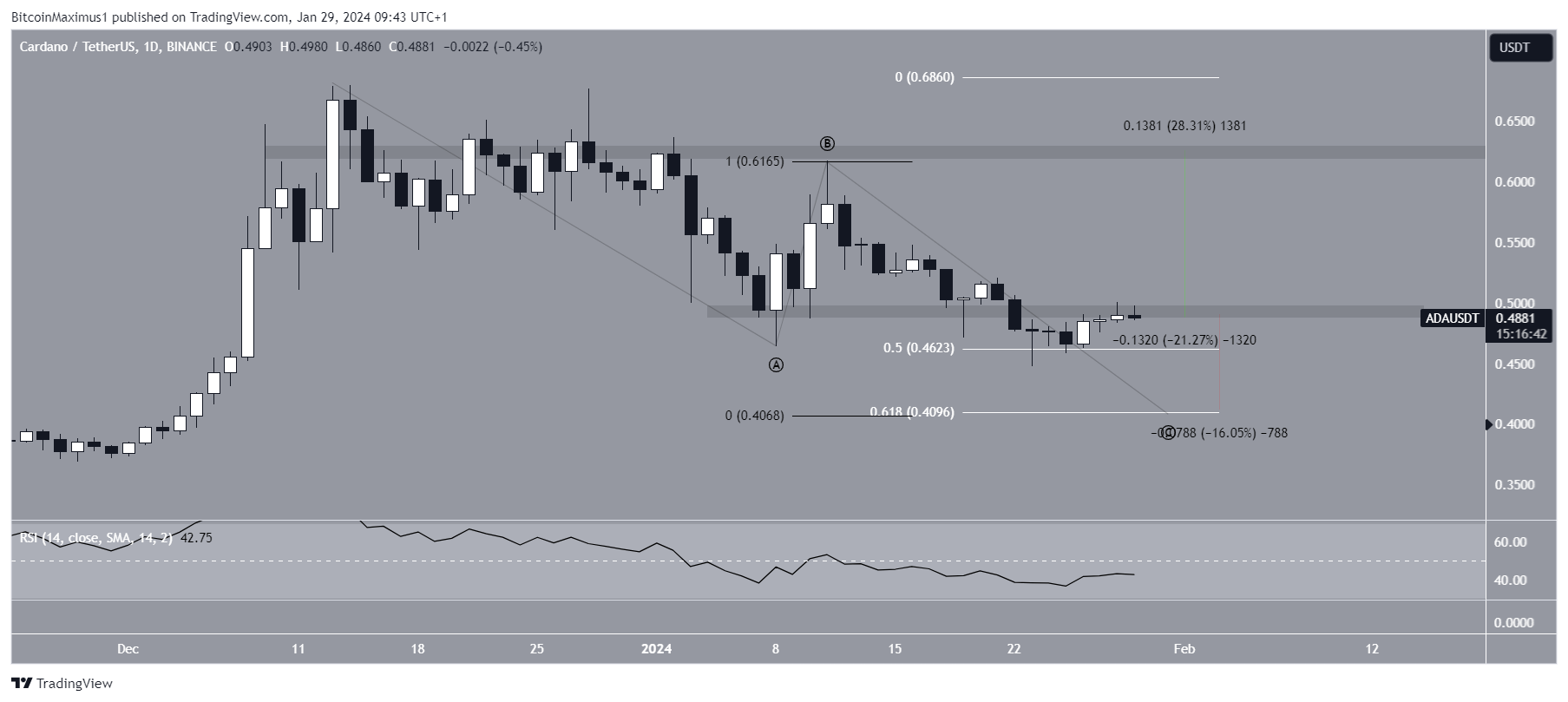

Cardano Daily Chart Analysis

The technical analysis of the daily timeframe predicts a bearish ADA trend due to price action, RSI, and the number of bars. Elliott Wave theory involves the analysis of repeating long-term price patterns and investor psychology to determine the direction of a trend. The most likely scenario shows that ADA is in the C wave of an A-B-C corrective structure. Assigning a 1:1 ratio to the A:C waves leads to a low level of $0.41, aligning with the 0.618 Fib retracement support level (white).

Price action shows that ADA confirmed the $0.50 area as resistance after breaking below it. This is a common retest following such breakouts. Lastly, the daily RSI is below 50 and declining, both signs of a bearish trend.

If the downward movement continues, ADA could retreat to the $0.41 level, which is the 0.618 Fib retracement support level, representing a 16% decrease. Despite this bearish trend prediction, reclaiming $0.50 could trigger an approximate 30% increase to the next resistance at $0.63.

Türkçe

Türkçe Español

Español